Corporate America Family Credit Union: Financial Services Overview

✅Corporate America Family Credit Union offers comprehensive financial services, including loans, savings, and investment options, ensuring financial security and growth.

Corporate America Family Credit Union (CAFCU) provides a wide range of financial services tailored to meet the needs of its members. These services include savings accounts, checking accounts, loans, credit cards, and investment opportunities. CAFCU is dedicated to offering competitive rates and exceptional member service, aiming to help members achieve their financial goals.

In this article, we will delve into the various financial services offered by CAFCU, exploring the specific features and benefits of each. This comprehensive overview will help you understand how CAFCU can support your financial well-being, whether you are looking to save, invest, or borrow money.

Savings Accounts

CAFCU offers several types of savings accounts to cater to different financial needs:

- Regular Savings Account: This account offers a competitive interest rate with no monthly fees, allowing members to grow their savings effortlessly.

- Money Market Account: With higher interest rates and check-writing capabilities, this account is ideal for those who want to earn more on their deposits while maintaining liquidity.

- Certificates of Deposit (CDs): CAFCU offers a variety of CD terms with attractive interest rates, providing a secure way to invest your money over a fixed period.

Checking Accounts

CAFCU’s checking accounts are designed to offer convenience and flexibility:

- Free Checking: This account comes with no monthly maintenance fees, unlimited check writing, and access to a large network of ATMs.

- Interest Checking: Earn interest on your checking account balance while enjoying the same benefits as the Free Checking account.

- Student Checking: Tailored for students, this account provides no monthly fees and easy access to funds, making it perfect for managing daily expenses.

Loans

CAFCU offers a variety of loan products to help members finance their needs:

- Auto Loans: Competitive rates and flexible terms make CAFCU auto loans a great choice for financing your next vehicle.

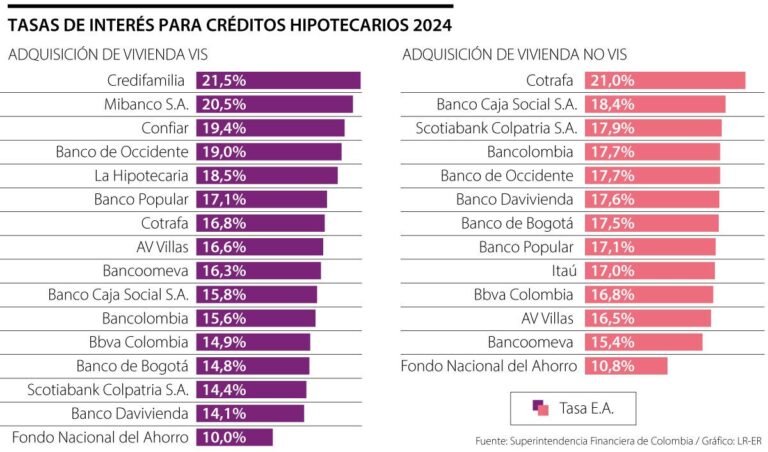

- Home Loans: Whether you’re buying a new home or refinancing an existing mortgage, CAFCU offers a range of home loan options with competitive rates.

- Personal Loans: Unsecured loans that can be used for various purposes, from debt consolidation to funding a vacation.

- Credit Builder Loans: Designed to help members build or improve their credit score, these loans are ideal for those looking to establish a positive credit history.

Credit Cards

CAFCU provides several credit card options, each with unique benefits:

- Visa Platinum: This card offers a low interest rate, no annual fee, and rewards points on purchases.

- Visa Secured: Ideal for members looking to build or rebuild their credit, this card requires a security deposit and offers the same benefits as the Visa Platinum card.

- Visa Signature: With premium rewards and benefits, this card is perfect for those who want to maximize their spending power.

Investment Opportunities

CAFCU also provides investment services to help members grow their wealth:

- Retirement Accounts: Options include Traditional and Roth IRAs, which offer tax advantages and a secure way to save for retirement.

- Investment Services: Through partnerships with financial advisors, CAFCU offers personalized investment strategies to help members achieve their financial goals.

By offering a diverse range of financial services, Corporate America Family Credit Union aims to be a one-stop financial institution for its members, providing the tools and support needed to achieve financial success.

Tipos de cuentas ofrecidas y sus beneficios específicos

When it comes to managing your finances, Corporate America Family Credit Union (CAFCU) offers a variety of accounts to suit different needs. Let’s explore the types of accounts provided by CAFCU and the specific benefits they offer:

1. Checking Accounts:

CAFCU provides different checking account options tailored to meet the diverse financial requirements of its members. Whether you are looking for a basic account with no minimum balance or one that earns interest, CAFCU has you covered. Some key benefits of CAFCU checking accounts include:

- No monthly maintenance fees

- Online and mobile banking services for convenient account management

- Access to a large network of ATMs for free cash withdrawals

2. Savings Accounts:

For those looking to save and grow their money, CAFCU offers a range of savings accounts with competitive interest rates. Members can choose from regular savings accounts, money market accounts, or certificates of deposit. The benefits of CAFCU savings accounts include:

- Higher interest rates compared to traditional banks

- Federal insurance coverage on deposits for added security

- Flexible terms to meet individual saving goals

3. Loans and Credit Cards:

CAFCU provides various loan options, including auto loans, mortgages, personal loans, and credit cards. Members can benefit from competitive interest rates, flexible repayment terms, and personalized customer service. The advantages of CAFCU loans and credit cards include:

- Low rates for qualified borrowers

- Rewards programs for credit card holders

- Online loan applications for quick approval processes

By offering a diverse range of accounts and financial products, Corporate America Family Credit Union aims to cater to the unique needs of its members and help them achieve their financial goals.

Opciones de préstamos y líneas de crédito disponibles

When it comes to managing your finances, having a variety of loan options and lines of credit available can provide the flexibility and support you need. At Corporate America Family Credit Union, we offer a range of financial solutions to meet your borrowing needs.

Types of Loans:

Here are some of the loan products you can access at Corporate America Family Credit Union:

- Auto Loans: Whether you’re buying a new car or refinancing an existing loan, our competitive auto loan rates can help you save money.

- Personal Loans: From unexpected expenses to debt consolidation, our personal loans offer fixed rates and flexible terms.

- Mortgage Loans: Planning to buy a home? Explore our mortgage loan options and get personalized guidance throughout the homebuying process.

Lines of Credit:

In addition to traditional loans, we also provide lines of credit to give you access to funds when you need them:

- Credit Cards: Our credit card options come with competitive rates and rewards programs to suit your spending habits.

- Home Equity Lines of Credit (HELOC): Tap into your home’s equity with a HELOC for projects, emergencies, or other financial needs.

Having a mix of loan products and lines of credit can help you navigate various financial situations and achieve your goals. Whether you’re looking to make a big purchase, consolidate debt, or cover unexpected expenses, Corporate America Family Credit Union is here to support you.

Frequently Asked Questions

What financial services does Corporate America Family Credit Union offer?

Corporate America Family Credit Union offers a variety of financial services including savings accounts, checking accounts, loans, credit cards, and online banking.

Can anyone join Corporate America Family Credit Union?

Membership at Corporate America Family Credit Union is open to employees and family members of certain partner companies, as well as residents of select communities.

What are the benefits of banking with Corporate America Family Credit Union?

Benefits of banking with Corporate America Family Credit Union include competitive interest rates, low fees, personalized customer service, and access to a nationwide network of ATMs.

How can I access my accounts with Corporate America Family Credit Union?

You can access your accounts with Corporate America Family Credit Union online through their website, mobile app, by phone, or by visiting one of their branch locations.

Is Corporate America Family Credit Union insured?

Yes, Corporate America Family Credit Union is federally insured by the National Credit Union Administration (NCUA) up to $250,000 per depositor.

Does Corporate America Family Credit Union offer financial education resources?

Yes, Corporate America Family Credit Union provides financial education resources such as workshops, webinars, and online tools to help members improve their financial literacy.

| Key Points |

|---|

| Membership open to employees of partner companies and residents of select communities |

| Offers savings accounts, checking accounts, loans, credit cards, and online banking |

| Federally insured by the NCUA up to $250,000 per depositor |

| Provides access to a nationwide network of ATMs |

| Focus on financial education with workshops, webinars, and online tools |

Leave a comment below if you have any more questions about Corporate America Family Credit Union’s financial services. Don’t forget to check out our other articles for more information that may interest you!