Can I Open a DCU Account Online Easily? Yes, Here’s How

✅Yes, opening a DCU account online is simple! Visit DCU’s website, fill out the application, and submit. Enjoy hassle-free banking today!

Yes, you can easily open a DCU (Digital Federal Credit Union) account online. The process is straightforward, user-friendly, and can be completed in just a few steps. Whether you are looking to open a checking account, savings account, or any other financial product, DCU has made it convenient to get started from the comfort of your home.

In this article, we will walk you through the step-by-step process of opening a DCU account online. We will also discuss the requirements, benefits, and offer tips to make the application process smoother. By the end of this guide, you will be well-equipped to open your DCU account with ease.

Step-by-Step Guide to Opening a DCU Account Online

1. Gather Required Information

Before you begin the application process, make sure you have the following information ready:

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

- Valid government-issued ID (e.g., driver’s license, passport)

- Proof of address (e.g., utility bill, lease agreement)

- Contact information (phone number and email address)

2. Visit the DCU Website

Go to the DCU official website and navigate to the “Open an Account” section. Here, you will find options to open various types of accounts such as checking, savings, and more.

3. Choose the Type of Account

Select the type of account you wish to open. Each account type may have different features and benefits, so make sure to review the options to find one that best suits your needs.

4. Complete the Online Application Form

Fill out the online application form with the required information. This form will ask for your personal details, contact information, and financial information. Double-check to ensure all information is accurate to avoid delays in processing.

5. Verify Your Identity

DCU may require you to verify your identity as part of the application process. This could involve uploading a copy of your ID or answering security questions based on your credit report.

6. Fund Your New Account

Once your application is approved, you will need to fund your new account. You can do this by transferring money from an existing bank account, setting up direct deposit, or using other available funding methods.

7. Review and Submit

Before submitting your application, review all the information you have entered to ensure it is correct. Once satisfied, submit your application. You should receive a confirmation email shortly after submission.

Benefits of Opening a DCU Account Online

Opening a DCU account online comes with several benefits:

- Convenience: Complete the process from anywhere, at any time.

- Speed: The entire application process can take as little as 10-15 minutes.

- Accessibility: Easily manage your account online or through the DCU mobile app.

- Competitive Rates: DCU often offers competitive rates on savings and loan products.

Tips for a Smooth Application Process

To ensure a smooth and hassle-free application process, consider the following tips:

- Double-check your information: Make sure all entered information is accurate and up-to-date.

- Prepare your documents: Have all required documents and information ready before you start the application.

- Follow instructions: Carefully read and follow the instructions provided on the DCU website.

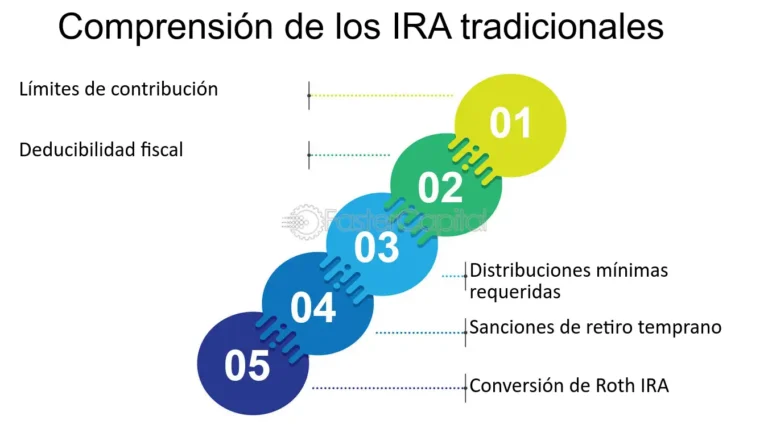

Requisitos y Documentación Necesarios para Abrir una Cuenta en DCU

When it comes to opening a DCU account online, there are specific requirements and documents you need to have on hand to ensure a smooth process. Providing the necessary information from the start can help expedite the account opening process and get you one step closer to enjoying the benefits of banking with DCU.

Document Checklist for Opening a DCU Account Online:

- Identification: You will typically need a valid government-issued photo ID, such as a driver’s license, passport, or state ID.

- Social Security Number (SSN): Your SSN is essential for identity verification and tax reporting purposes.

- Proof of Address: DCU may require a document like a utility bill, lease agreement, or bank statement with your current address.

- Initial Deposit: Be prepared to fund your new account. The amount required may vary based on the type of account you are opening.

- Personal Information: This includes your full name, date of birth, contact information, and employment details.

Having these documents ready and providing accurate information will help streamline the online account opening process with DCU. Remember that online banking offers convenience and accessibility, allowing you to manage your finances from anywhere at any time.

Benefits of Opening a DCU Account Online:

By opting for online account opening with DCU, you can enjoy a range of benefits, including:

- Convenience: No need to visit a physical branch, saving you time and effort.

- 24/7 Account Access: Manage your account, transfer funds, and pay bills at your convenience.

- Enhanced Security: DCU employs robust security measures to protect your information and transactions.

- Online Support: Access customer service and assistance online or through mobile banking.

Whether you are opening a checking account, savings account, or applying for a loan with DCU, the online process offers a seamless and efficient way to get started on your financial goals.

Paso a Paso: Guía Completa para Abrir tu Cuenta en DCU Online

Now, let’s dive into the step-by-step guide on how to open a DCU account online easily. Follow these simple instructions to get started:

1. Visit the DCU Website

The first step is to go to the DCU website. You can do this by typing “DCU” into your web browser’s search bar or by directly entering the URL.

2. Click on “Open an Account”

Once you are on the DCU website, look for the “Open an Account” button or a similar option. This is usually located prominently on the homepage.

3. Choose the Type of Account

DCU offers a variety of accounts, such as checking accounts, savings accounts, and more. Select the type of account you wish to open based on your needs.

4. Fill Out the Online Application

Complete the online application form with your personal information, including your name, address, Social Security number, and any other details required. Make sure to double-check all the information for accuracy.

5. Fund Your Account

After submitting your application, you may need to fund your DCU account. This can usually be done through a bank transfer, mobile deposit, or other methods supported by DCU.

6. Verify Your Identity

As part of the account opening process, you may need to verify your identity. This could involve providing additional documentation or answering security questions.

By following these steps, you can easily open a DCU account online from the comfort of your home.

Frequently Asked Questions

Can I open a DCU account online?

Yes, you can easily open a DCU account online by visiting their website and following the application process.

What information do I need to open a DCU account online?

You will need to provide personal information such as your name, address, social security number, and employment details.

Is there a minimum deposit required to open a DCU account online?

Yes, there is a minimum deposit required to open a DCU account online, but the amount may vary depending on the type of account you are opening.

How long does it take to open a DCU account online?

The process of opening a DCU account online is usually quick and can be completed in a matter of minutes, but verification may take a few business days.

Can I fund my DCU account online?

Yes, you can fund your DCU account online using a debit card, credit card, or by transferring funds from another bank account.

What are the benefits of opening a DCU account online?

Opening a DCU account online provides convenience, access to online banking services, and the ability to manage your finances from anywhere.

- Easy online account opening process

- Secure verification procedures

- Variety of account options available

- Online fund transfer capabilities

- 24/7 access to online banking services

- Mobile banking app for on-the-go account management

Feel free to leave your comments below with any additional questions you may have about opening a DCU account online. Don’t forget to check out other articles on our website that may interest you!