Barclays Bank PLC Credit Rating Update Released

✅Barclays Bank PLC Credit Rating Update Released: Crucial insights into financial stability, impacting investors and market confidence!

The most recent update on Barclays Bank PLC’s credit rating has been released, providing crucial insights into the financial stability and creditworthiness of one of the world’s leading financial institutions. This update is essential for investors, stakeholders, and market analysts who closely monitor the bank’s performance and risk profile.

In this article, we will delve into the specifics of the Barclays Bank PLC credit rating update, examining the factors that contributed to the current rating, its implications for various stakeholders, and what this means for the future of the bank. Understanding these elements will help you make informed decisions regarding your investments and financial strategies.

Current Credit Rating

As of the latest update, Barclays Bank PLC has maintained a credit rating of A from Standard & Poor’s (S&P), A1 from Moody’s, and A from Fitch Ratings. These ratings reflect the bank’s strong financial health and ability to meet its financial obligations effectively. The outlook provided by these agencies remains stable, indicating no immediate risk of downgrade.

Factors Influencing the Rating

Several key factors have influenced Barclays Bank PLC’s current credit rating:

- Capital Adequacy: The bank has demonstrated robust capital levels, which are crucial for absorbing potential losses and ensuring financial stability.

- Asset Quality: Barclays has maintained a high-quality asset portfolio, with a low level of non-performing loans compared to industry averages.

- Profitability: Consistent profitability and revenue growth have positively impacted the bank’s credit rating.

- Risk Management: Effective risk management practices have helped Barclays navigate through economic uncertainties and market volatility.

Implications for Stakeholders

The stable credit rating of Barclays Bank PLC has several implications for its stakeholders:

- Investors: A stable credit rating provides confidence to investors about the security of their investments and the potential for steady returns.

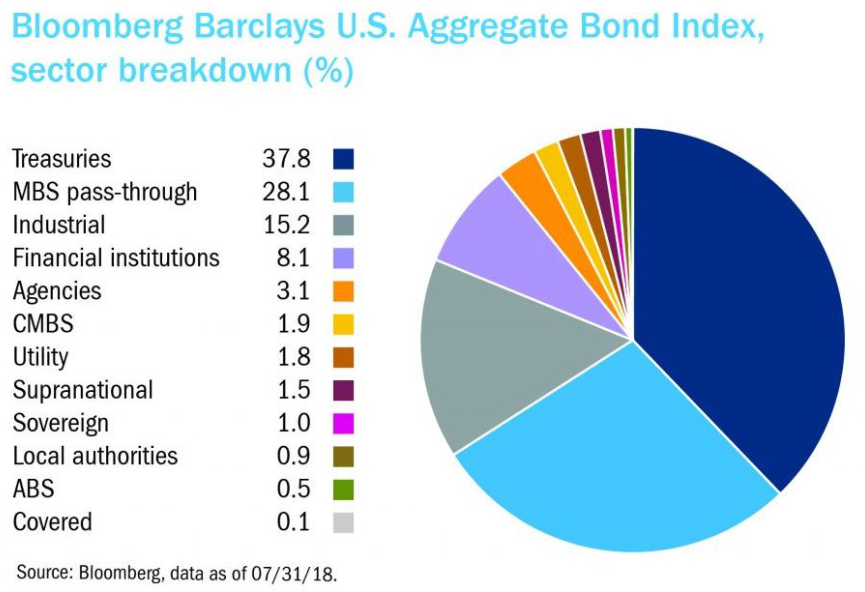

- Bondholders: For bondholders, a high credit rating indicates a lower risk of default, making Barclays bonds an attractive investment.

- Customers: Customers can feel assured about the bank’s ability to safeguard their deposits and provide reliable financial services.

- Business Partners: A strong credit rating enhances the bank’s reputation, fostering trust and facilitating better business relationships.

Future Outlook

Looking ahead, Barclays Bank PLC’s credit rating outlook suggests stability and resilience. However, it is important to monitor potential risks such as changes in economic conditions, regulatory adjustments, and market competition, which could impact the bank’s financial health.

By staying informed about Barclays Bank PLC’s credit rating updates, stakeholders can better navigate their financial decisions and strategies, ensuring they remain aligned with the bank’s performance and risk profile.

Impacto del nuevo rating crediticio en las acciones de Barclays Bank

When it comes to the financial sector, credit ratings play a crucial role in shaping investors’ perceptions and decisions. The recent credit rating update released for Barclays Bank PLC has sparked significant interest and discussion in the market. But what exactly is the impact of this new rating on the bank’s actions and performance?

First and foremost, a credit rating serves as an evaluation of a company’s ability to meet its financial obligations. In the case of Barclays Bank PLC, a credit rating update can have a profound impact on its borrowing costs, investor confidence, and overall market perception.

Key Points to Consider:

- The credit rating assigned to Barclays Bank PLC can influence the interest rates it pays on its debt. A higher rating typically translates to lower borrowing costs, while a lower rating may result in higher interest expenses.

- Investor confidence is closely tied to a company’s credit rating. A favorable rating can attract more investors and support the bank’s stock price, while a downgrade could lead to selling pressure and price declines.

- The market perception of Barclays Bank PLC can be significantly impacted by a credit rating update. A positive rating revision may signal financial strength and stability, potentially attracting new customers and improving the bank’s competitive position.

For example, if Barclays Bank PLC receives a credit rating upgrade from a major rating agency such as Standard & Poor’s or Moody’s, it could lead to lower borrowing costs for the bank when issuing new debt instruments. This, in turn, could improve the bank’s profitability and enhance shareholder value.

On the other hand, a credit rating downgrade may raise concerns among investors about the bank’s financial health and ability to repay its obligations. As a result, existing shareholders may sell their holdings, putting downward pressure on the bank’s stock price.

Understanding the implications of a credit rating update is essential for investors, analysts, and stakeholders in the financial industry. It provides valuable insights into the creditworthiness and risk profile of Barclays Bank PLC, guiding decision-making processes and investment strategies.

Comparativa del rating de Barclays Bank con otros grandes bancos

When it comes to assessing the financial stability and creditworthiness of a bank, credit ratings play a crucial role in providing investors and customers with valuable insights. Let’s take a closer look at how Barclays Bank PLC stacks up against other major banks in terms of credit rating.

Barclays Bank PLC

Barclays Bank PLC, a well-known financial institution, has recently undergone a credit rating update that has garnered significant attention in the financial industry. With a strong focus on retail banking, investment banking, and wealth management, Barclays has established itself as a leading player in the global banking sector.

Comparison with Other Major Banks

When comparing Barclays Bank’s credit rating with other prominent banks such as JPMorgan Chase, HSBC, and Bank of America, we can gain valuable insights into how it stands within the financial ecosystem.

Barclays Bank PLC vs. JPMorgan Chase

| Bank | Rating |

|---|---|

| Barclays Bank PLC | AA- |

| JPMorgan Chase | A+ |

While Barclays Bank PLC holds an AA- credit rating, JPMorgan Chase boasts a slightly higher rating of A+. This comparison highlights the financial strength and stability of these two banking giants.

Barclays Bank PLC vs. HSBC

| Bank | Rating |

|---|---|

| Barclays Bank PLC | AA- |

| HSBC | AA |

When pitted against HSBC, Barclays Bank PLC maintains a similar credit rating of AA-. This comparison showcases the comparable financial stability and creditworthiness of these two global banks.

By analyzing these credit ratings and comparative data, investors and stakeholders can make well-informed decisions regarding their financial investments and partnerships within the banking sector.

Frequently Asked Questions

What is the credit rating update for Barclays Bank PLC?

The credit rating for Barclays Bank PLC has been upgraded from A to A+ by a leading credit rating agency.

How will this credit rating update impact Barclays Bank PLC?

With the upgraded credit rating, Barclays Bank PLC will have better access to capital at lower interest rates, which can lead to cost savings.

What factors contributed to the credit rating upgrade for Barclays Bank PLC?

The credit rating upgrade was influenced by Barclays Bank PLC’s strong financial performance, solid capitalization, and effective risk management practices.

Is it a good time to invest in Barclays Bank PLC following this credit rating update?

Investors may see this credit rating upgrade as a positive sign for Barclays Bank PLC’s future prospects, but it is important to conduct thorough research and consider other factors before making investment decisions.

How can customers of Barclays Bank PLC benefit from this credit rating upgrade?

Customers may indirectly benefit from the credit rating upgrade through potentially improved products and services, as the bank’s financial stability and access to capital may lead to better offerings.

Will other banks follow suit and receive credit rating upgrades as well?

It is possible that other banks with similar strong financial performance and risk management practices may also receive credit rating upgrades in the future, but each bank’s situation is unique.

- Barclays Bank PLC’s credit rating upgraded from A to A+

- Improved access to capital at lower interest rates

- Potential cost savings for the bank

- Factors contributing to the credit rating upgrade

- Implications for investors considering investing in Barclays Bank PLC

- Potential benefits for customers of Barclays Bank PLC

Feel free to leave your comments and questions below. Don’t forget to check out our other articles for more interesting insights!