Does Accredited Debt Relief Hurt Your Credit Score?

✅Accredited Debt Relief can temporarily lower your credit score, but it helps manage debt and improve financial health in the long run.

Enrolling in a debt relief program with Accredited Debt Relief can have an impact on your credit score, but the extent and direction of that impact depend on several factors. Generally, participating in a debt relief program may initially lower your credit score due to the nature of debt settlement and the potential for missed payments before settlements are reached. However, over time, as debts are settled and your financial situation improves, your credit score can begin to recover.

Understanding how Accredited Debt Relief works and the potential effects on your credit score is crucial for making an informed decision. Below, we explore the different ways debt relief can affect your credit, the steps involved in the process, and tips for mitigating any negative impacts on your credit score.

How Debt Relief Programs Affect Your Credit Score

Accredited Debt Relief, like other debt relief companies, typically involves negotiating with creditors to settle your debts for less than what you owe. This process can influence your credit score in several ways:

- Missed Payments: Before settlements are reached, you may need to stop making payments on your debts. This can lead to missed or late payments, which negatively impact your credit score.

- Debt Settlements: When a debt is settled for less than the full amount, it may be reported to credit bureaus as “settled” rather than “paid in full,” which can be seen as a negative mark on your credit report.

- Collections Accounts: If your debts are sent to collections before they are settled, these accounts can further damage your credit score.

Steps Involved in the Debt Relief Process

Here’s a breakdown of what typically happens when you enroll in a debt relief program:

- Initial Consultation: You’ll have a consultation to assess your financial situation and determine if debt relief is a suitable option for you.

- Enrollment: If you decide to proceed, you’ll enroll in the program and begin making monthly deposits into a dedicated account rather than paying your creditors directly.

- Negotiation: The debt relief company will negotiate with your creditors to settle your debts for less than what you owe.

- Settlement: Once a settlement is reached, the funds from your dedicated account are used to pay off the agreed-upon amount.

Tips to Mitigate Negative Impacts

While debt relief can affect your credit score, there are steps you can take to minimize the damage and work towards rebuilding your credit:

- Keep Up with Payments: Whenever possible, try to stay current on other financial obligations to prevent further damage to your credit score.

- Monitor Your Credit Report: Regularly check your credit report for any errors and ensure that settled debts are accurately reported.

- Build Credit Over Time: After your debts are settled, focus on building positive credit habits, such as making timely payments and keeping credit card balances low.

By understanding the potential impacts and taking proactive steps to manage your credit, you can navigate the debt relief process more effectively and work towards a healthier financial future.

Impacto de los programas de alivio de deuda en el puntaje crediticio

When considering enrolling in a debt relief program, one major concern for many individuals is how it will affect their credit score. Understanding the impact of debt relief programs on credit scores is crucial for making an informed decision about managing your finances.

Debt relief programs can have both positive and negative effects on your credit score, depending on various factors such as the type of program you choose and your financial situation. Let’s explore how different debt relief options can influence your credit score:

Debt Consolidation:

Debt consolidation involves combining multiple debts into a single loan with a lower interest rate. This can help simplify your payments and reduce the overall amount of interest you pay. When done responsibly, debt consolidation can have a positive impact on your credit score by lowering your credit utilization ratio and making it easier to manage your debt.

Debt Settlement:

Debt settlement programs negotiate with creditors to settle your debts for less than what you owe. While this can help you get out of debt faster, it typically involves stopping payments to creditors, which can result in a temporary decrease in your credit score. However, as you settle your debts, your credit score may start to improve over time.

Bankruptcy:

Filing for bankruptcy is a serious decision that can have a significant impact on your credit score. While bankruptcy can provide a fresh start for those overwhelmed by debt, it stays on your credit report for several years and can lower your credit score substantially. However, with responsible financial habits, you can start rebuilding your credit score after bankruptcy.

It’s essential to weigh the pros and cons of each debt relief option and consider how it aligns with your financial goals and credit situation. Seeking advice from financial professionals and credit counselors can help you make an informed decision that is best for your unique circumstances.

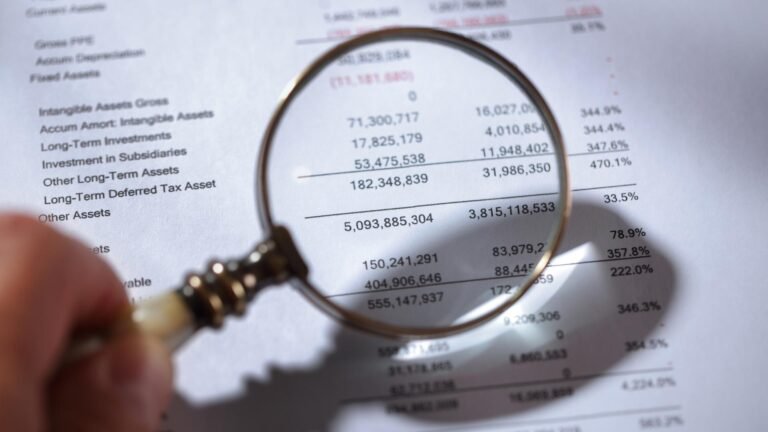

Comparación entre alivio de deuda y consolidación de deuda en el crédito

When facing financial challenges, debt relief and debt consolidation are two common strategies that individuals consider to manage their debts and improve their financial situation. Each approach has its advantages and potential impact on your credit score. Let’s compare debt relief and debt consolidation in terms of how they affect your credit:

Differences Between Debt Relief and Debt Consolidation

| Criteria | Debt Relief | Debt Consolidation |

|---|---|---|

| Impact on Credit Score | Can have a negative impact initially as accounts may be marked as settled or paid less than owed. | May have a neutral to positive impact if payments are made on time and credit utilization decreases. |

| Types of Debts | Usually targeted for unsecured debts like credit card debt or medical bills. | Can be used for various types of debts, including credit cards, personal loans, or student loans. |

| Process | Typically involves negotiating with creditors to settle debts for less than what is owed. | Involves taking out a new loan to pay off existing debts, consolidating them into one monthly payment. |

Debt relief programs, such as debt settlement, can result in a negative impact on your credit score initially because accounts may be marked as settled for less than the full amount owed. On the other hand, debt consolidation through a loan or a credit counseling program may have a more positive or neutral effect on your credit if payments are made consistently and if your overall credit utilization improves.

For individuals considering debt relief options, it is essential to weigh the potential short-term negative impact on credit against the long-term benefits of becoming debt-free. Conversely, debt consolidation may be a better choice for those looking to streamline their payments and potentially improve their credit in the process.

Ultimately, the best approach depends on your financial goals, current credit situation, and the types of debts you have. It’s crucial to research and understand the implications of each strategy before making a decision.

Preguntas frecuentes

Does enrolling in an accredited debt relief program hurt your credit score?

Enrolling in a debt relief program may initially lower your credit score, but it can improve over time as you make payments and reduce your debt.

How long does it take for a credit score to recover after using a debt relief program?

The time it takes for your credit score to recover after using a debt relief program can vary, but it typically takes a few months to a few years.

Can I still get credit while enrolled in a debt relief program?

While enrolled in a debt relief program, it may be more difficult to obtain new credit, but it is still possible in some cases.

Will creditors stop contacting me once I enroll in a debt relief program?

Once you enroll in a debt relief program, creditors may stop contacting you directly as the program will handle communications on your behalf.

What types of debts can be included in a debt relief program?

Debt relief programs typically include unsecured debts such as credit card debt, medical bills, and personal loans.

Is accredited debt relief the same as debt settlement?

Accredited debt relief typically refers to companies that offer a range of debt relief services, including debt settlement, debt consolidation, and credit counseling.

Key Points:

- Enrolling in a debt relief program may initially lower your credit score.

- Credit score recovery time after a debt relief program varies.

- It may be more difficult to get new credit while in a debt relief program.

- Creditors may stop contacting you directly once enrolled in a debt relief program.

- Debt relief programs usually include unsecured debts like credit card debt.

- Accredited debt relief companies offer various services including debt settlement and consolidation.

Feel free to leave your comments and check out our other articles for more information on debt relief and credit management.