Are Credit Repair Companies Legit? Understanding Their Role

✅Credit repair companies can be legit, but it’s crucial to research thoroughly. They can help fix your credit, but beware of scams and false promises!

Are credit repair companies legit? This is a common question among individuals looking to improve their credit scores. The legitimacy of credit repair companies can vary significantly, and while there are reputable firms that can help you navigate the complexities of credit improvement, there are also many scams that can take advantage of desperate consumers.

Credit repair companies work by attempting to remove inaccurate or outdated information from your credit report, which can, in turn, improve your credit score. They generally operate within the framework of the Fair Credit Reporting Act (FCRA), which gives consumers the right to dispute information in their credit reports. However, it’s crucial to understand that you can also dispute errors on your credit report yourself, at no cost.

Understanding the Role of Credit Repair Companies

Before diving into the services offered by credit repair companies, it’s essential to understand their role and the potential benefits and risks involved. These companies typically offer services such as:

- Credit Report Analysis: Reviewing your credit reports from the major credit bureaus (Experian, Equifax, and TransUnion) to identify inaccurate or outdated information.

- Dispute Filing: Submitting disputes to the credit bureaus on your behalf to challenge incorrect or unverifiable information.

- Credit Counseling: Providing advice on how to manage your credit and improve your credit score over time.

Potential Benefits of Using Credit Repair Companies

There are several potential benefits to using a credit repair company, including:

- Expertise: Credit repair companies often have experience and knowledge about the intricacies of credit reporting and the dispute process.

- Time-Saving: Handling disputes and following up with credit bureaus can be time-consuming. A credit repair company can manage this process for you.

- Improved Credit Score: By removing incorrect or outdated information, your credit score may improve, potentially leading to better loan terms and interest rates.

Risks and Drawbacks of Credit Repair Companies

Despite the potential benefits, there are also risks and drawbacks to consider:

- Cost: Credit repair services can be expensive, with fees ranging from hundreds to thousands of dollars.

- No Guarantees: Legitimate credit repair companies cannot guarantee the removal of negative items from your credit report. Be wary of any company that promises specific results.

- Scams: Unfortunately, there are many fraudulent credit repair companies that prey on vulnerable consumers. It’s essential to research and choose a reputable company.

How to Identify Reputable Credit Repair Companies

To ensure you are working with a legitimate credit repair company, consider the following tips:

- Check for Accreditation: Look for companies that are accredited by organizations such as the Better Business Bureau (BBB).

- Read Reviews: Search for consumer reviews and testimonials to gauge the experiences of other customers.

- Avoid Upfront Fees: Be cautious of companies that demand payment before providing any services. The Credit Repair Organizations Act (CROA) prohibits this practice.

- Understand Your Rights: Familiarize yourself with your rights under the FCRA and CROA to ensure the company operates legally and ethically.

Ultimately, the legitimacy of a credit repair company depends on their practices and your due diligence in researching them. While these companies can offer valuable assistance, it’s essential to weigh the benefits against the costs and risks.

Cómo funcionan las compañías de reparación de crédito en la práctica

Understanding how credit repair companies work in practice is essential for anyone considering their services. These companies typically offer to help individuals improve their credit scores by identifying and disputing errors on their credit reports. Let’s delve into the practical aspects of how these companies operate:

1. Initial Consultation

When you engage a credit repair company, the process often starts with an initial consultation. During this consultation, the company will review your credit report to identify any negative items that could be disputed. This step is crucial as it sets the foundation for the rest of the credit repair process.

2. Dispute Process

Once potential errors or discrepancies are identified in your credit report, the credit repair company will proceed with the dispute process. They will communicate with credit bureaus and creditors on your behalf to challenge inaccurate information. This may involve sending letters, submitting documentation, and following up to ensure timely responses.

3. Monitoring and Updates

As the dispute process unfolds, reputable credit repair companies will keep you updated on the progress. They will monitor any changes to your credit report and inform you of any deletions or improvements. This level of transparency is essential for clients to track the effectiveness of the services they are receiving.

4. Educational Resources

Besides the dispute process, many credit repair companies also provide educational resources to help clients understand credit management better. These resources may include budgeting tips, debt repayment strategies, and guidance on maintaining a healthy credit profile in the long run.

By understanding how credit repair companies operate in practice, individuals can make informed decisions about whether to enlist their services. While these companies can offer valuable assistance in certain situations, it’s essential to research and choose a reputable company with a proven track record of success.

Regulaciones y leyes que rigen a las compañías de reparación de crédito

When considering the regulations and laws that govern credit repair companies, it’s essential to understand the framework within which these organizations operate. In the United States, several laws protect consumers from deceptive practices and ensure that individuals have the right to accurate credit reports.

One of the key pieces of legislation in this area is the Fair Credit Reporting Act (FCRA), which aims to promote the accuracy, fairness, and privacy of information in credit reports. Under the FCRA, consumers have the right to dispute inaccurate information on their credit reports and have it corrected by the credit bureaus.

Additionally, the Credit Repair Organizations Act (CROA) sets forth requirements for credit repair companies operating in the United States. This law mandates that these companies must provide consumers with a written contract detailing the services they will provide, the terms of payment, and their cancellation rights.

By familiarizing yourself with the regulatory landscape surrounding credit repair, you can better protect yourself from scams and ensure that you are working with a reputable and legitimate organization. It’s crucial to research any credit repair company you are considering and verify that they comply with all relevant laws and regulations.

Frequently Asked Questions

Are credit repair companies legal?

Yes, credit repair companies are legal, but they must comply with the Credit Repair Organizations Act (CROA).

How do credit repair companies work?

Credit repair companies work by identifying errors on your credit report, disputing them with the credit bureaus, and helping you improve your credit score.

Can credit repair companies guarantee results?

No, credit repair companies cannot guarantee specific results, as the outcome depends on various factors, including the accuracy of the information on your credit report.

How long does it take for credit repair companies to improve my credit score?

The time it takes for credit repair companies to improve your credit score varies depending on the complexity of your situation, but it can take several months to see significant changes.

What should I look for in a reputable credit repair company?

You should look for a credit repair company that is transparent about its services, fees, and guarantees, has positive reviews, and is accredited by organizations like the Better Business Bureau.

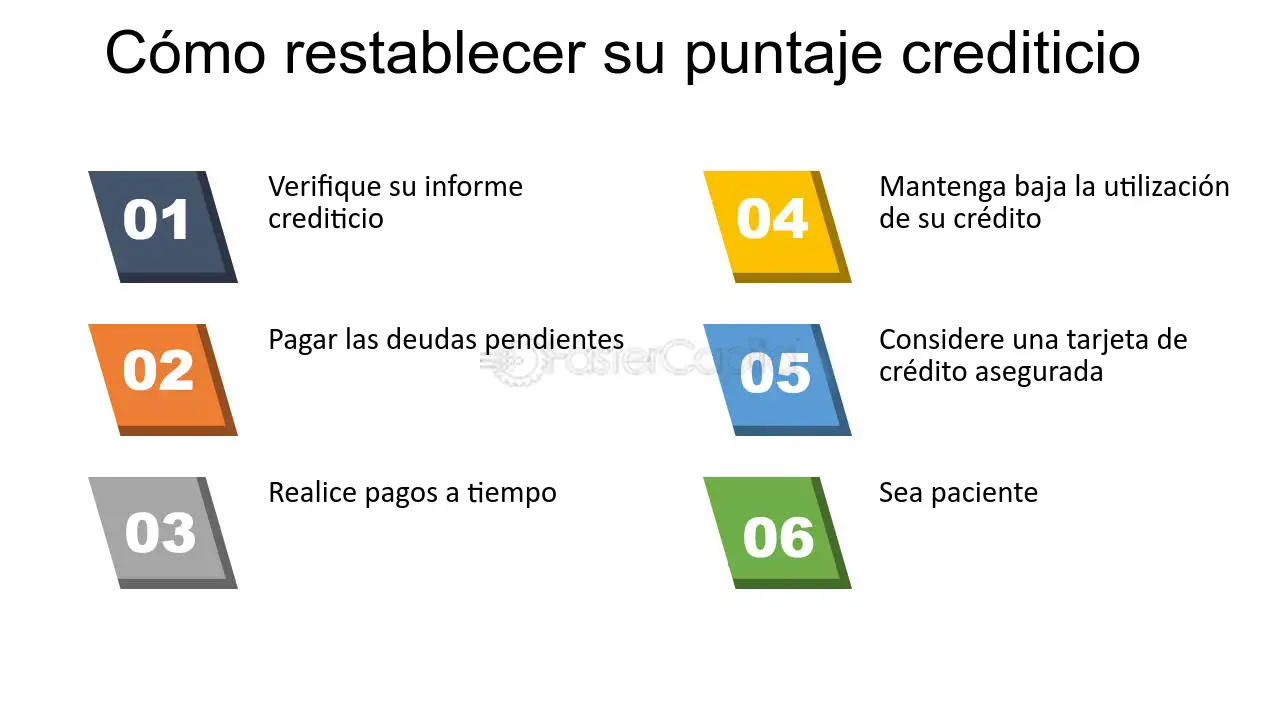

Are there any alternatives to using a credit repair company?

Yes, you can improve your credit score on your own by reviewing your credit report, disputing errors, paying bills on time, and managing your credit responsibly.

| Key Points about Credit Repair Companies |

|---|

| Credit repair companies are legal but must comply with regulations. |

| They work by identifying errors, disputing them, and helping improve credit scores. |

| Results are not guaranteed, and timeframes for improvements vary. |

| Look for transparency, positive reviews, and accreditation when choosing a company. |

| Improving credit score independently is an alternative to using credit repair companies. |

Feel free to leave your comments and check out our other articles for more information on managing your finances!