Check Cashing Fees at ACE Cash Express Explained

✅Discover ACE Cash Express check cashing fees! Fast, convenient, but be aware of costs. Understand your options before cashing your check.

When it comes to cashing checks, ACE Cash Express is one of the popular options many people consider. However, understanding the fees associated with their services is crucial for making an informed decision. ACE Cash Express charges varying fees depending on the type of check you want to cash and its amount. Generally, these fees can range from 1% to 6% of the check amount, but there are specific details and conditions to be aware of.

To give you a more comprehensive understanding, let’s delve into the specifics of the check cashing fees at ACE Cash Express and how they may affect you.

Breakdown of ACE Cash Express Check Cashing Fees

ACE Cash Express charges fees based on several factors, including the type of check, its amount, and the state regulations where the service is provided. Here is a detailed look at these fees:

Types of Checks and Their Associated Fees

- Payroll Checks: Typically, the fee ranges from 2% to 4% of the check amount. For instance, if you cash a $500 payroll check, you might pay between $10 and $20.

- Government Checks: These checks usually incur a lower fee, often around 1% to 3% of the check amount. For example, cashing a $1,000 government check might cost you between $10 and $30.

- Personal Checks: Personal checks generally have higher fees, often ranging from 4% to 6%. Cashing a $200 personal check could cost you between $8 and $12.

- Other Checks: Fees for other types of checks, such as insurance checks or money orders, can vary widely. It’s advisable to inquire directly at the location for specific rates.

Factors Influencing Fee Amounts

Several factors can influence the exact fee you will pay at ACE Cash Express:

- Check Amount: Larger checks often incur lower percentage fees compared to smaller checks.

- State Regulations: Some states have caps on check cashing fees, which can affect the cost.

- Promotional Offers: Occasionally, ACE Cash Express may offer promotions that reduce fees for certain types of checks.

Tips for Minimizing Check Cashing Fees

To minimize the fees you pay when cashing checks at ACE Cash Express, consider the following tips:

- Check for Promotions: Always ask if there are any current promotions that could reduce your fees.

- Compare with Other Services: Before deciding, compare ACE Cash Express’s fees with other check-cashing services in your area.

- Cash Larger Checks: If possible, cash larger checks to take advantage of lower percentage fees.

Example Fee Calculation

Let’s say you have a $1,000 payroll check. If the fee is 3%, you would pay $30 to cash it. On the other hand, if you have a $500 government check with a 2% fee, you would pay $10 to cash it.

By understanding the check cashing fees at ACE Cash Express, you can better manage your finances and make the most out of the services offered.

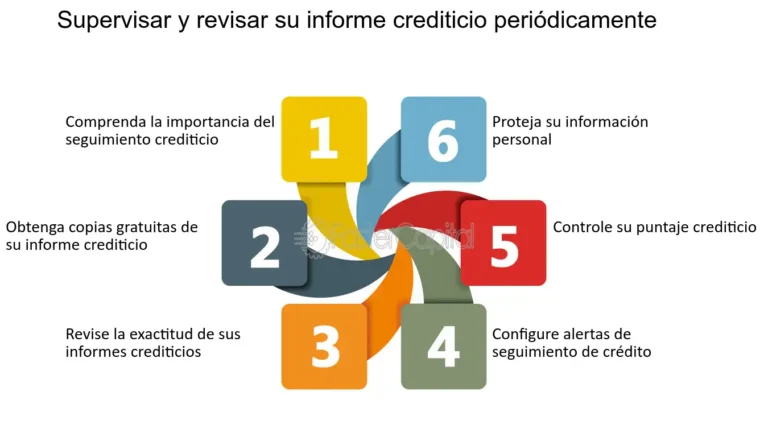

Factors Influencing Check Cashing Fees at ACE Cash Express

When it comes to understanding the factors that influence check cashing fees at ACE Cash Express, it’s essential to delve into the key elements that determine the costs associated with this service. Check cashing fees can vary depending on several factors, and being aware of these can help you make informed decisions regarding your financial transactions.

1. Check Amount:

One of the primary factors that can affect the check cashing fee is the amount of the check being cashed. ACE Cash Express may charge a different fee for checks below a certain amount compared to larger checks. For instance, a flat fee may apply for checks below $100, while a percentage fee may be charged for checks above that threshold.

2. Check Type:

The type of check being cashed can also impact the check cashing fee at ACE Cash Express. Different fees may apply to payroll checks, government checks, personal checks, or other types of checks. Understanding the fee structure for each check type can help you anticipate the costs involved.

3. Membership or Rewards Programs:

Some financial institutions, including ACE Cash Express, offer membership or rewards programs that can help customers save on check cashing fees. By enrolling in these programs, you may be eligible for discounts or lower fees based on your membership status or transaction history.

By considering these factors and exploring options such as membership programs or understanding the fee structure for different check types, you can make informed decisions when it comes to cashing checks at ACE Cash Express.

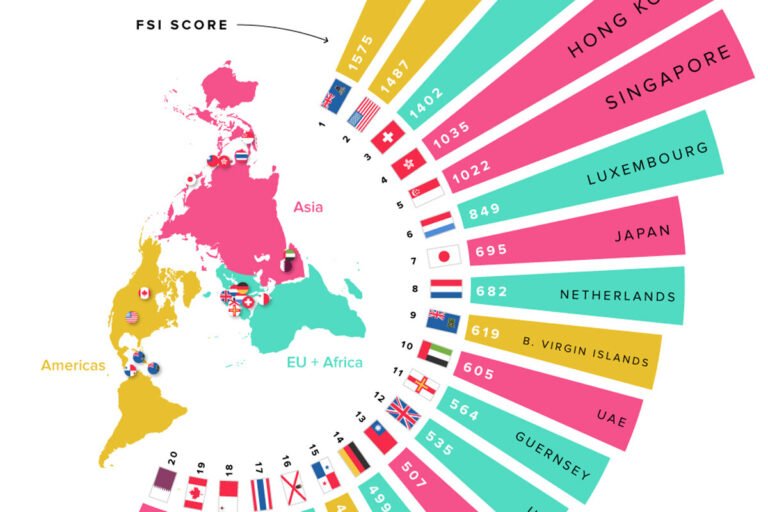

Comparison of ACE Cash Express Fees with Other Services

When it comes to comparison of ACE Cash Express fees with other services, it’s essential to understand how different companies structure their fees for check cashing services. Let’s take a closer look at how ACE Cash Express stacks up against some of its competitors in the industry.

ACE Cash Express

ACE Cash Express offers check cashing services with fees that typically range from 3% to 5% of the check amount. For example, if you need to cash a $1,000 check, you could expect to pay between $30 and $50 in fees. While these fees may seem high compared to traditional bank deposits, ACE Cash Express provides a convenient and quick solution for individuals who may not have access to a bank account.

Other Check Cashing Services

Compared to other check cashing services, such as Walmart or local grocery stores, ACE Cash Express fees may be slightly higher. However, the trade-off is the speed and accessibility that ACE Cash Express offers. For individuals who need cash immediately and cannot wait for a traditional bank deposit to clear, the convenience of ACE Cash Express may outweigh the slightly higher fees.

Factors to Consider

When deciding between ACE Cash Express and other check cashing services, it’s essential to consider factors such as convenience, speed, and cost. While ACE Cash Express may have higher fees, the ease of access to their services and the quick availability of cash can be invaluable in certain situations.

Ultimately, the choice of check cashing service will depend on your individual needs and circumstances. It’s essential to weigh the fees against the benefits of quick access to funds and convenience when making your decision.

Frequently Asked Questions

What are the fees for cashing a check at ACE Cash Express?

The fees for cashing a check at ACE Cash Express vary depending on the type of check and the amount. It is usually a percentage of the check amount plus a flat fee.

Can I cash a personal check at ACE Cash Express?

Yes, ACE Cash Express typically allows customers to cash personal checks, but they may have specific requirements such as a valid ID and verification of funds.

Are there any limits on the amount of a check I can cash at ACE Cash Express?

ACE Cash Express may have limits on the amount of a check you can cash, usually based on your previous transaction history and the type of check.

Do I need to be a customer of ACE Cash Express to cash a check?

No, you do not need to be a customer of ACE Cash Express to cash a check, but you may be subject to additional fees or requirements if you are not a regular customer.

Are there any alternatives to cashing a check at ACE Cash Express?

Some alternatives to cashing a check at ACE Cash Express include depositing the check into a bank account, using mobile check deposit apps, or visiting other check cashing locations.

What forms of ID do I need to cash a check at ACE Cash Express?

ACE Cash Express typically requires a valid government-issued ID such as a driver’s license, state ID, or passport to cash a check.

- Check cashing fees vary based on the type of check and amount.

- Personal checks can usually be cashed at ACE Cash Express.

- There may be limits on the amount of a check you can cash.

- You do not need to be a customer to cash a check, but additional fees may apply.

- Alternative options to cashing a check include mobile deposit apps and bank deposits.

- A valid government-issued ID is typically required to cash a check.

Feel free to leave your comments or questions below. Check out our other articles for more financial tips and information!