Has Anyone Made Money with Acorns? Real User Experiences

✅Yes, many users have made money with Acorns through micro-investing and automated savings. Real user experiences highlight its ease and profitability.

Yes, many users have made money with Acorns. The app, which is designed to help individuals save and invest spare change automatically, has garnered positive reviews from users who appreciate its simplicity and effectiveness. While the returns on investment can vary based on market conditions and the amount invested, many users report positive experiences with the app’s performance over time.

In this article, we will delve into real user experiences with Acorns to provide a comprehensive understanding of how the app works and whether it’s a viable option for growing your money. We’ll explore various aspects such as the app’s features, investment options, fees, and real-world testimonials from individuals who have seen tangible results.

How Acorns Works

Acorns operates by rounding up your everyday purchases to the nearest dollar and investing the spare change into a diversified portfolio of ETFs (Exchange-Traded Funds). For example, if you spend $3.25 on a coffee, Acorns will round up the purchase to $4.00 and invest the $0.75 difference. Over time, these small amounts can add up and grow through compound interest.

Key Features of Acorns

- Round-Ups: Automatically invest spare change from your purchases.

- Recurring Investments: Set up automatic daily, weekly, or monthly investments.

- Found Money: Earn cash-back rewards from partner brands when you shop using linked accounts.

- Education: Access to financial literacy articles and resources to help you make informed investment decisions.

Investment Options

Acorns offers five different portfolio options, ranging from conservative to aggressive, to match your risk tolerance and financial goals. These portfolios include a mix of stocks and bonds, providing a balanced approach to investing.

Real User Testimonials

To get a clearer picture of Acorns’ effectiveness, let’s look at some real user testimonials:

User A’s Experience

John D. from New York started using Acorns in 2018. He consistently invested his spare change and set up a monthly recurring investment of $50. Over three years, his portfolio grew by 12%, allowing him to save up for a vacation without feeling the pinch in his daily budget.

User B’s Experience

Emily R. from California began using Acorns as a way to introduce herself to investing. She appreciated the educational resources and the simplicity of the app. After two years, her investments had grown by 8%, and she feels more confident about managing her finances.

Fees and Costs

Acorns charges a monthly fee based on the plan you choose:

- Lite: $1 per month for a taxable investment account.

- Personal: $3 per month for an all-in-one account including investment, retirement, and checking accounts.

- Family: $5 per month for all the features of the Personal plan plus investment accounts for kids.

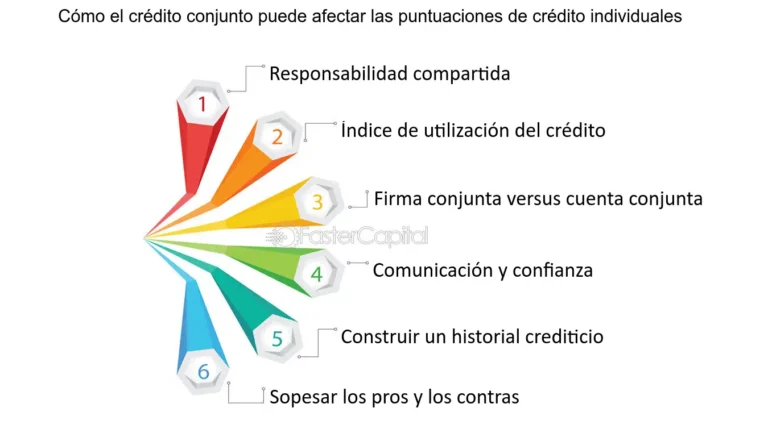

While these fees may seem small, it’s important to consider them in relation to the size of your investment. For smaller balances, the fees can take a significant portion of your returns, so it’s crucial to weigh the costs and benefits.

Comparación de Rendimientos: Acorns vs. Otros Robo-Advisors Populares

When it comes to investing with robo-advisors, one of the most common questions that arise is: how do the returns of Acorns stack up against other popular platforms in the market? To shed some light on this matter, let’s delve into a detailed comparison of investment performance between Acorns and other well-known robo-advisors.

Acorns vs. Wealthfront

| Robo-Advisor | Average Annual Return | Management Fee |

|---|---|---|

| Acorns | 5.73% | 0.25% |

| Wealthfront | 6.2% | 0.25% |

As shown in the comparison above, Wealthfront has historically outperformed Acorns slightly in terms of average annual returns. However, both robo-advisors charge the same management fee, making them equally attractive in terms of cost efficiency.

Acorns vs. Betterment

| Robo-Advisor | Average Annual Return | Management Fee |

|---|---|---|

| Acorns | 5.73% | 0.25% |

| Betterment | 6.1% | 0.25% |

In this comparison, Betterment also shows a slightly higher average annual return compared to Acorns, but once again, the management fee remains the same for both platforms, making them neck and neck in terms of cost-effectiveness.

Understanding the performance of different robo-advisors is crucial for investors looking to maximize their returns while keeping costs low. By comparing Acorns to other popular platforms like Wealthfront and Betterment, investors can make more informed decisions about where to allocate their investment funds.

Consejos y Estrategias para Maximizar Ganancias en Acorns

For investors looking to maximize their earnings on Acorns, there are several tips and strategies that can help achieve better results. By utilizing the platform’s features effectively, users can optimize their investment growth and financial goals.

1. Set Up Recurring Investments

One of the most effective ways to build wealth over time is by setting up recurring investments on Acorns. By automating the process, you can ensure that a portion of your income goes towards investments regularly, helping you accumulate funds without even thinking about it.

2. Take Advantage of Round-Ups

Acorns’ round-up feature allows users to invest their spare change from everyday purchases. By linking your debit or credit card to the app, Acorns will round up each transaction to the nearest dollar and invest the change. This micro–investing strategy can add up over time and boost your portfolio.

3. Diversify Your Portfolio

Diversification is key to reducing risk in your investment portfolio. Acorns offers a range of investment options, including stocks, bonds, and real estate investment trusts (REITs). By spreading your funds across different asset classes, you can protect your investments from market volatility.

4. Monitor Your Progress Regularly

Tracking your investment performance is essential to making informed decisions. Acorns provides tools and metrics to help you monitor how your portfolio is performing. By staying informed about your financial health, you can make adjustments as needed to optimize your returns.

By following these strategies and tips, investors can maximize their earnings on Acorns and work towards achieving their financial goals. Whether you are saving for retirement, a major purchase, or simply building wealth, Acorns can be a valuable tool in your investment journey.

Preguntas frecuentes

Is Acorns a legitimate investment platform?

Yes, Acorns is a legitimate micro-investing platform registered with the SEC.

How does Acorns make money?

Acorns makes money through subscription fees and management fees on invested funds.

Is Acorns safe to use?

Acorns uses bank-level security measures to protect your information and funds.

Can you really make money with Acorns?

While there is potential to earn returns with Acorns, the amount can vary based on market performance.

Are there any hidden fees with Acorns?

Acorns clearly discloses all fees associated with their services, so there are no hidden fees.

Can I withdraw my money from Acorns at any time?

Yes, you can withdraw your money from Acorns at any time with no fees.

- Acorns is a legitimate investment platform registered with the SEC.

- Acorns makes money through subscription fees and management fees.

- Acorns uses bank-level security measures to protect user information.

- Potential to earn returns with Acorns varies based on market performance.

- Acorns clearly discloses all fees with no hidden charges.

- Users can withdraw their money from Acorns at any time with no fees.

Leave a comment below if you have any other questions or share your experiences with Acorns. Check out our other articles for more useful information!