Can I Buy Asurion Insurance After Purchase? Here’s How

✅Yes, you can buy Asurion insurance after purchase, but timing is crucial. Act quickly to ensure comprehensive coverage for your valuable devices!

Yes, you can buy Asurion insurance after purchasing your device. Asurion offers a variety of insurance plans that can be added post-purchase, although there are some conditions and time limits that you need to be aware of. Typically, you can add insurance within 30 days of purchasing your device, but this can vary depending on the retailer or service provider from whom you bought the device.

Understanding how to add Asurion insurance after your purchase can save you from potential out-of-pocket expenses for repairs or replacements. In this article, we’ll walk you through the steps and requirements for adding Asurion insurance after your initial purchase, ensuring you have all the information you need to protect your investment.

Steps to Add Asurion Insurance After Purchase

Follow these steps to add Asurion insurance to your device after you’ve already purchased it:

- Check Eligibility: Verify that your device is eligible for insurance. This typically means it must have been purchased within the last 30 days.

- Locate Your Purchase Documentation: Gather your receipt or proof of purchase, as you’ll need this information to sign up for the insurance plan.

- Visit the Asurion Website or Contact Their Customer Service: Go to the Asurion website or call their customer service line to start the process. Be prepared to provide details about your device and purchase.

- Select Your Plan: Choose the insurance plan that best fits your needs. Asurion offers various plans with different levels of coverage and pricing.

- Complete the Enrollment: Follow the instructions to complete your enrollment. You’ll likely need to provide your device’s IMEI number, your contact information, and payment details.

Important Considerations

When adding Asurion insurance after purchase, keep the following considerations in mind:

- Time Limit: Most retailers require that you add insurance within 30 days of your device purchase.

- Device Condition: Your device must be in good working order and free of any pre-existing damage when you enroll.

- Plan Options: Review the different plans available to find the one that offers the best coverage for your needs.

Frequently Asked Questions

Here are some common questions about adding Asurion insurance after purchase:

- Can I add insurance if my device is already damaged?

- No, the device must be in good working condition and without any pre-existing damage at the time of adding the insurance.

- What if I miss the 30-day window?

- If you miss the 30-day window, you may not be able to add Asurion insurance. However, some retailers or service providers might offer extended enrollment periods, so it’s worth checking with them directly.

- How do I know if my device is eligible?

- You can check eligibility by contacting Asurion customer service or visiting their website. Typically, eligibility depends on the time since purchase and the condition of the device.

Adding Asurion insurance after your initial purchase is a smart way to safeguard your device against unexpected issues. By following the steps outlined above and considering the important factors, you can ensure that your device is protected.

Requisitos y plazos para adquirir Asurion Insurance post-compra

Para aquellos que se preguntan “Can I buy Asurion Insurance after purchase?”, la buena noticia es que sí, es posible adquirir este seguro incluso después de haber comprado un dispositivo electrónico. Sin embargo, existen ciertos requisitos y plazos que debes tener en cuenta para poder hacerlo de manera adecuada.

Requisitos para adquirir Asurion Insurance después de la compra:

- El dispositivo debe estar en buenas condiciones: Antes de poder comprar el seguro de Asurion, es importante que el dispositivo esté en buen estado y plenamente funcional. Si el dispositivo ya tiene daños o problemas, es posible que no califique para adquirir el seguro post-compra.

- Probar la elegibilidad: Es fundamental verificar si el dispositivo en cuestión cumple con los requisitos de elegibilidad establecidos por Asurion para poder ser asegurado después de la compra.

Plazos para adquirir Asurion Insurance después de la compra:

Es crucial tener en cuenta los plazos establecidos por Asurion para la compra del seguro después de la adquisición del dispositivo. Aunque estos plazos pueden variar según el tipo de dispositivo y el país, por lo general, se suele permitir la compra del seguro post-compra dentro de un período determinado, que suele ser de 30 días a partir de la fecha de compra del dispositivo.

Algunos beneficios de adquirir Asurion Insurance después de la compra incluyen:

- Protección contra daños accidentales.

- Cobertura de robo o pérdida.

- Asistencia técnica y soporte especializado.

Si te estás preguntando si es posible comprar Asurion Insurance después de haber adquirido un dispositivo electrónico, la respuesta es afirmativa. Si cumples con los requisitos y respetas los plazos establecidos, podrás disfrutar de la tranquilidad que ofrece este seguro para proteger tu dispositivo en caso de imprevistos.

Proceso paso a paso para agregar Asurion Insurance después de la compra

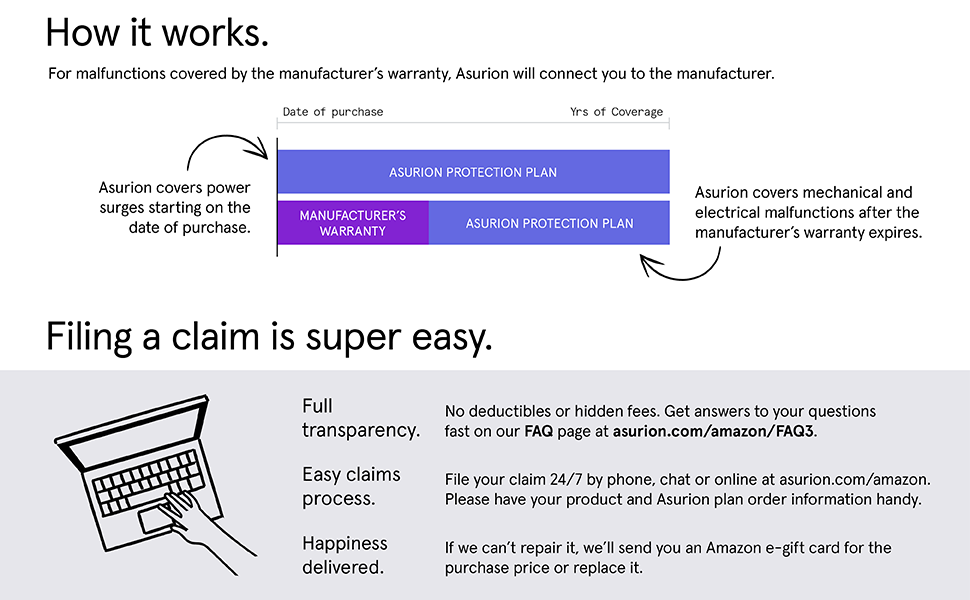

Adding Asurion Insurance to your purchase after the fact can provide an extra layer of protection for your valuable items. Here is a step-by-step guide on how to do it:

Step 1: Visit the Retailer’s Website

First, go to the retailer’s website where you made your purchase. Look for the section related to warranties or insurance options.

Step 2: Find the Asurion Insurance Option

Once you are on the warranty or insurance page, locate the Asurion Insurance option. This may be listed under extended warranties or protection plans.

Step 3: Choose Your Coverage

Select the coverage plan that best suits your needs. This could include protection against accidental damage, loss, theft, or malfunction.

Step 4: Add to Cart and Check Out

After choosing your coverage, add the Asurion Insurance plan to your cart. Proceed to check out and complete the purchase by providing the necessary information.

Step 5: Confirmation and Policy Details

Once the purchase is complete, you should receive a confirmation email with your Asurion Insurance policy details. Keep this information in a safe place for future reference.

By following these simple steps, you can easily add Asurion Insurance to your purchase after the fact, giving you peace of mind knowing your items are protected.

Frequently Asked Questions

Can I purchase Asurion insurance after buying my device?

Yes, you can purchase Asurion insurance after buying your device by visiting their website or contacting their customer service.

What devices can I insure with Asurion?

Asurion offers insurance for smartphones, tablets, laptops, desktop computers, TVs, and other electronic devices.

Does Asurion cover accidental damage?

Yes, Asurion insurance covers accidental damage, including drops, spills, and cracked screens.

How do I file a claim with Asurion?

You can file a claim with Asurion online or by calling their customer service. You will need to provide details about the issue and pay a deductible.

What is the deductible for Asurion insurance claims?

The deductible for Asurion insurance claims varies depending on the device and the type of damage. It can range from $50 to $250.

Can I cancel my Asurion insurance plan?

Yes, you can cancel your Asurion insurance plan at any time. You may be eligible for a prorated refund depending on how long you have been covered.

- Asurion offers insurance for a wide range of electronic devices.

- Accidental damage such as drops and spills is covered by Asurion.

- Deductibles for insurance claims range from $50 to $250.

- Claims can be filed online or by calling Asurion’s customer service.

- Customers can cancel their Asurion insurance plan at any time.

Feel free to leave a comment below with any other questions you may have about Asurion insurance. Don’t forget to check out our other articles for more helpful information!