Farmers Insurance Roof Replacement Policy: What You Need to Know

✅Farmers Insurance Roof Replacement Policy: Essential coverage details, claim process, exclusions, and how to maximize your benefits for roof repairs.

Farmers Insurance offers comprehensive roof replacement policies that are designed to provide homeowners with the financial support they need in the event of damage or wear and tear. Understanding the specifics of what is covered, the claims process, and any potential exclusions is crucial for policyholders to make informed decisions about their home insurance.

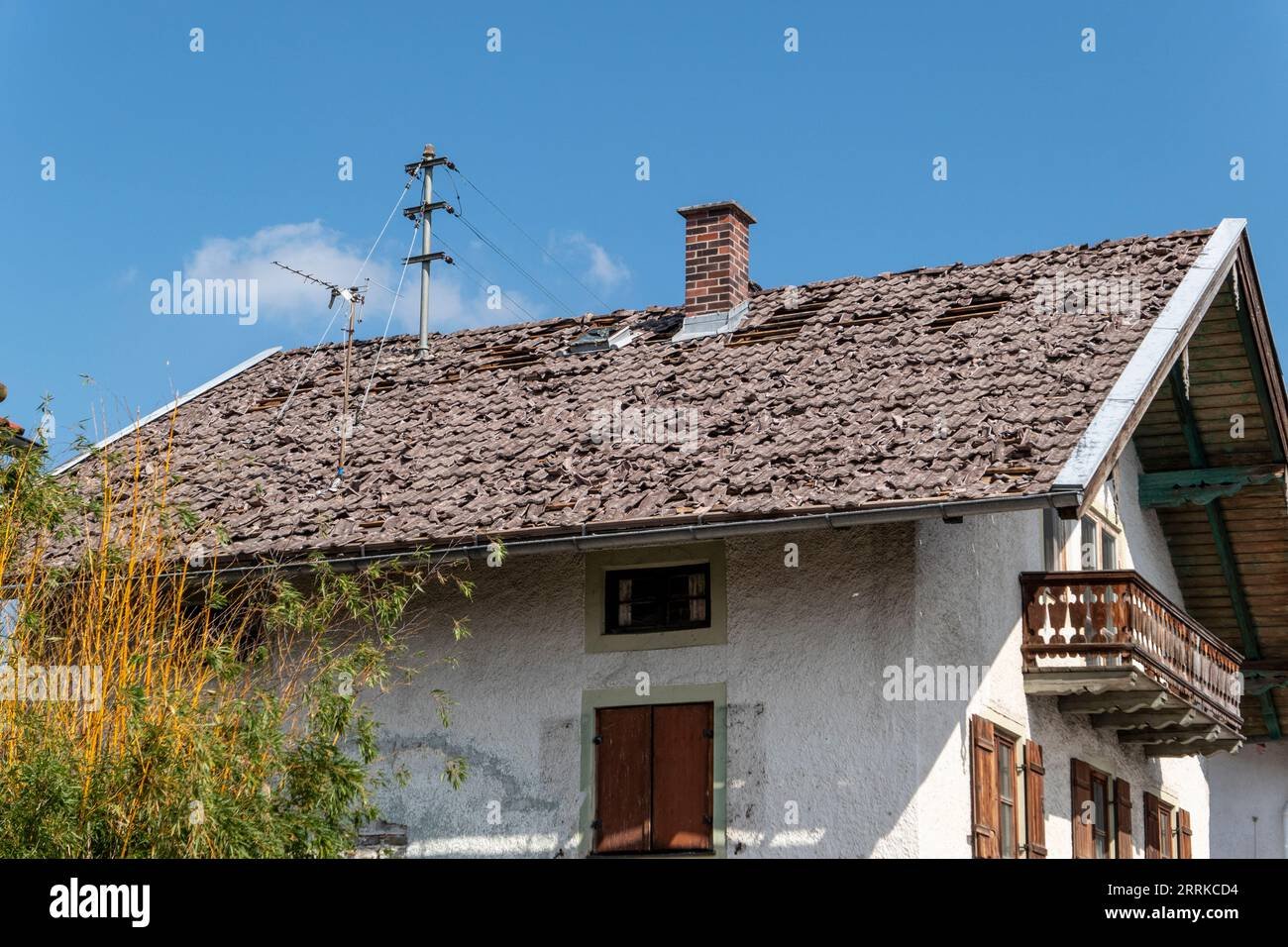

When dealing with Farmers Insurance roof replacement policies, there are several key aspects to consider. Whether you are facing damage from a natural disaster, such as a storm or hail, or simply dealing with an aging roof, knowing the details of your coverage can help you navigate the repair or replacement process more smoothly.

Coverage Details

Farmers Insurance typically covers roof damage caused by weather events, such as hail, wind, and storms. Additionally, they may cover damage from falling objects, like trees or debris. It’s important to review your individual policy to understand the specific types of damage that are covered.

Types of Roof Damage Covered

- Hail Damage: Dents, cracks, and other impacts from hailstones.

- Wind Damage: Missing or lifted shingles due to high winds.

- Storm Damage: General damage from severe weather conditions.

- Falling Objects: Damage caused by trees, branches, or other debris.

Claims Process

Filing a claim with Farmers Insurance for roof replacement involves several steps:

- Document the Damage: Take photos or videos of the damage to provide evidence for your claim.

- Contact Your Agent: Reach out to your Farmers Insurance agent to report the damage and start the claims process.

- Schedule an Inspection: An adjuster will visit your property to assess the damage and determine the extent of the coverage.

- Receive the Estimate: You will receive an estimate for the repair or replacement costs based on the inspection.

- Approval and Repair: Once the claim is approved, you can proceed with hiring a contractor to complete the work.

Potential Exclusions

It’s important to be aware of any exclusions that may apply to your roof replacement policy. Common exclusions can include:

- Wear and Tear: Damage due to normal aging and lack of maintenance.

- Poor Installation: Issues resulting from improper installation of the roof.

- Cosmetic Damage: Minor aesthetic damage that does not affect the roof’s functionality.

Understanding these exclusions can help you maintain your roof and avoid surprises during the claims process. Regular maintenance and inspections can often prevent issues that might not be covered by your insurance policy.

Tips for Maintaining Your Roof

To ensure your roof remains in good condition and to minimize the risk of damage, consider the following maintenance tips:

- Regular Inspections: Have your roof inspected at least once a year by a professional.

- Clean Gutters: Keep gutters clean to prevent water buildup and damage.

- Trim Trees: Trim any overhanging branches that could fall and cause damage.

- Repair Minor Issues: Address small issues, such as missing shingles, promptly to prevent larger problems.

Eligibility Criteria for Roof Replacement Coverage

When it comes to roof replacement coverage under Farmers Insurance, understanding the eligibility criteria is crucial. Roof damage can be a major headache for homeowners, and having a solid insurance policy in place can provide peace of mind.

Insurance companies typically have specific requirements that must be met for coverage to apply to roof replacements. Farmers Insurance is no exception. To ensure you meet the eligibility criteria for roof replacement coverage, consider the following factors:

1. Age of the Roof

The age of your roof is a key factor in determining eligibility for coverage. Most insurance companies, including Farmers, may only cover roofs that are under a certain age. For example, if your roof is over 20 years old, you may have a harder time getting coverage for a full roof replacement.

2. Type of Damage

The type of damage to your roof is also important. Insurance policies typically cover damage caused by specific events, such as storms, fire, or vandalism. Wear and tear due to aging may not be covered. Make sure to document the damage to your roof thoroughly and provide this information to your insurance company.

3. Regular Maintenance

Insurance companies may also consider whether you have performed regular maintenance on your roof. Neglecting maintenance tasks like replacing missing shingles or fixing leaks could affect your eligibility for coverage. Keeping up with roof maintenance not only extends the life of your roof but also demonstrates your commitment to caring for your property.

By meeting the eligibility criteria for roof replacement coverage set by Farmers Insurance, you can ensure that you are prepared for unexpected roof damage. Remember, prevention is key, but being informed about your insurance policy can save you from financial stress in the event of a roofing emergency.

Steps to File a Roof Replacement Claim with Farmers Insurance

When it comes to roof replacement claims with Farmers Insurance, following the right steps can make the process smoother and more efficient. Here’s a guide on how to file a roof replacement claim with Farmers Insurance:

1. Assess the Damage:

Before filing a claim, it’s essential to assess the damage to your roof. Look for missing shingles, leaks, or any other visible signs of damage. Taking photos of the damage can help support your claim.

2. Contact Farmers Insurance:

Once you’ve documented the damage, contact Farmers Insurance to start the roof replacement claim process. You can do this online, through their mobile app, or by calling their claims department. Provide them with all the necessary information about the damage.

3. Schedule an Inspection:

After filing your roof replacement claim, Farmers Insurance will schedule an inspection of your roof. An adjuster will assess the damage and determine the extent of the repairs needed. Be present during the inspection to point out any specific areas of concern.

4. Get Repair Estimates:

It’s a good idea to get repair estimates from roofing contractors to compare with the adjuster’s assessment. This can help ensure that you receive a fair settlement from Farmers Insurance for your roof replacement.

5. Review Your Policy:

Before approving any roof replacement work, review your Farmers Insurance policy to understand your coverage limits and deductible. Make sure you are aware of any out-of-pocket expenses you may be responsible for.

By following these steps and staying informed throughout the roof replacement claim process, you can navigate the insurance procedures smoothly and get your roof repaired or replaced efficiently.

Frequently Asked Questions

Does Farmers Insurance cover roof replacement?

Yes, Farmers Insurance provides coverage for roof replacement in certain situations, such as damage caused by a covered peril like a storm or fire.

How do I know if my roof damage is covered by Farmers Insurance?

You should review your insurance policy to understand what is covered. It’s also recommended to contact Farmers Insurance and file a claim to determine coverage for your specific situation.

What factors can affect the coverage of my roof replacement claim?

Factors such as the age of your roof, the cause of damage, your policy details, and the extent of the damage can all affect the coverage of your roof replacement claim.

Is there a deductible for roof replacement claims with Farmers Insurance?

Yes, like most insurance policies, Farmers Insurance typically has a deductible that you are responsible for paying before the coverage kicks in for roof replacement.

Can I choose my own contractor for the roof replacement with Farmers Insurance?

In most cases, you can choose your own contractor for the roof replacement. However, it’s important to check with Farmers Insurance to see if there are any specific requirements or recommendations.

How long does it take to process a roof replacement claim with Farmers Insurance?

The time it takes to process a roof replacement claim can vary depending on the complexity of the claim, the extent of the damage, and other factors. It’s best to contact Farmers Insurance for an estimate of the timeline.

- Review your insurance policy to understand coverage details.

- Contact Farmers Insurance to file a claim for roof damage.

- Consider factors like deductible, age of roof, and extent of damage.

- Choose a reputable contractor for the roof replacement.

- Stay informed about the progress of your claim with Farmers Insurance.

- Ensure all necessary documentation is provided for the claim process.

Feel free to leave your questions and comments below. Don’t forget to check out other articles on our website that may interest you!