Check ‘n Go Pay Online: Easy Payment Solutions

✅Check ‘n Go Pay Online offers easy, hassle-free payment solutions for quick and secure transactions. Simplify your financial management today!

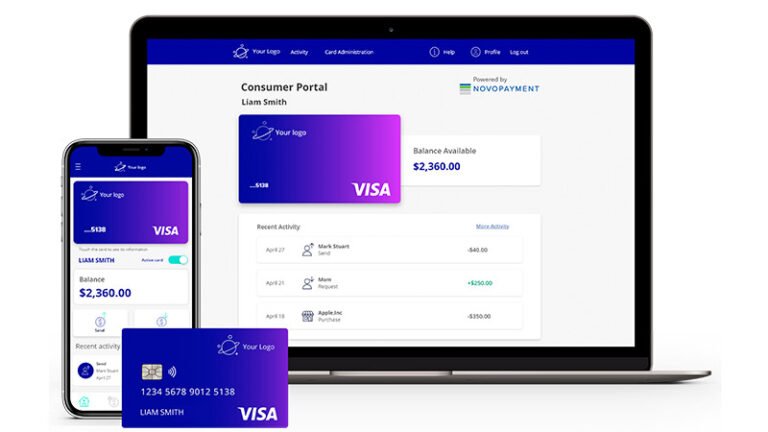

For customers looking to pay their Check ‘n Go loans online, the process is straightforward, secure, and convenient. The online payment system allows users to manage their accounts, make payments, and keep track of their loan balances from the comfort of their own homes. With just a few clicks, you can ensure your payments are processed on time, avoiding late fees and maintaining a good credit standing.

In this section, we will guide you through the steps of making an online payment with Check ‘n Go, outline the benefits of using their online platform, and provide tips to ensure your payment process is smooth and hassle-free.

Steps to Make an Online Payment with Check ‘n Go

Follow these simple steps to make your Check ‘n Go payment online:

- Log In to Your Account: Visit the Check ‘n Go website and log in using your account credentials. If you don’t have an account, you will need to create one by providing some personal information and your loan details.

- Navigate to the Payment Section: Once logged in, go to the payment section of your account. This is typically found in the main menu or dashboard.

- Select Payment Method: Choose your preferred payment method. Check ‘n Go accepts various payment options including bank transfers, debit cards, and credit cards.

- Enter Payment Details: Enter the required payment details, such as the amount you wish to pay and your payment method information. Double-check to ensure all information is correct to avoid any errors.

- Confirm and Submit: Review your payment details and confirm the transaction. Once submitted, you should receive a confirmation email or notification.

Benefits of Paying Online

Using Check ‘n Go’s online payment system comes with several advantages:

- Convenience: Pay your loan from anywhere at any time without the need to visit a physical location.

- Speed: Online payments are processed quickly, ensuring your account is updated promptly.

- Security: The platform uses advanced encryption technologies to protect your personal and financial information.

- Tracking: Easily keep track of your payment history and loan balance through your online account.

Tips for a Smooth Payment Process

To ensure your payment process is as smooth as possible, consider the following tips:

- Set Up Reminders: Use calendar reminders or notifications to remember your payment due dates.

- Save Payment Information: If possible, save your payment information securely on the platform to speed up future transactions.

- Verify Details: Always double-check your payment details before submitting to avoid any errors or delays.

- Contact Support: If you encounter any issues, don’t hesitate to contact Check ‘n Go customer support for assistance.

Conclusion

By following these steps and tips, you can make your Check ‘n Go payments online with ease and confidence. The online system is designed to be user-friendly, secure, and efficient, ensuring that managing your loan payments is a hassle-free experience.

Cómo crear una cuenta para pagar en línea

Creating an account to pay online with Check ‘n Go is a straightforward process that can save you time and provide you with convenient payment solutions. Follow these simple steps to set up your online payment account:

- Visit the Check ‘n Go website: Head to the official Check ‘n Go website to begin the account creation process. Ensure that you are on the secure website to safeguard your personal information.

- Click on the “Sign Up” or “Create Account” button: Look for the prominent button that allows you to start the registration process. This button is usually located at the top right corner of the website for easy access.

- Provide your information: Fill in the required fields with accurate information, including your full name, email address, phone number, and any other details requested by the platform.

- Choose a secure password: Select a strong password that combines letters, numbers, and special characters to enhance the security of your online account. Avoid using easily guessable passwords to protect your payment information.

- Verify your email: After completing the registration form, you may need to verify your email address by clicking on a link sent to your inbox. This step is crucial to ensure the validity of your account.

By following these steps, you can create a secure online account with Check ‘n Go and enjoy the convenience of making payments from the comfort of your home or on the go. Once your account is set up, you can easily access your payment history, schedule automatic payments, and manage your payment preferences with just a few clicks.

Beneficios de usar Check ‘n Go Pay Online

Beneficios de usar Check ‘n Go Pay Online

When it comes to managing your finances and making payments, having a convenient and reliable online payment solution can make a world of difference. Check ‘n Go Pay Online offers a range of benefits that can streamline the payment process and provide peace of mind to users.

Convenience

One of the key advantages of using Check ‘n Go Pay Online is the convenience it offers. Users can make payments from anywhere, at any time, as long as they have an internet connection. This eliminates the need to visit a physical location or send payments through the mail, saving time and effort.

Flexibility

With Check ‘n Go Pay Online, users have the flexibility to schedule payments in advance, set up recurring payments, and choose from multiple payment methods. This level of flexibility ensures that users can manage their payments in a way that fits their individual needs and preferences.

Security

Security is a top priority when it comes to online payments, and Check ‘n Go Pay Online takes this seriously. By using encryption technology and secure payment processing systems, users can trust that their financial information is safe and protected when making payments online.

Real-Time Tracking

Another benefit of Check ‘n Go Pay Online is the ability to track payments in real time. Users can easily monitor the status of their payments, receive notifications when payments are processed, and access payment history for reference. This level of transparency and visibility can help users stay organized and on top of their finances.

Overall, Check ‘n Go Pay Online offers a user-friendly and efficient payment solution that prioritizes convenience, flexibility, security, and real-time tracking. By taking advantage of these benefits, users can simplify their payment process and have more control over their financial transactions.

Frequently Asked Questions

Is paying online with Check ‘n Go secure?

Yes, Check ‘n Go uses secure encryption technology to protect your personal information.

Can I set up automatic payments with Check ‘n Go?

Yes, you can enroll in automatic payments to ensure your payments are always on time.

What payment methods are accepted for online payments?

Check ‘n Go accepts payments via credit or debit cards, as well as ACH transfers.

Are there any additional fees for paying online with Check ‘n Go?

Check ‘n Go may charge a convenience fee for online payments, depending on the payment method used.

How can I access my payment history with Check ‘n Go?

You can view your payment history by logging into your online account on the Check ‘n Go website.

What should I do if I encounter any issues while trying to pay online with Check ‘n Go?

If you experience any difficulties, you can contact Check ‘n Go’s customer service for assistance.

- Secure online payment options

- Ability to set up automatic payments

- Accepted payment methods include credit/debit cards and ACH transfers

- Possible convenience fees for online payments

- Access to payment history through online account

- Customer service support for payment issues

Leave a comment below if you have any questions or feedback, and don’t forget to check out our other articles for more helpful information!