Check Cashing Apps That Don’t Use Ingo: Top Alternatives

✅Discover top check cashing apps that don’t use Ingo: PayPal, Venmo, and Cash App for seamless, instant deposits!

When looking for check cashing apps that don’t use Ingo, there are several reliable alternatives you can consider. These apps offer similar services without relying on Ingo for processing checks, ensuring flexibility and convenience for users. Popular options include PayPal, Venmo, and Chime, among others.

Below, we will delve into the details of the top alternatives to Ingo, highlighting their features, benefits, and any potential drawbacks. This comprehensive guide aims to help you make an informed decision on which app best fits your needs.

1. PayPal

PayPal is a well-known financial service that allows you to cash checks through their mobile app. The process is straightforward: take a photo of the check, and once it’s approved, the funds are available in your PayPal account.

- Features: Instant transfer to your PayPal balance, usage of funds through PayPal Debit Card or transfer to a linked bank account.

- Fees: No fees for standard processing (up to 10 days), but a 1% fee applies for instant access to funds.

- Drawbacks: Limited to users with a PayPal account.

2. Venmo

Venmo, owned by PayPal, also offers a check cashing feature through its app. Similar to PayPal, you can deposit checks by capturing a photo of the check using the app.

- Features: Easy integration with your Venmo account, which can be used for payments and transfers.

- Fees: Standard processing is free, but instant check cashing incurs a 1% fee.

- Drawbacks: Only available to Venmo users who have verified their identity.

3. Chime

Chime is another great alternative for cashing checks without using Ingo. Chime offers mobile check deposit through its app, allowing users to deposit checks directly into their Chime account.

- Features: No fees for check deposits, and funds can be accessed through the Chime Visa Debit Card.

- Fees: No fees for standard deposits, which take up to 5 business days.

- Drawbacks: Limited to Chime account holders.

Other Alternatives

1. NetSpend

NetSpend offers a mobile check deposit feature through its app, allowing you to deposit checks directly into your NetSpend prepaid card account.

- Features: Immediate access to funds with a fee, or free standard processing.

- Fees: 1% fee for payroll and government checks, 4% fee for other checks for expedited processing.

- Drawbacks: Higher fees compared to other alternatives.

2. Green Dot

Green Dot allows you to deposit checks through its app, which can be used with Green Dot prepaid cards.

- Features: Funds available within minutes for a fee, or free standard deposit.

- Fees: 1% fee for government and payroll checks, 4% fee for others for instant processing.

- Drawbacks: Higher fees for expedited processing.

By exploring these alternatives, you can find a check cashing app that meets your financial needs without the use of Ingo. Each option offers unique features and varying fees, so consider what is most important for your personal or business finances when making your choice.

Características Clave a Considerar en una App de Cobro de Cheques

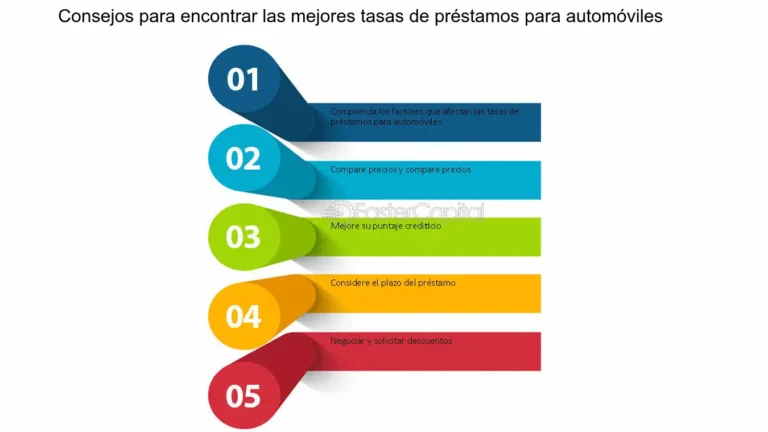

When looking for check cashing apps that don’t use Ingo, it’s important to consider some key features that can make the process smooth and efficient. Here are some crucial aspects to keep in mind:

1. Mobile Deposit Limits:

Check the mobile deposit limits of the app to ensure they meet your needs. Some apps have daily, weekly, or monthly limits on the amount you can deposit via mobile check capture. Make sure these limits align with the volume of checks you anticipate depositing.

2. Fees and Charges:

Compare the fees and charges associated with using the app. Look for transparent fee structures that are easy to understand. Some apps may charge a flat fee per check deposited, while others may take a percentage of the total amount.

3. Processing Time:

Consider the processing time of the app. Ideally, you want an app that offers quick processing to access your funds promptly. Some apps may have instant processing for an additional fee, while others may take a few business days.

4. User-Friendly Interface:

Choose an app with a user-friendly interface that makes the check cashing process intuitive and straightforward. A clutter-free design, easy navigation, and clear instructions can enhance your overall experience.

5. Security Measures:

Ensure the app prioritizes security measures to protect your sensitive financial information. Look for features like encryption, multi-factor authentication, and biometric login options to safeguard your data.

By considering these key features, you can select a check cashing app that aligns with your requirements and provides a seamless experience for cashing your checks without relying on Ingo.

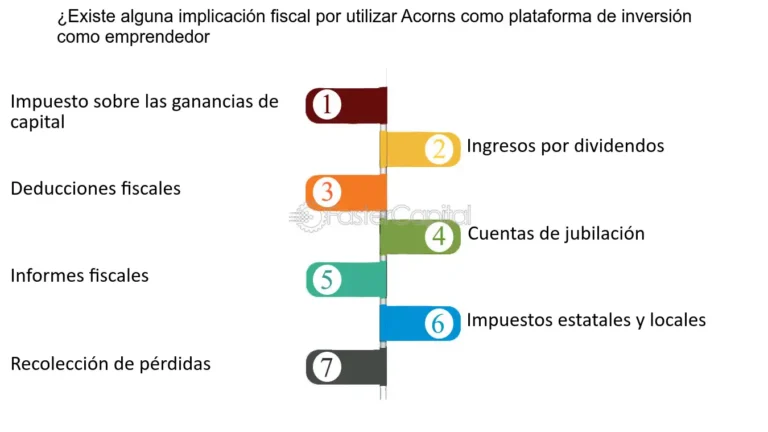

Beneficios y Desventajas de las Apps de Cobro de Cheques Alternativas

When it comes to check cashing apps, there are various alternatives to consider aside from those that use Ingo Money. Each alternative comes with its own set of benefits and drawbacks that users should take into account before making a decision. Let’s explore some of the key advantages and disadvantages of these alternative check cashing apps:

Benefits of Alternative Check Cashing Apps:

- Lower Fees: Some check cashing apps offer lower fees compared to traditional check cashing services, helping users save money on transactions.

- Faster Access to Funds: Many alternative apps provide fast access to funds, allowing users to get their money quickly without the need to wait for a check to clear.

- Convenience: With check cashing apps, users can cash their checks anytime, anywhere, using their smartphones, providing a convenient way to access funds on the go.

- Security: These apps often come with security features such as encryption and biometric authentication to ensure the safety of users’ financial information.

Drawbacks of Alternative Check Cashing Apps:

- Limitations on Check Amounts: Some check cashing apps may have limitations on the amount of the check that can be cashed, which could be a drawback for users with large checks.

- Account Verification Requirements: Users may need to go through a verification process to link their bank account to the app, which can be time-consuming and cumbersome.

- Technology Dependence: These apps rely on technology and internet connectivity, so users without access to smartphones or a stable internet connection may face challenges in using them.

Understanding the benefits and drawbacks of alternative check cashing apps can help users make an informed decision based on their specific needs and preferences. Whether it’s for lower fees, faster access to funds, or enhanced security, exploring different options can lead to a more tailored check cashing experience.

Frequently Asked Questions

What are some alternative check cashing apps besides Ingo?

Some alternative check cashing apps include PayPal, Brink’s Money, and ACE Elite.

Are there any check cashing apps that don’t use Ingo for depositing funds?

Yes, there are several check cashing apps that do not use Ingo, such as PayPal, Brink’s Money, and ACE Elite.

Which check cashing apps offer the fastest deposit times?

Ingo is known for its fast deposit times, but PayPal and Brink’s Money also offer quick deposit options for check cashing.

Can I cash a check without a bank account using these apps?

Yes, many check cashing apps, including Ingo, PayPal, and Brink’s Money, allow you to cash checks without a bank account.

Are there any fees associated with using these check cashing apps?

Yes, most check cashing apps have fees associated with cashing checks, such as a percentage of the check amount or a flat fee.

Is it safe to use check cashing apps for depositing funds?

Check cashing apps use secure encryption and verification processes to ensure the safety of your funds and personal information.

| Key Points |

|---|

| Alternative check cashing apps include PayPal, Brink’s Money, and ACE Elite. |

| Some check cashing apps offer fast deposit times similar to Ingo. |

| Most check cashing apps have fees for cashing checks. |

| Check cashing apps can be used without a bank account. |

| Security measures are in place to protect your funds and personal information. |

Leave your comments below and check out our other articles for more information on financial apps!