Indigo Mastercard with a Higher Credit Limit: Boost Your Spending Power

✅Unlock greater financial freedom and elevate your purchasing potential with the Indigo Mastercard’s higher credit limit. Boost your spending power today!

The Indigo Mastercard is a popular choice for those looking to improve their credit score or establish a credit history. However, one of the main concerns for users is the typically low credit limit that comes with the card. Fortunately, there are ways to increase your credit limit over time, which can significantly boost your spending power and improve your overall credit utilization ratio.

In this article, we will explore the steps you can take to qualify for a higher credit limit on your Indigo Mastercard. From maintaining a good payment history to understanding the factors that affect credit limit increases, we’ll provide you with actionable tips and insights to help you make the most of your credit card.

Understanding Your Current Credit Limit

The initial credit limit on an Indigo Mastercard typically ranges from $300 to $1,000, depending on your creditworthiness at the time of application. This limit can feel restrictive, but it’s important to use your card responsibly to demonstrate your ability to manage credit effectively.

Factors That Affect Credit Limit Increases

Several factors influence whether you’ll be eligible for a higher credit limit:

- Payment History: Consistently paying your full balance on time is crucial. Late or missed payments can negatively impact your chances of a credit limit increase.

- Credit Utilization: Keeping your credit utilization ratio below 30% is advisable. This means if your credit limit is $1,000, you should aim to keep your balance below $300.

- Credit Score: A higher credit score indicates to the issuer that you are a lower risk, which can lead to a higher credit limit.

- Income: Reporting an increase in your income can also improve your chances of a credit limit increase, as it shows you have more financial resources to manage higher credit.

Steps to Request a Credit Limit Increase

Here are the steps you can follow to request a credit limit increase on your Indigo Mastercard:

- Review Your Credit Report: Before requesting an increase, ensure your credit report is accurate and up to date. Dispute any errors that could negatively impact your credit score.

- Contact Customer Service: Call the customer service number on the back of your card and inquire about the possibility of a credit limit increase. Be prepared to explain why you need the increase and how your financial situation has improved.

- Provide Updated Information: You may be asked to provide updated income information or other financial details. Be honest and thorough in your responses.

- Wait for a Decision: The issuer will review your request and make a decision, typically within a few business days. They may perform a soft or hard inquiry on your credit report as part of their evaluation.

Best Practices to Maintain a Higher Credit Limit

Once you’ve successfully increased your credit limit, it’s important to manage it wisely:

- Continue to Pay on Time: Maintaining a good payment history is crucial to keeping your higher credit limit.

- Monitor Your Spending: Avoid the temptation to overspend just because you have a higher limit. Stick to your budget to avoid accumulating debt.

- Keep Utilization Low: Aim to keep your credit utilization ratio low, ideally under 30%, to continue improving your credit score.

Increasing your credit limit on an Indigo Mastercard can significantly benefit your financial health by improving your credit score and giving you more purchasing power. By understanding the factors that affect credit limit increases and following the steps outlined above, you can take proactive measures to achieve a higher credit limit.

Requirements and Qualifications for a Higher Credit Limit

To qualify for a higher credit limit on your Indigo Mastercard, you need to meet certain requirements and demonstrate specific qualifications. Lenders consider various factors when deciding whether to increase your credit limit, as it represents the maximum amount of credit you can borrow on your card.

Here are some key criteria that credit card companies like Indigo may evaluate when determining your eligibility for a higher credit limit:

Credit History

Your credit history plays a significant role in the decision to raise your credit limit. Lenders review your payment history, credit utilization ratio, and length of credit history to assess your creditworthiness. A positive credit history with on-time payments and responsible credit usage can increase your chances of qualifying for a higher credit limit.

Income Level

Income level is another crucial factor considered by credit card issuers. Your income helps determine your ability to repay any additional credit extended to you. A higher income level may indicate a greater capacity to handle increased credit limits.

Usage of Current Credit Limit

How you currently utilize your credit limit also influences the decision to raise it. If you consistently max out your credit card or carry high balances, it may signal financial instability and hinder your chances of receiving a credit limit increase. On the other hand, responsible use of credit, such as keeping balances low and making timely payments, can demonstrate your creditworthiness.

Payment History

Payment history is a critical factor in determining your eligibility for a higher credit limit. Lenders assess whether you have a history of making payments on time or if you have any late or missed payments. Consistently paying your bills by the due date can positively impact your credit score and increase your chances of securing a higher credit limit.

By meeting these qualifications and maintaining good financial habits, you can improve your chances of being approved for a higher credit limit on your Indigo Mastercard. Remember, a higher credit limit can offer greater financial flexibility and increased purchasing power, but it also comes with the responsibility of managing credit wisely.

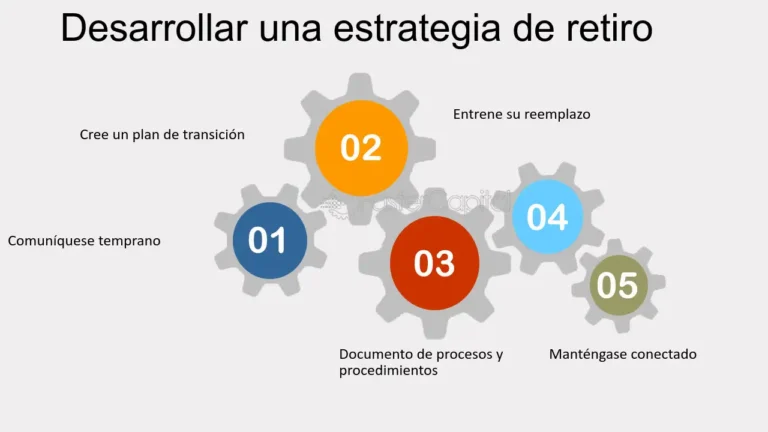

Strategies to Increase Your Indigo Mastercard Credit Limit

If you are looking to increase your Indigo Mastercard credit limit, there are several strategies you can implement to boost your spending power and improve your financial flexibility. A higher credit limit not only provides you with more purchasing ability but can also positively impact your credit score by lowering your credit utilization ratio.

1. Maintain a Good Payment History

One of the most important factors that credit card issuers consider when evaluating a credit limit increase is your payment history. Make sure to pay your bills on time every month to demonstrate your creditworthiness and financial responsibility. Consistent on-time payments can show the lender that you are a reliable borrower and may increase your chances of a credit limit raise.

2. Reduce Your Debt

Lowering your overall debt can also help you qualify for a higher credit limit. Lenders assess your debt-to-income ratio when determining your creditworthiness, so paying down existing debts can improve your financial profile and make you a more attractive candidate for a credit limit increase.

3. Request a Credit Limit Increase

If you have been a responsible cardholder and have a good payment history, consider requesting a credit limit increase directly from Indigo Mastercard. Many credit card issuers allow you to request a credit limit raise online or by contacting customer service. Be prepared to provide information about your income, employment status, and any changes in your financial situation that may support your request.

By following these strategies and maintaining a positive credit history, you can work towards increasing your Indigo Mastercard credit limit and enjoy greater financial flexibility.

Frequently Asked Questions

What is the Indigo Mastercard?

The Indigo Mastercard is a credit card designed for individuals with less than perfect credit.

How can I apply for an Indigo Mastercard?

You can apply for an Indigo Mastercard online by filling out an application form on their website.

What are the benefits of having an Indigo Mastercard?

Having an Indigo Mastercard can help you build or rebuild your credit score over time.

Is there an annual fee for the Indigo Mastercard?

Yes, there is an annual fee associated with the Indigo Mastercard, which varies depending on your credit profile.

Can I get a higher credit limit with the Indigo Mastercard?

Yes, some cardholders may qualify for a higher credit limit based on their creditworthiness and financial situation.

What is the APR for the Indigo Mastercard?

The APR for the Indigo Mastercard varies depending on the prime rate and your creditworthiness.

| Key Points about the Indigo Mastercard |

|---|

| Designed for individuals with less than perfect credit |

| Helps build or rebuild credit score |

| Annual fee required |

| Possibility of a higher credit limit |

| APR varies based on prime rate and creditworthiness |

Feel free to leave your comments below and check out other articles on our website that may interest you!