JPMorgan Chase Bank Loan Department: Services and Application Process

✅Explore JPMorgan Chase Bank Loan Department: Comprehensive services, streamlined application process, competitive rates, and personalized financial solutions.

The JPMorgan Chase Bank Loan Department offers a wide range of loan services tailored to meet the financial needs of individuals, businesses, and corporations. Whether you are looking for a personal loan, a mortgage, or a business loan, JPMorgan Chase provides various options with competitive rates and flexible terms.

Understanding the different loan services and the application process at JPMorgan Chase is crucial for making informed financial decisions. This article will guide you through the types of loans available, the eligibility criteria, and the step-by-step application process to help you secure the financing you need.

Types of Loans Offered by JPMorgan Chase

JPMorgan Chase provides several loan options to cater to different financial needs:

- Personal Loans: These are unsecured loans that can be used for a variety of purposes such as debt consolidation, home improvement, or unexpected expenses. They typically have fixed interest rates and terms ranging from 12 to 84 months.

- Home Loans: Includes mortgages for purchasing a home, refinancing existing mortgages, and home equity lines of credit (HELOC). JPMorgan Chase offers both fixed-rate and adjustable-rate mortgages (ARMs).

- Auto Loans: Financing options for purchasing new or used vehicles. They offer competitive rates and flexible repayment terms.

- Business Loans: Various lending solutions for small to large businesses including term loans, lines of credit, commercial real estate loans, and SBA loans.

Eligibility Criteria

Eligibility for loans at JPMorgan Chase varies depending on the type of loan:

- Credit Score: A good to excellent credit score (typically 670 or higher) increases the chances of loan approval and securing better interest rates.

- Income: Steady and sufficient income to cover loan repayments. For business loans, financial statements and business plans may be required.

- Debt-to-Income Ratio: A lower debt-to-income ratio (typically below 43%) is preferred.

- Collateral: For secured loans, collateral such as property or vehicles may be required.

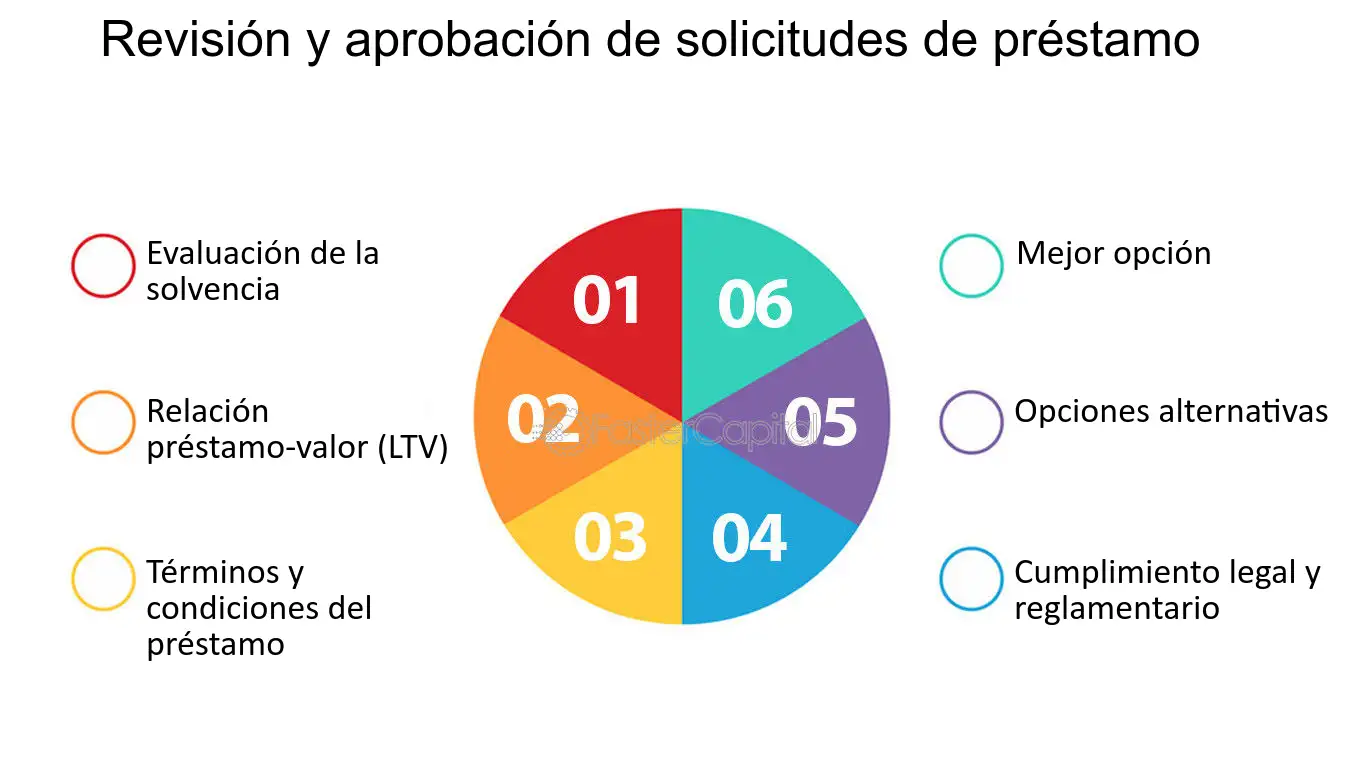

Application Process

The application process for a loan at JPMorgan Chase is straightforward and can be completed online, over the phone, or in person at a branch. Here are the steps involved:

- Pre-Qualification: Determine your eligibility and the loan amount you may qualify for by providing basic information about your finances.

- Application Submission: Complete the loan application form with detailed information about your financial situation, employment, and the purpose of the loan.

- Documentation: Submit required documents such as proof of income, tax returns, and identification. Business loans may require additional documents like financial statements and business plans.

- Credit Check: JPMorgan Chase will conduct a credit check to assess your creditworthiness.

- Approval and Terms: If approved, you will receive the loan terms including interest rate, repayment schedule, and any fees. Review and accept the terms to proceed.

- Disbursement: Once the terms are accepted, the loan amount will be disbursed to your account or the relevant third party (e.g., car dealership, home seller).

Tips for a Successful Loan Application

To increase your chances of loan approval, consider the following tips:

- Check and improve your credit score before applying.

- Ensure all required documents are complete and accurate.

- Provide honest and detailed information about your financial situation.

- Compare different loan options and choose the one that best suits your needs.

By understanding the services offered and the application process at JPMorgan Chase, you can confidently navigate the loan process and secure the financing that aligns with your financial goals.

Types of Loans Offered by JPMorgan Chase Bank

When considering types of loans offered by JPMorgan Chase Bank, it’s essential to understand the diverse range of financial products available to meet various needs. Whether you are looking to finance a new home, start a business, or consolidate debt, JPMorgan Chase Bank provides loan solutions tailored to your specific requirements.

1. Mortgage Loans:

One of the most common types of loans offered by JPMorgan Chase Bank is mortgage loans. These loans are used to purchase real estate properties, such as homes or commercial buildings. With competitive interest rates and flexible repayment terms, JPMorgan Chase Bank’s mortgage loans are popular among homebuyers.

2. Personal Loans:

For individuals looking for financial assistance for personal expenses, JPMorgan Chase Bank offers personal loans. Whether you need funds for home improvements, medical bills, or other personal needs, personal loans can provide the necessary financial support with fixed monthly payments.

3. Business Loans:

Entrepreneurs and businesses can benefit from JPMorgan Chase Bank’s business loans to fund operations, expansion, or other business initiatives. Business loans come with competitive terms and rates, making them a suitable financial solution for small businesses and corporations alike.

Key Benefits of JPMorgan Chase Bank’s Loan Offerings:

- Competitive Interest Rates: JPMorgan Chase Bank offers competitive interest rates on its various loan products, making borrowing financially advantageous.

- Flexible Repayment Terms: With flexible repayment options, borrowers can choose a repayment schedule that aligns with their financial goals and capabilities.

- Online Application Process: JPMorgan Chase Bank provides an easy and convenient online application process for loan applications, simplifying the borrowing experience for customers.

Whether you are in need of a mortgage loan to purchase a new home, a personal loan for unexpected expenses, or a business loan to grow your company, JPMorgan Chase Bank’s diverse loan offerings cater to a wide range of financial needs.

Step-by-Step Guide to Applying for a Loan at JPMorgan Chase

Step-by-Step Guide to Applying for a Loan at JPMorgan Chase

When it comes to applying for a loan at JPMorgan Chase, the process is designed to be straightforward and efficient. Below is a detailed guide on how to navigate through the loan application process with JPMorgan Chase:

1. Determine Your Needs:

Before applying for a loan, it’s crucial to determine your financial needs and the purpose of the loan. Whether you need a mortgage, auto loan, personal loan, or any other type of financing, having a clear understanding of your requirements will help streamline the application process.

2. Gather Necessary Documents:

Prepare all the required documents in advance to expedite the application process. These documents may include proof of income, identification, tax returns, bank statements, and any other relevant paperwork depending on the type of loan you are applying for.

3. Online Application:

Most banks, including JPMorgan Chase, offer the convenience of applying for loans online. Visit the official website, navigate to the loan section, and fill out the online application form. Make sure to provide accurate information to avoid delays in processing your application.

4. In-Person Application:

If you prefer a more personalized approach, you can schedule an appointment at a JPMorgan Chase branch to meet with a loan officer. During the meeting, you can discuss your loan options, ask any questions you may have, and submit your application in person.

5. Review and Approval:

Once you have submitted your loan application, the bank will review your information, perform a credit check, and assess your eligibility for the loan. This process may take some time, so it’s essential to be patient. If approved, you will receive a loan offer outlining the terms and conditions.

By following this step-by-step guide, you can navigate the loan application process at JPMorgan Chase with confidence and ease. Whether you are a first-time borrower or an experienced applicant, being prepared and informed can help you secure the financing you need.

Frequently Asked Questions

What type of loans does JPMorgan Chase Bank offer?

JPMorgan Chase Bank offers a variety of loans, including personal loans, home loans, auto loans, and small business loans.

What are the requirements to apply for a loan at JPMorgan Chase Bank?

The requirements vary depending on the type of loan, but generally include proof of income, credit history, and collateral for secured loans.

How long does it take to get a loan approved at JPMorgan Chase Bank?

The approval process can take anywhere from a few days to a few weeks, depending on the complexity of the loan and the completeness of the application.

Can I apply for a loan online at JPMorgan Chase Bank?

Yes, JPMorgan Chase Bank offers online loan applications for added convenience.

What is the maximum loan amount I can apply for at JPMorgan Chase Bank?

The maximum loan amount varies depending on the type of loan and your financial situation. It is best to consult with a loan officer for specific details.

Is there a prepayment penalty for loans at JPMorgan Chase Bank?

Some loans may have prepayment penalties, while others do not. It is important to review the terms and conditions of your loan agreement.

- JPMorgan Chase Bank offers personal loans, home loans, auto loans, and small business loans.

- Loan requirements may include proof of income, credit history, and collateral.

- Loan approval times can vary from a few days to a few weeks.

- Online loan applications are available for added convenience.

- Maximum loan amounts vary based on the type of loan and financial situation.

- Some loans may have prepayment penalties, so it is important to review the terms carefully.

Feel free to leave your comments below and check out our other articles for more information on financial services.