Crear Cuenta en Capital One: Guía Rápida y Sencilla

✅Unlock financial freedom! Follow this quick and easy guide to create your Capital One account and start managing your money effortlessly today!

Creating an account with Capital One is a straightforward process that can be done entirely online in just a few minutes. Whether you are looking to open a checking account, savings account, or credit card, Capital One offers a user-friendly platform to get you started quickly.

In this article, we’ll walk you through the step-by-step process of creating an account with Capital One. We’ll cover everything from the initial setup to the information you’ll need to provide, making it easy for you to get started with your new account.

Step-by-Step Guide to Creating a Capital One Account

1. Visit the Capital One Website

To begin, navigate to the official Capital One website. Look for the “Sign Up” or “Open an Account” button, usually located at the top right corner of the homepage.

2. Select the Type of Account

Capital One offers various types of accounts including checking, savings, and credit cards. Choose the type of account you want to open. For the purpose of this guide, we’ll focus on opening a checking account.

3. Fill Out the Application Form

Once you’ve selected your account type, you will be directed to an application form. You will need to provide the following information:

- Personal Information: Full name, date of birth, Social Security number, and contact details.

- Employment Information: Current employment status and income details.

- Identification: A government-issued ID such as a driver’s license or passport.

4. Review Terms and Conditions

Before submitting your application, take a moment to review the terms and conditions. Make sure you understand any fees, interest rates, and other account-specific details.

5. Submit Your Application

After reviewing the terms and conditions, you can submit your application. Capital One will process your information and, in most cases, you will receive an instant decision.

6. Fund Your Account

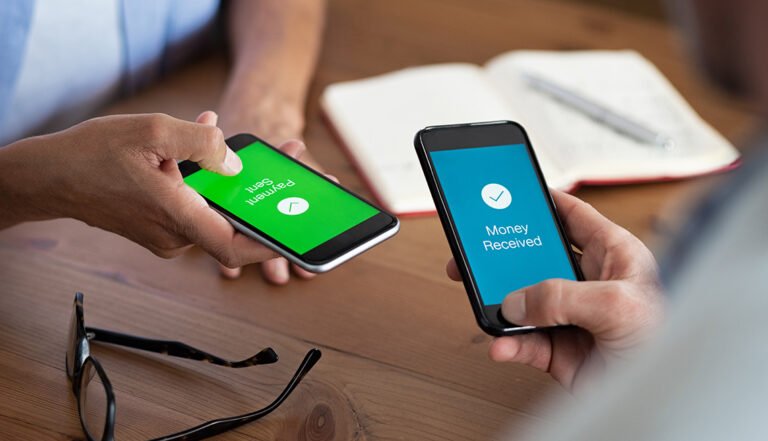

If your application is approved, the next step is to fund your account. You can do this by transferring funds from an existing bank account or by depositing a check. Capital One provides various methods to make this process easy.

7. Set Up Online Banking

Once your account is funded, you can set up your online banking profile. This will allow you to manage your account, pay bills, and transfer funds from the comfort of your home or on the go using the Capital One mobile app.

Additional Tips and Recommendations

Choosing the Right Account

Before you decide on the type of account, consider your financial goals and needs. Capital One offers different accounts with varying benefits:

- Checking Accounts: Ideal for everyday transactions and bill payments.

- Savings Accounts: Great for saving money and earning interest over time.

- Credit Cards: Useful for building credit and earning rewards.

Utilize Customer Support

If you have any questions or run into issues during the application process, Capital One offers robust customer support. You can reach out via phone, email, or live chat for assistance.

By following these steps and tips, you can easily create a Capital One account that suits your financial needs. Stay tuned for more detailed information on managing your new account and maximizing its benefits.

Requisitos Necesarios para Abrir una Cuenta en Capital One

When opening a new account with Capital One, there are certain requirements that need to be met to ensure a smooth process. Before you start the application process, make sure you have the following documents and information ready:

- Personal Identification: You will need a valid government-issued ID such as a driver’s license, passport, or state ID.

- Proof of Address: Capital One may require a document like a utility bill or bank statement with your name and current address.

- Social Security Number (SSN): Providing your SSN is a standard requirement for opening most financial accounts in the United States.

- Initial Deposit: Depending on the type of account you are opening, you may need to make an initial deposit to fund your account.

Having these items ready before you begin the account setup process can help expedite the verification process and ensure that your new Capital One account is opened without any delays.

Capital One takes security and compliance seriously, so make sure to have all the necessary paperwork and information in order to meet their requirements. Once you have everything ready, the process of creating a new account with Capital One should be quick and straightforward.

Pasos para Completar el Registro en Línea de Capital One

Creating an account online with Capital One is a simple and quick process that allows you to access a wide range of financial services. Following these steps will guide you through the registration process smoothly:

- Visit the Capital One website: Head to the official Capital One website and look for the “Sign In” or “Register” button to begin the process.

- Provide your personal information: Enter your full name, email address, date of birth, and Social Security Number. This information is crucial for identity verification and account security.

- Create your login credentials: Choose a strong password that includes a mix of letters, numbers, and special characters. This will help protect your account from unauthorized access.

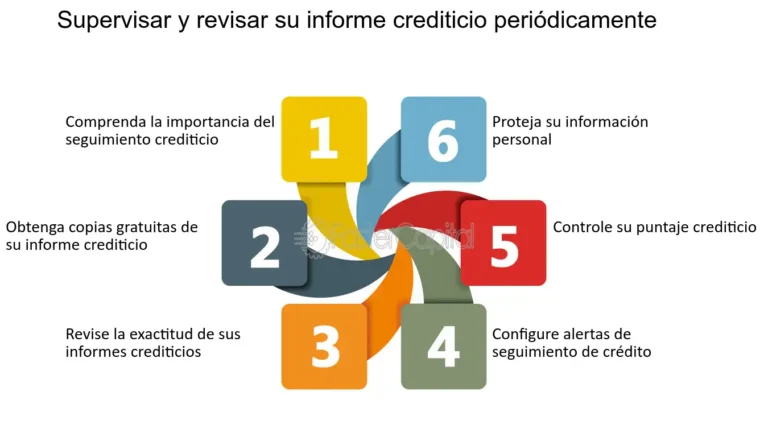

- Set up security features: Capital One takes security seriously, so you may be asked to set up additional security measures such as security questions or two-factor authentication.

- Agree to the terms and conditions: Before finalizing your account creation, make sure to read and agree to Capital One’s terms and conditions regarding the use of their online banking services.

- Verify your identity: In some cases, Capital One might require additional verification steps to confirm your identity and prevent fraud. This could involve sending a verification code to your phone or email.

By following these straightforward steps, you can quickly create an online account with Capital One and gain access to a variety of banking services, including checking your account balance, paying bills, transferring funds, and more.

Preguntas frecuentes

¿Qué requisitos necesito para abrir una cuenta en Capital One?

Para abrir una cuenta en Capital One necesitarás ser mayor de edad, tener un número de seguro social válido, y contar con una dirección física en Estados Unidos.

¿Qué tipos de cuentas ofrece Capital One?

Capital One ofrece cuentas de ahorro, cuentas corrientes (cheques), cuentas de inversión y tarjetas de crédito.

¿Cuánto cuesta abrir una cuenta en Capital One?

Abrir una cuenta en Capital One generalmente no tiene costo, pero es importante revisar las tarifas asociadas a cada tipo de cuenta.

¿Cómo puedo depositar fondos en mi cuenta de Capital One?

Puedes depositar fondos en tu cuenta de Capital One mediante transferencias bancarias, depósitos directos, cheques móviles o en los cajeros automáticos de la red.

¿Capital One ofrece servicios de banca en línea?

Sí, Capital One cuenta con una plataforma de banca en línea que te permite gestionar tus cuentas, realizar transferencias, pagar facturas y más desde tu computadora o dispositivo móvil.

¿Qué debo hacer si pierdo mi tarjeta de débito o crédito de Capital One?

En caso de extravío o robo de tu tarjeta de débito o crédito de Capital One, debes reportarlo de inmediato llamando al número de atención al cliente para que sea bloqueada y solicitar una nueva.

- Requisitos para abrir una cuenta en Capital One.

- Tipos de cuentas ofrecidas por Capital One.

- Costos asociados a la apertura de una cuenta en Capital One.

- Formas de depositar fondos en una cuenta de Capital One.

- Servicios de banca en línea de Capital One.

- Procedimiento en caso de pérdida o robo de tarjeta de débito o crédito de Capital One.

¡Déjanos tus comentarios y revisa otros artículos de interés en nuestra web!