Ent Credit Union in Colorado Springs, Colorado

✅Ent Credit Union in Colorado Springs offers exceptional financial services, low rates, and community-focused banking. Discover the difference today!

Ent Credit Union in Colorado Springs, Colorado is one of the most prominent financial institutions in the region, providing a wide array of banking services to its members. Established in 1957, Ent has grown to become the largest credit union in Colorado, offering competitive rates, financial education, and various products tailored to meet the needs of its diverse membership base.

In this article, we will explore the various services and benefits that Ent Credit Union offers to its members in Colorado Springs, Colorado. From checking and savings accounts to loans and financial advisory services, Ent strives to be a comprehensive financial partner for individuals and businesses alike.

Overview of Ent Credit Union

Ent Credit Union was founded with the mission to provide exceptional financial services to its members. With a focus on community and member satisfaction, Ent has established itself as a trustworthy and reliable financial institution. As of 2023, Ent serves over 430,000 members with assets exceeding $8 billion.

Banking Services Offered

Ent Credit Union offers a variety of banking services designed to meet the needs of its members:

- Checking Accounts: Ent offers several checking account options, including free checking, interest-bearing accounts, and accounts tailored for students and military personnel.

- Savings Accounts: Members can choose from regular savings accounts, money market accounts, and special savings for holidays or vacations.

- Loans: Ent provides competitive rates on personal loans, auto loans, mortgages, and home equity lines of credit.

- Credit Cards: A variety of credit card options are available, including rewards cards and low-interest cards.

- Investment Services: Ent offers financial planning, retirement accounts, and investment advisory services to help members grow their wealth.

Financial Education and Resources

Understanding the importance of financial literacy, Ent Credit Union provides numerous educational resources to its members. These include:

- Workshops and Seminars: Covering topics such as budgeting, credit management, and home buying.

- Online Resources: Articles, calculators, and interactive tools available on Ent’s website.

- One-on-One Counseling: Personalized financial advice from qualified advisors.

Community Involvement

Ent Credit Union is deeply committed to the Colorado Springs community. They actively participate in local events, sponsor community programs, and support various charitable organizations. Their involvement includes:

- Financial contributions to local non-profits.

- Volunteer efforts by Ent employees.

- Partnerships with local schools and educational institutions.

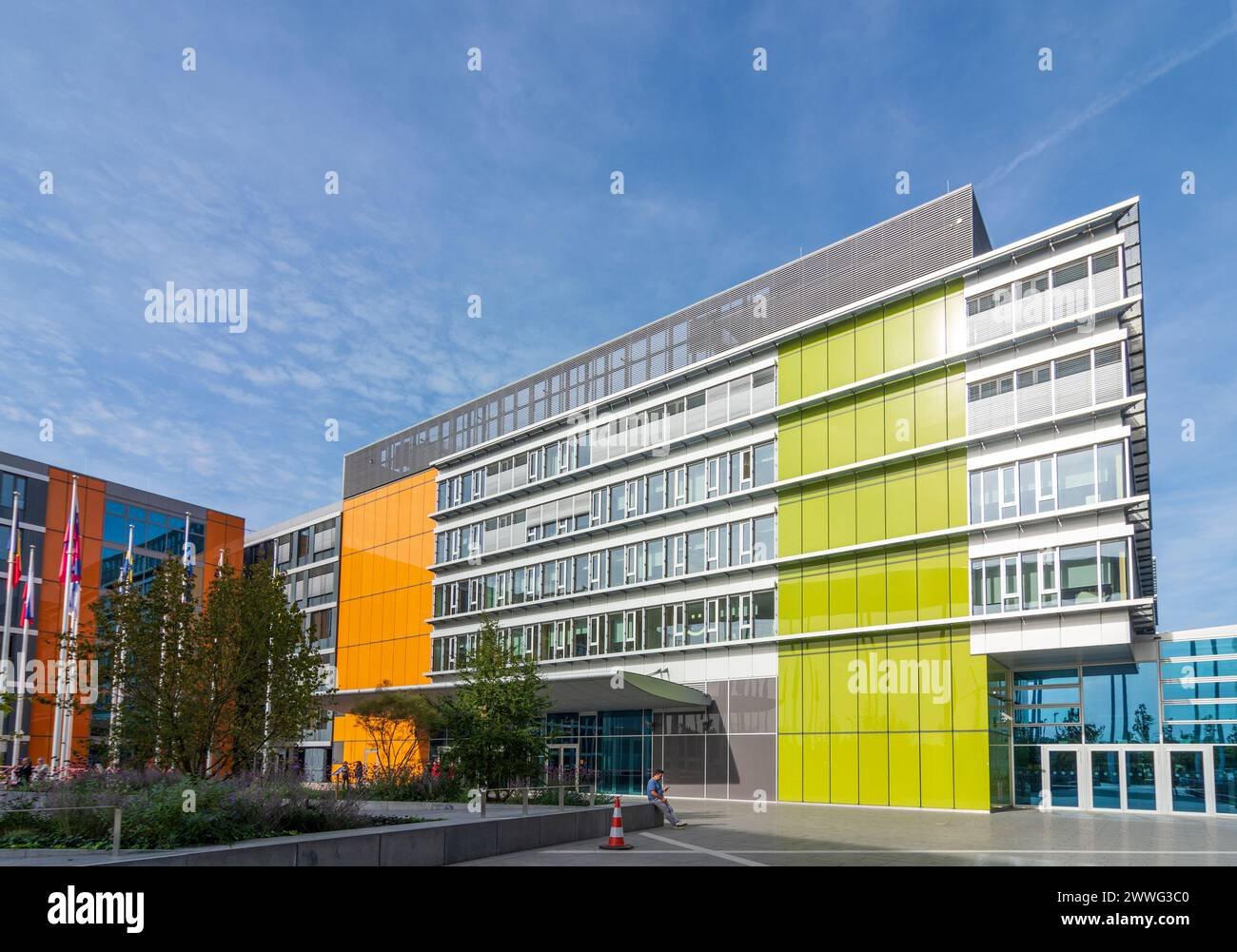

Locations and Accessibility

Ent Credit Union has multiple branches and ATMs throughout Colorado Springs, making it convenient for members to access their accounts and services. Additionally, Ent offers robust online and mobile banking platforms, ensuring that members can manage their finances anytime, anywhere.

Customer Service and Support

Ent Credit Union prides itself on providing excellent customer service. Members can reach out for support via phone, email, or in-person visits to any branch. The credit union’s commitment to member satisfaction is evident in their high ratings and numerous awards for service excellence.

Historia y evolución de Ent Credit Union en Colorado Springs

History and Evolution of Ent Credit Union in Colorado Springs

Ent Credit Union has a rich history and a strong presence in Colorado Springs, Colorado. Founded in 1957, Ent has grown to become one of the largest credit unions in the state, serving over 380,000 members with assets totaling more than $7 billion.

Throughout its evolution, Ent Credit Union has remained committed to its founding principles of community involvement and member service excellence. This dedication has allowed Ent to not only survive but thrive in a competitive financial landscape.

Key Milestones:

- 1957: Ent Credit Union is established to serve the employees of the Colorado Springs-based Pikes Peak Entertainment Corporation.

- 1974: Ent expands its field of membership to include residents of El Paso, Teller, and Pueblo counties.

- 1997: Ent surpasses $1 billion in assets, marking a significant milestone in its growth trajectory.

- 2018: Ent achieves a record-breaking year, opening multiple new service centers and introducing innovative digital banking solutions.

Ent Credit Union’s success can be attributed to its focus on personalized member experiences and innovative financial products. By offering competitive loan rates, convenient banking services, and a range of financial education resources, Ent has built a loyal member base that continues to expand.

Community Impact:

Ent Credit Union is deeply involved in the communities it serves, supporting local initiatives and charitable organizations. Through its Ent Community Foundation, the credit union provides grants and scholarships to individuals and groups dedicated to making a positive impact in Colorado Springs and beyond.

Looking ahead, Ent Credit Union remains committed to innovation and sustainability, ensuring that it continues to meet the evolving needs of its members and communities while upholding its core values.

Servicios financieros ofrecidos por Ent Credit Union en Colorado Springs

When it comes to financial services, Ent Credit Union in Colorado Springs offers a wide range of options to meet the diverse needs of its members. From traditional banking services to modern digital solutions, Ent Credit Union strives to provide convenient and reliable financial products.

Ent Credit Union offers checking accounts with competitive interest rates and low fees, making it easier for members to manage their day-to-day finances. Additionally, their savings accounts help individuals and families set aside money for future expenses or emergencies.

Benefits of Choosing Ent Credit Union for Financial Services

- Personalized Service: Unlike larger banks, Ent Credit Union prides itself on offering personalized attention to each member, ensuring that their financial goals are understood and supported.

- Community Involvement: As a credit union deeply rooted in the Colorado Springs community, Ent Credit Union actively participates in local events and initiatives, fostering a sense of belonging among its members.

- Competitive Rates: Whether it’s for loans, mortgages, or investment accounts, Ent Credit Union strives to offer competitive rates to help members grow their wealth effectively.

For those looking to secure a loan for a new home, car, or other expenses, Ent Credit Union provides loan options with flexible terms and favorable interest rates. By choosing Ent Credit Union for their borrowing needs, members can benefit from a seamless application process and personalized guidance throughout the loan repayment period.

Moreover, Ent Credit Union’s online banking platform allows members to conveniently manage their accounts, pay bills, and transfer funds from the comfort of their homes. This digital banking solution ensures that members have access to their finances 24/7, enhancing overall convenience and efficiency.

Preguntas frecuentes

What services does Ent Credit Union offer?

Ent Credit Union offers a variety of financial services including checking accounts, savings accounts, loans, and investment options.

How can I become a member of Ent Credit Union?

You can become a member of Ent Credit Union by meeting certain eligibility criteria such as living or working in select Colorado counties, or being employed by a partner company.

Does Ent Credit Union have online banking services?

Yes, Ent Credit Union offers online banking services that allow you to manage your accounts, pay bills, and transfer funds conveniently from your computer or mobile device.

What are the locations of Ent Credit Union branches?

Ent Credit Union has multiple branches located throughout Colorado Springs and other areas in Colorado. You can find the nearest branch using their online branch locator tool.

Does Ent Credit Union offer financial education resources?

Yes, Ent Credit Union provides financial education resources such as workshops, articles, and tools to help members improve their financial literacy and make informed decisions.

Can I apply for a loan or mortgage online with Ent Credit Union?

Yes, Ent Credit Union allows you to apply for loans, mortgages, and other financial products online through their website or mobile app for added convenience.

- Ent Credit Union offers a variety of financial services including checking accounts, savings accounts, loans, and investment options.

- You can become a member of Ent Credit Union by meeting certain eligibility criteria such as living or working in select Colorado counties, or being employed by a partner company.

- Ent Credit Union provides online banking services for convenient account management.

- Ent Credit Union has multiple branches located throughout Colorado.

- Ent Credit Union offers financial education resources to help members improve their financial literacy.

- Ent Credit Union allows online applications for loans, mortgages, and other products.

Feel free to leave a comment if you have any other questions or check out our other articles for more information on financial services!