Amica Mutual Insurance: Homeowners Insurance Coverage

✅Amica Mutual Insurance offers comprehensive homeowners insurance coverage, providing peace of mind with protection against property damage, theft, and liability.

Amica Mutual Insurance offers a variety of homeowners insurance coverage options designed to protect your home, belongings, and personal liability. Known for its exceptional customer service and comprehensive policies, Amica is a popular choice for homeowners seeking reliable and customizable insurance solutions.

In this article, we will explore the different types of coverage available through Amica Mutual Insurance homeowners insurance, as well as the benefits and additional options that can enhance your policy. Whether you are a new homeowner or looking to switch providers, understanding the specifics of Amica’s offerings can help you make an informed decision.

Types of Coverage Offered by Amica Mutual Insurance

Amica Mutual Insurance provides a range of coverage types to ensure that homeowners have the protection they need. Here are some of the key coverage options:

1. Dwelling Coverage

This type of coverage helps to repair or rebuild your home if it is damaged by covered perils such as fire, windstorms, or hail. Dwelling coverage typically includes the main structure of your home, as well as any attached structures like a garage or deck.

2. Personal Property Coverage

Personal property coverage protects your belongings, such as furniture, electronics, and clothing, in the event they are damaged or stolen. Amica offers replacement cost coverage, which reimburses you for the cost of replacing the items with new ones, rather than their depreciated value.

3. Liability Coverage

Liability coverage helps protect you financially if someone is injured on your property or if you are found legally responsible for damage to someone else’s property. This can include medical expenses, legal fees, and settlements or judgments.

4. Additional Living Expenses (ALE)

If your home becomes uninhabitable due to a covered loss, additional living expenses coverage can help pay for temporary housing, meals, and other necessary expenses while your home is being repaired or rebuilt.

Additional Coverage Options

Amica Mutual Insurance also offers several optional coverages that homeowners can add to their policy for extra protection:

- Flood Insurance: Standard homeowners insurance does not cover flood damage. Amica offers separate flood insurance policies to protect your home and belongings from flood-related losses.

- Earthquake Insurance: For homeowners in earthquake-prone areas, Amica provides coverage specifically for earthquake damage.

- Identity Fraud Expense Coverage: This coverage helps cover the costs associated with restoring your identity if you become a victim of identity theft.

- Scheduled Personal Property: For high-value items such as jewelry, fine art, or collectibles, Amica offers additional coverage to ensure these items are adequately protected.

Benefits of Choosing Amica Mutual Insurance

Amica Mutual Insurance is highly regarded for its commitment to customer satisfaction and the quality of its coverage. Here are some benefits of choosing Amica for your homeowners insurance:

- Exceptional Customer Service: Amica consistently receives high ratings for customer satisfaction, thanks to its responsive and helpful customer service team.

- Discounts and Savings: Amica offers various discounts, such as multi-policy discounts, loyalty discounts, and discounts for safety features like smoke detectors and security systems.

- Customizable Policies: With a range of coverage options and add-ons, homeowners can tailor their policy to meet their specific needs and budget.

How to Get a Quote

Getting a quote from Amica Mutual Insurance is straightforward and can be done online or by contacting an agent. By providing information about your home and coverage needs, you can receive a personalized quote that outlines the cost and coverage options available to you.

Tipos de coberturas disponibles para propietarios de viviendas

When it comes to protecting your home, having the right homeowners insurance coverage is essential. Amica Mutual Insurance offers a variety of coverage options to meet the needs of homeowners. Let’s explore some of the types of coverages available for homeowners:

1. Dwelling Coverage:

This type of coverage protects the structure of your home, including walls, roof, and foundation, from covered perils such as fire, wind, and theft. Dwelling coverage is crucial to repair or rebuild your home in case of damage.

2. Personal Property Coverage:

Personal property coverage helps protect your belongings inside your home, such as furniture, clothing, and electronics. In the event of a covered loss, this coverage can help replace or repair your personal items.

3. Liability Coverage:

Liability coverage is essential for homeowners as it provides financial protection if someone is injured on your property and decides to sue you. This coverage can help with legal expenses and medical bills resulting from the incident.

4. Additional Living Expenses (ALE) Coverage:

When your home becomes uninhabitable due to a covered loss, ALE coverage helps with temporary living expenses such as hotel bills, meals, and other accommodations while your home is being repaired.

Choosing the right combination of home insurance coverages is crucial to protect your home and assets. Understanding the different types of coverages available can help you make an informed decision based on your needs and budget.

Cómo presentar un reclamo de seguro de vivienda con Amica

Cómo presentar un reclamo de seguro de vivienda con Amica

En caso de que necesites presentar un reclamo de seguro de vivienda con Amica Mutual Insurance, es fundamental seguir un proceso claro y eficiente para asegurarte de obtener la compensación adecuada por cualquier daño que afecte tu propiedad. Aquí te presentamos una guía paso a paso para ayudarte a presentar un reclamo con éxito:

1. Comunícate con Amica

Lo primero que debes hacer al enfrentar una situación que requiera un reclamo es ponerte en contacto con Amica. Puedes hacerlo a través de su línea telefónica de atención al cliente o a través de su plataforma en línea. Es importante proporcionar toda la información necesaria de manera clara y detallada.

2. Documenta el daño

Es fundamental documentar cualquier daño sufrido en tu propiedad. Toma fotografías y videos que muestren claramente la extensión de los daños. Esta evidencia visual será crucial para respaldar tu reclamo y agilizar el proceso de evaluación por parte de Amica.

3. Revisa tu póliza de seguro

Antes de presentar el reclamo, es importante revisar cuidadosamente tu póliza de seguro de vivienda con Amica. Asegúrate de entender los límites de cobertura, las exclusiones y cualquier otro detalle relevante que pueda afectar la compensación que recibirás por el reclamo.

4. Proporciona toda la información requerida

Al presentar tu reclamo, asegúrate de proporcionar toda la información solicitada por Amica. Esto puede incluir detalles sobre cómo ocurrió el daño, la fecha y hora en que sucedió, y cualquier otra información relevante que pueda ayudar en la evaluación de tu reclamo.

5. Colabora con el ajustador

Una vez que hayas presentado tu reclamo, es probable que un ajustador de Amica se comunique contigo para programar una inspección de la propiedad. Es importante colaborar con el ajustador, proporcionarle acceso a la propiedad y responder cualquier pregunta que pueda tener de manera honesta y completa.

Seguir estos pasos te ayudará a presentar un reclamo de seguro de vivienda de manera efectiva con Amica Mutual Insurance y a obtener la compensación que necesitas para reparar los daños en tu hogar.

Preguntas frecuentes

What does homeowners insurance cover?

Homeowners insurance typically covers damage to your home, personal belongings, liability protection, and additional living expenses.

How much homeowners insurance do I need?

The amount of homeowners insurance you need depends on factors such as the value of your home, personal belongings, and potential liability risks.

What is the difference between actual cash value and replacement cost coverage?

Actual cash value coverage pays for the cost of the item at the time it was damaged, while replacement cost coverage pays for the cost of a new item to replace the damaged one.

Are natural disasters covered by homeowners insurance?

Most standard homeowners insurance policies do not cover damage from floods, earthquakes, or hurricanes. Additional coverage may be required.

Can I save money on homeowners insurance?

Yes, you can save money on homeowners insurance by bundling policies, improving home security, and maintaining a good credit score.

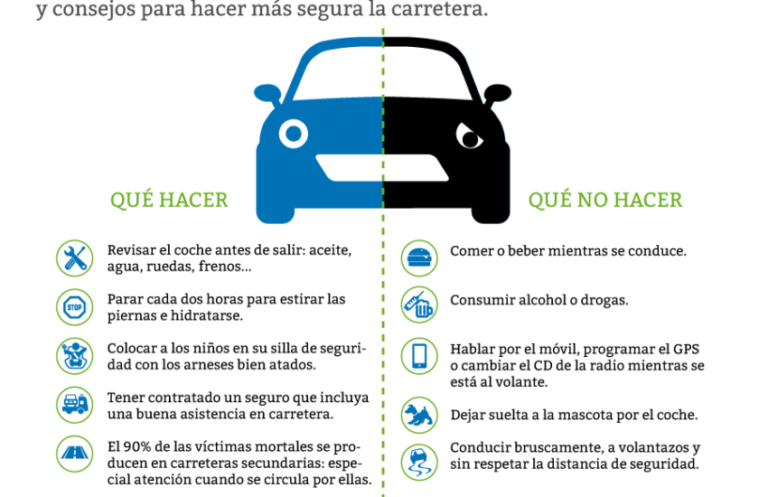

What should I do if I need to file a homeowners insurance claim?

If you need to file a homeowners insurance claim, contact your insurance company as soon as possible, document the damage, and provide any requested information or documentation.

Key Points about Homeowners Insurance

- Homeowners insurance typically covers damage to your home, personal belongings, liability protection, and additional living expenses.

- The amount of homeowners insurance you need depends on the value of your home, personal belongings, and potential liability risks.

- Actual cash value coverage pays for the cost of the item at the time it was damaged, while replacement cost coverage pays for the cost of a new item to replace the damaged one.

- Most standard homeowners insurance policies do not cover damage from floods, earthquakes, or hurricanes. Additional coverage may be required.

- Ways to save money on homeowners insurance include bundling policies, improving home security, and maintaining a good credit score.

- If you need to file a homeowners insurance claim, contact your insurance company promptly, document the damage, and provide any requested information or documentation.