Credit Union of So California: Financial Services and Community Support

✅Credit Union of So California: Offering tailored financial services and strong community support, enhancing financial well-being and local growth.

The Credit Union of Southern California (CU SoCal) provides a wide range of financial services tailored to meet the diverse needs of its members. From checking and savings accounts to loans and credit cards, CU SoCal offers competitive rates and personalized service that sets it apart from traditional banks. Moreover, CU SoCal is deeply committed to supporting the local community through various initiatives and programs aimed at improving financial literacy and well-being.

In this section, we will explore the various financial services offered by CU SoCal and highlight their community support initiatives. By understanding the comprehensive offerings and the ways CU SoCal contributes to the community, you can make an informed decision about whether this credit union is the right fit for your financial needs.

Financial Services Offered by CU SoCal

CU SoCal provides a variety of financial products designed to help you manage your money efficiently. Here are some of the key services:

Checking and Savings Accounts

- Free Checking Accounts: No monthly maintenance fees, free online banking, and access to over 30,000 surcharge-free ATMs nationwide.

- High-Yield Savings Accounts: Competitive interest rates that help you grow your savings over time.

Loans and Credit

- Auto Loans: Low interest rates and flexible terms to help you finance your next vehicle.

- Home Loans: Mortgage options including fixed-rate and adjustable-rate loans to meet your housing needs.

- Personal Loans: Unsecured loans for various purposes such as debt consolidation, home improvement, or unexpected expenses.

- Credit Cards: A range of credit card options with benefits like cash back, rewards points, and low interest rates.

Community Support Initiatives

CU SoCal is more than just a financial institution; it is a community partner. Here are some of the initiatives that demonstrate their commitment to community support:

Financial Literacy Programs

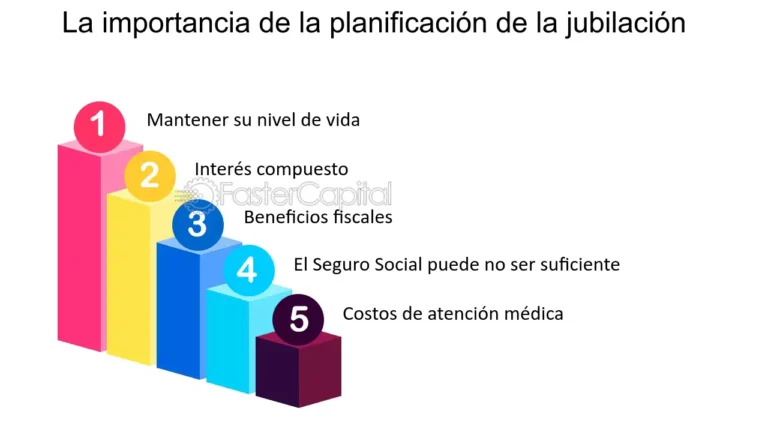

CU SoCal offers workshops and seminars on various financial topics, including budgeting, saving for retirement, and managing credit. These programs are designed to empower members with the knowledge they need to make informed financial decisions.

Charitable Contributions and Volunteering

CU SoCal actively participates in local charity events and encourages its employees to volunteer in the community. The credit union supports numerous causes, including food banks, educational programs, and healthcare initiatives.

Scholarship Programs

To support the educational aspirations of young members, CU SoCal offers scholarship programs that provide financial assistance for college tuition and other educational expenses.

By offering a robust suite of financial services and actively engaging in community support, the Credit Union of Southern California demonstrates its dedication to both its members and the broader community. Whether you’re looking for financial products or ways to contribute to local causes, CU SoCal provides valuable resources and opportunities.

Beneficios de unirse a la Credit Union of So California

When it comes to managing your finances, joining a Credit Union like Credit Union of So California can offer a wide array of benefits. Let’s explore some of the key advantages of becoming a member:

1. Personalized Financial Services

One of the primary benefits of joining a Credit Union is the personalized approach to financial services. Unlike traditional banks, Credit Unions often prioritize building relationships with their members. This means you can expect tailored advice, customized solutions, and a more personalized experience when managing your finances.

2. Competitive Rates and Fees

Credit Unions are known for offering competitive rates on loans, credit cards, and savings accounts. Members can benefit from lower interest rates on loans and credit cards, higher interest rates on savings accounts, and fewer fees compared to many traditional banks. For example, you may find that a Credit Union offers lower mortgage rates, helping you save money over the life of your loan.

3. Community Involvement and Support

Unlike banks that prioritize profits, Credit Unions often focus on giving back to the community and supporting local initiatives. By joining a Credit Union like Credit Union of So California, you are not just a customer but also a member of a community-focused financial institution. Your membership helps support community development projects, financial education programs, and other initiatives that benefit the local area.

4. Member Ownership and Decision-Making

Credit Unions operate as not-for-profit organizations owned by their members. This means that as a member, you have a voice in the decision-making processes of the Credit Union. You can participate in voting for the Board of Directors, providing feedback on services, and shaping the future direction of the institution. This democratic structure ensures that members’ interests are at the forefront of the Credit Union’s operations.

By becoming a member of Credit Union of So California, you not only gain access to a range of financial products and services but also become part of a community-driven organization that prioritizes your financial well-being and the prosperity of the local community.

Programas de educación financiera para miembros

One of the key initiatives offered by Credit Union of So California is its financial education programs for members. These programs are designed to empower individuals with the knowledge and skills needed to make informed financial decisions, manage their money effectively, and plan for the future.

Through a variety of educational workshops, online resources, and one-on-one counseling sessions, members can learn about topics such as budgeting, saving, investing, and credit management. By participating in these programs, members can improve their financial literacy and confidence in handling their finances.

Benefits of Financial Education Programs:

- Empowerment: By gaining financial knowledge, members feel empowered to take control of their financial well-being.

- Improved Decision Making: Education helps individuals make better financial decisions, such as choosing the right savings or investment options.

- Debt Management: Learning about credit and debt management can help members avoid financial pitfalls and reduce debt over time.

- Long-Term Planning: Financial education encourages members to plan for their future, set financial goals, and work towards achieving them.

For example, a member who attends a workshop on retirement planning may gain insights into different retirement savings vehicles, understand the importance of starting early, and develop a personalized plan for retirement based on their goals and risk tolerance.

Financial education is not just about numbers; it’s about empowering individuals to take control of their financial future and achieve their goals.

By offering these programs, Credit Union of So California demonstrates its commitment to not only providing financial services but also supporting the financial well-being and success of its members and the community at large.

Frequently Asked Questions

What financial services does Credit Union of So California offer?

Credit Union of So California offers a wide range of financial services including savings accounts, checking accounts, loans, credit cards, and online banking.

How can I become a member of Credit Union of So California?

To become a member of Credit Union of So California, you must meet certain eligibility requirements such as living, working, or attending school in specific counties, or being a family member of an existing member.

What are the benefits of joining Credit Union of So California?

Members of Credit Union of So California enjoy lower interest rates on loans, higher interest rates on savings accounts, personalized customer service, and access to community events and financial education.

Is my money safe at Credit Union of So California?

Yes, Credit Union of So California is federally insured by the NCUA, so your deposits are protected up to $250,000 per account.

Can I access my accounts online?

Yes, Credit Union of So California offers online banking services where you can check your account balances, transfer funds, pay bills, and more.

How can I contact Credit Union of So California for further assistance?

You can contact Credit Union of So California by phone at 1-800-555-1234, by email at info@creditunionofsocal.com, or by visiting one of their branches.

- Founded in 1954

- Serving members in Southern California

- Community-focused financial institution

- Offers competitive rates on loans and savings accounts

- Member-owned cooperative

Feel free to leave a comment below if you have any more questions or check out our other articles for more information on financial services and community support.