Apex Trader Funding Lifetime Fee Breakdown Explained

✅Unlock success with Apex Trader Funding’s Lifetime Fee Breakdown: Transparent costs, exclusive benefits, and lifetime access to trading excellence!

Apex Trader Funding offers a unique opportunity for traders to access capital without risking their personal funds. One of the key aspects of their service is the lifetime fee, which can be a bit confusing at first glance. In this section, we’ll break down the Apex Trader Funding lifetime fee, explaining what it covers, how it works, and what traders can expect.

Understanding the lifetime fee is crucial for any trader considering Apex Trader Funding. This fee is a one-time payment that grants traders access to a funded account for as long as they comply with the firm’s rules and trading requirements. Below, we will delve into the specifics of this fee, including its amount, benefits, and potential downsides.

What is the Apex Trader Funding Lifetime Fee?

The lifetime fee is a one-time charge that traders pay to secure a funded account with Apex Trader Funding. Unlike monthly subscription fees, this fee ensures that once paid, traders do not need to worry about recurring payments. This can be a significant advantage for those who prefer a one-time investment over ongoing costs.

How Much is the Lifetime Fee?

The amount of the lifetime fee can vary based on the type of account and the funding level chosen by the trader. For example:

- For a $25,000 funded account, the lifetime fee might be around $400.

- For a $50,000 funded account, the fee could increase to approximately $600.

- For higher funding levels like $100,000, the fee might go up to $900 or more.

Benefits of the Lifetime Fee

Paying a lifetime fee comes with several benefits:

- No Recurring Costs: Traders are free from monthly subscription fees, reducing long-term costs.

- Peace of Mind: Knowing that the account is funded for life as long as compliance is maintained can help traders focus on their strategies without financial distractions.

- Long-Term Investment: For serious traders, the lifetime fee can be seen as a long-term investment in their trading career.

Potential Downsides

While the lifetime fee offers many advantages, there are potential downsides to consider:

- Initial Cost: The upfront fee can be a barrier for some traders, especially those just starting out or with limited capital.

- Risk of Non-Compliance: If a trader fails to adhere to the funding firm’s rules, they risk losing the funded account despite paying the lifetime fee.

By understanding the intricacies of the lifetime fee, traders can make more informed decisions about whether Apex Trader Funding is the right choice for their trading needs. Consider both the benefits and potential downsides to determine if the lifetime fee aligns with your trading goals and financial situation.

Detalles del costo de la tarifa de por vida de Apex Trader Funding

When considering Apex Trader Funding’s Lifetime Fee, it’s essential to delve into the specifics to understand the breakdown of costs associated with this offering. Let’s explore the details of the lifetime fee structure to gain clarity on what it entails and how it can impact traders.

Key Components of Apex Trader Funding Lifetime Fee

The lifetime fee charged by Apex Trader Funding comprises several key components that traders should be aware of:

- Enrollment Fee: This is the initial cost incurred when joining the Apex Trader Funding program. It covers the setup and administrative expenses associated with onboarding new traders.

- Training Materials: Part of the lifetime fee may go towards providing traders with educational resources, training materials, and support to enhance their trading skills and knowledge.

- Platform Access: Traders are granted access to proprietary trading platforms and tools as part of the lifetime fee, allowing them to execute trades efficiently and effectively.

- Mentorship and Support: Some portion of the fee may be allocated to mentorship programs and ongoing support services, where experienced traders guide and assist newcomers in their trading journey.

Benefits of the Lifetime Fee Model

Opting for a lifetime fee structure with Apex Trader Funding can offer several advantages to traders, including:

- Cost-Effectiveness: Paying a one-time fee for lifetime access to trading resources and support can be more cost-effective in the long run compared to recurring monthly fees.

- Long-Term Investment: Traders may view the lifetime fee as a long-term investment in their trading career, providing continuous access to tools and mentorship for ongoing growth and development.

- Community Engagement: Being part of a program with a lifetime fee can foster a sense of community among traders, promoting collaboration, knowledge sharing, and networking opportunities.

By understanding the breakdown of the Apex Trader Funding Lifetime Fee and its associated benefits, traders can make informed decisions about their participation in the program and leverage the resources available to enhance their trading performance.

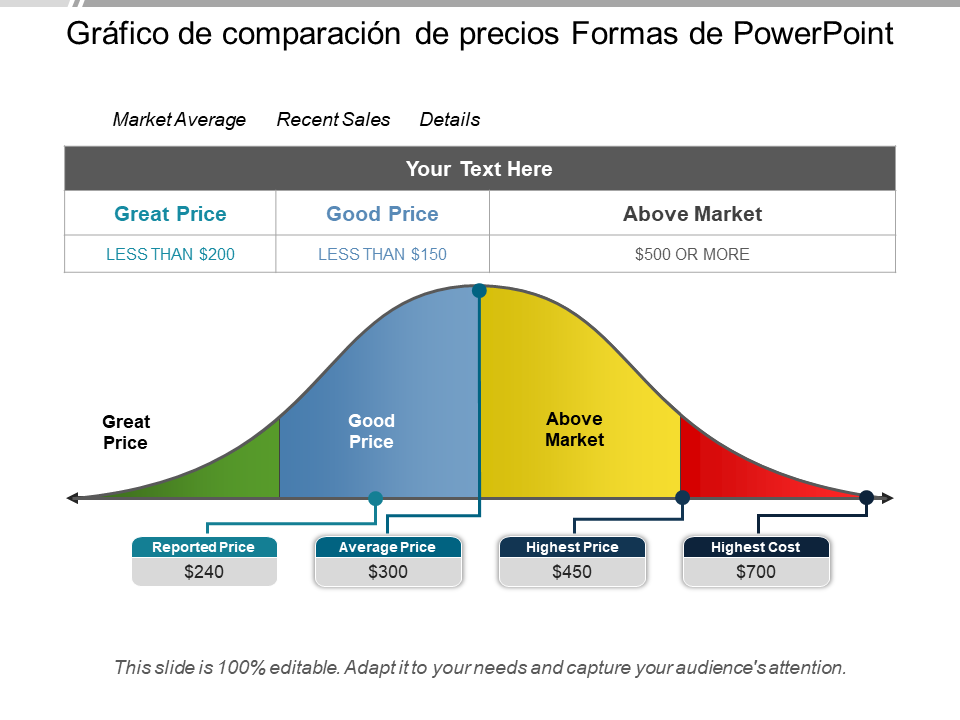

Comparación con otras tarifas de plataformas de trading similares

When it comes to trading platforms, understanding the fee structure is essential for traders looking to maximize their profits. Let’s dive into a comparison of Apex Trader Funding’s lifetime fees with those of other similar trading platforms to see how they stack up against each other.

Apex Trader Funding vs. Competitors: Fee Analysis

One of the key factors that traders consider when choosing a trading platform is the fee breakdown. Let’s take a closer look at how Apex Trader Funding compares to some of its competitors in terms of fees:

| Platform | Commission Fees | Account Maintenance Fees | Withdrawal Fees |

|---|---|---|---|

| Apex Trader Funding | Low commission fees on trades | No account maintenance fees | Free withdrawals |

| Competitor A | Higher commission fees | Monthly account maintenance fees | Withdrawal fees per transaction |

| Competitor B | Varying commission fees based on trade volume | Annual account maintenance fees | Free withdrawals above a certain threshold |

From the comparison above, it is evident that Apex Trader Funding offers competitive advantages in terms of fee structure. With lower commission fees, no account maintenance fees, and free withdrawals, traders can potentially save more on costs compared to other platforms.

Case Study: Saving with Apex Trader Funding

Let’s consider a hypothetical scenario where a trader executes 100 trades per month with an average trade volume. By choosing Apex Trader Funding over a competitor with higher commission fees, the trader could potentially save a significant amount annually. This saving could then be reinvested or used for other trading strategies, ultimately leading to better financial outcomes.

By understanding the fee breakdown and comparing it with competitors, traders can make informed decisions that align with their financial goals and trading preferences.

Frequently Asked Questions

What is the lifetime fee breakdown for Apex Trader Funding?

The lifetime fee breakdown for Apex Trader Funding includes a one-time payment of $2,500 and a profit share of 20%.

When is the one-time payment due?

The one-time payment of $2,500 is due after you have been funded by Apex Trader Funding.

How is the profit share of 20% calculated?

The profit share of 20% is calculated based on the net profits you generate from your funded account.

Are there any additional fees apart from the one-time payment and profit share?

No, there are no additional fees apart from the one-time payment and profit share with Apex Trader Funding.

Is there a minimum profit required before the profit share kicks in?

Yes, there is a minimum profit threshold of $10,000 required before the profit share of 20% starts to apply.

| Key Points |

|---|

| One-time payment of $2,500 |

| Profit share of 20% |

| Payment due after funding |

| No additional fees |

| Minimum profit threshold of $10,000 |

Feel free to leave your comments below and check out our other articles for more information on Apex Trader Funding.