Altra Federal Credit Union Services in Rochester, MN

✅Discover Altra Federal Credit Union’s top-notch services in Rochester, MN—mortgages, loans, savings accounts, and financial planning. Join a trusted community!

Altra Federal Credit Union in Rochester, MN, offers a comprehensive range of financial services designed to meet the diverse needs of its members. Whether you are looking for personal banking solutions, loans, or investment opportunities, Altra Federal Credit Union provides tailored options with competitive rates and exceptional customer service.

In this article, we will delve into the various services offered by Altra Federal Credit Union in Rochester, MN. We will cover personal banking, loan options, investment services, and additional resources available to members. This detailed overview will help you understand how Altra can support your financial goals and needs.

Personal Banking Services

Altra Federal Credit Union offers a variety of personal banking services to help you manage your finances effectively. These services include:

- Checking Accounts: Multiple checking account options with features like no monthly fees, online banking, and mobile deposit.

- Savings Accounts: Competitive interest rates on savings accounts, including regular savings, money market accounts, and certificates of deposit (CDs).

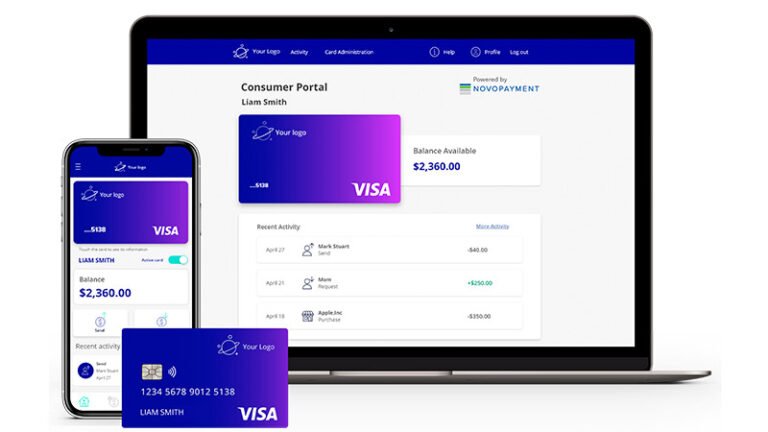

- Online and Mobile Banking: Convenient access to your accounts with online banking, mobile apps, and e-statements.

- Debit and Credit Cards: A range of card options with rewards, low interest rates, and enhanced security features.

Loan Options

Whether you are looking to buy a home, a car, or need personal loans, Altra Federal Credit Union offers a variety of loan products to suit your needs:

- Mortgage Loans: Competitive rates on fixed and adjustable-rate mortgages, first-time homebuyer programs, and refinancing options.

- Auto Loans: Financing for new and used vehicles with flexible terms and low rates.

- Personal Loans: Unsecured loans for various needs, including debt consolidation, home improvements, or unexpected expenses.

- Student Loans: Funding options for higher education, including undergraduate and graduate loans.

Investment Services

Planning for your future is crucial, and Altra Federal Credit Union provides investment services to help you achieve your long-term financial goals. These services include:

- Retirement Accounts: Traditional and Roth IRAs with competitive returns to secure your retirement.

- Financial Planning: Access to professional financial advisors who can help you create personalized investment strategies.

- Wealth Management: Comprehensive services including portfolio management, estate planning, and tax-efficient investment strategies.

Additional Member Resources

Altra Federal Credit Union goes beyond traditional banking and offers several resources to assist its members:

- Financial Education: Workshops, webinars, and online resources to improve your financial literacy.

- Member Discounts: Exclusive discounts on various services and products for credit union members.

- Community Involvement: Active participation in local community events and support for charitable organizations.

Overview of Altra Federal Credit Union’s History and Mission

Let’s dive into the Overview of Altra Federal Credit Union’s History and Mission.

Altra Federal Credit Union has a rich history that dates back to 1931 when it was founded in the small town of Onalaska, Wisconsin. Over the years, it has grown to become a leading financial institution serving members not only in Wisconsin but also in various other states, including Minnesota.

Credit unions like Altra are not-for-profit financial cooperatives that exist to serve their members rather than generate profits for shareholders. This unique structure allows credit unions to offer competitive rates, low fees, and personalized service to their members.

At the core of Altra Federal Credit Union’s mission is a commitment to financial education and community involvement. By empowering members with the knowledge and tools they need to make sound financial decisions, Altra helps individuals and families achieve their financial goals.

Key Features of Altra Federal Credit Union Services

Here are some of the key features that set Altra apart from traditional banks:

- Personalized Service: Altra takes pride in building relationships with its members and providing personalized financial solutions tailored to their unique needs.

- Competitive Rates: As a credit union, Altra can offer lower loan rates, higher savings rates, and fewer fees compared to many banks.

- Community Involvement: Altra is deeply committed to giving back to the communities it serves through volunteer work, financial literacy programs, and donations to local charities.

- Online and Mobile Banking: Altra provides convenient digital banking services that allow members to manage their accounts, transfer funds, pay bills, and deposit checks from anywhere.

Whether you’re looking for a new checking account, planning to buy a home, or saving for retirement, Altra Federal Credit Union offers a wide range of products and services to help you achieve your financial goals.

Why Choose Altra Federal Credit Union?

Here are a few reasons why individuals and families in Rochester, MN, and beyond choose Altra for their banking needs:

- Member-Owned: As a member of Altra, you have a voice in how the credit union is run and share in its financial success.

- Financial Education: Altra offers resources and workshops to help members improve their financial literacy and make informed decisions.

- Local Decision-Making: Altra’s branches are staffed by local professionals who understand the needs of the community and can provide personalized service.

By choosing Altra Federal Credit Union, you’re not just choosing a financial institution; you’re joining a community that prioritizes your financial well-being and success.

Membership Eligibility and Benefits at Altra Federal Credit Union

When it comes to choosing a financial institution, membership eligibility and benefits play a crucial role in the decision-making process. At Altra Federal Credit Union, prospective members in Rochester, MN are offered a range of exclusive services and advantages that set them apart from traditional banks.

Membership eligibility at Altra Federal Credit Union is open to individuals who meet certain criteria, such as residing in specific counties, working for select employers, or being affiliated with partner organizations. This inclusive approach ensures that a wide range of community members can access the benefits of credit union membership.

Benefits of Joining Altra Federal Credit Union

Joining Altra Federal Credit Union in Rochester, MN comes with a host of advantages that cater to the diverse financial needs of members. Some key benefits include:

- Competitive Rates: Members can take advantage of competitive interest rates on savings accounts, loans, and other financial products.

- Personalized Service: Altra Federal Credit Union prides itself on offering personalized service, ensuring that members receive individualized attention and support.

- Financial Education: The credit union provides resources and workshops to help members improve their financial literacy and make informed decisions.

- Community Involvement: Altra Federal Credit Union is actively involved in the local community, supporting various initiatives and events.

By becoming a member of Altra Federal Credit Union, individuals in Rochester, MN not only gain access to financial services but also become part of a community-focused organization dedicated to their financial well-being.

Frequently Asked Questions

What services does Altra Federal Credit Union offer in Rochester, MN?

Altra Federal Credit Union in Rochester, MN offers a wide range of financial services including savings accounts, checking accounts, loans, mortgages, and investment options.

How can I become a member of Altra Federal Credit Union in Rochester, MN?

To become a member of Altra Federal Credit Union in Rochester, MN, you can visit their branch location or apply online through their website. Membership requirements typically include residency or employment in the area.

What are the benefits of banking with Altra Federal Credit Union in Rochester, MN?

Some of the benefits of banking with Altra Federal Credit Union in Rochester, MN include competitive interest rates, low fees, personalized customer service, and access to online banking tools.

Does Altra Federal Credit Union in Rochester, MN offer mobile banking services?

Yes, Altra Federal Credit Union in Rochester, MN provides mobile banking services that allow you to check account balances, transfer funds, pay bills, and deposit checks using your smartphone or tablet.

Can I apply for a loan or mortgage online with Altra Federal Credit Union in Rochester, MN?

Yes, you can apply for a loan or mortgage online through the Altra Federal Credit Union website. The online application process is secure, convenient, and can help expedite the approval process.

What are the contact details for Altra Federal Credit Union in Rochester, MN?

You can contact Altra Federal Credit Union in Rochester, MN by phone at (507) 258-6175, or visit their branch located at 123 16th St SE, Rochester, MN 55904.

Key Points about Altra Federal Credit Union in Rochester, MN

- Offers a variety of financial services including savings accounts, checking accounts, loans, mortgages, and investments.

- Membership eligibility may require residency or employment in the area.

- Provides mobile banking services for convenient account management.

- Online loan and mortgage applications are available for faster processing.

- Located at 123 16th St SE, Rochester, MN 55904 with contact number (507) 258-6175.

Leave a comment below if you have any other questions or check out our other articles for more information on financial services!