massachusetts mutual life insurance company massmutual

✅Massachusetts Mutual Life Insurance Company (MassMutual) offers robust financial services, life insurance, and investment solutions to secure your future.

Massachusetts Mutual Life Insurance Company, commonly known as MassMutual, is a leading mutual life insurance company in the United States. Established in 1851, MassMutual offers a wide range of insurance products and financial services, including life insurance, disability income insurance, long-term care insurance, annuities, retirement planning, and investment management.

MassMutual’s core mission is to help individuals secure their future and protect the ones they love. The company operates on a mutual structure, meaning it is owned by its policyholders rather than shareholders. This allows MassMutual to focus on the long-term needs and interests of its policyholders. Below, we delve into the various services and benefits that MassMutual provides, as well as its reputation within the insurance and financial services industry.

Services Offered by MassMutual

MassMutual provides a comprehensive suite of financial products designed to meet the diverse needs of individuals and businesses. Some of the key services include:

- Life Insurance: Offers term life, whole life, and universal life insurance policies to help secure your family’s financial future.

- Disability Income Insurance: Provides income protection in the event you are unable to work due to illness or injury.

- Long-Term Care Insurance: Helps cover the cost of care services needed if you can no longer perform everyday activities.

- Annuities: Products designed to provide a steady income stream during retirement.

- Retirement Planning: Solutions to help individuals save for retirement and manage their retirement income.

- Investment Management: Offers a variety of investment options tailored to meet your financial goals.

MassMutual’s Reputation and Financial Strength

MassMutual is known for its financial stability and strong performance. The company has consistently received high ratings from major credit rating agencies, which reflects its ability to meet policyholder obligations. As of 2023, MassMutual holds the following ratings:

- A.M. Best: A++ (Superior)

- Moody’s: Aa3 (High Quality)

- Standard & Poor’s: AA+ (Very Strong)

These ratings underscore MassMutual’s strong financial position and its commitment to maintaining a secure foundation for its policyholders. The company’s mutual structure further enhances its focus on long-term stability and policyholder benefits.

Why Choose MassMutual?

There are several reasons why individuals and businesses might choose MassMutual for their insurance and financial planning needs:

- Customer-centric Approach: As a mutual company, MassMutual prioritizes the needs of its policyholders.

- Diverse Product Offerings: A wide range of products to meet various financial needs.

- Financial Strength: High ratings from credit agencies ensure reliability and trust.

- Experienced Advisors: Professional financial advisors who provide personalized guidance.

Whether you are looking to protect your family, plan for retirement, or manage your investments, MassMutual offers the expertise and resources to help you achieve your financial goals. In the following sections, we will explore some of these products in more detail, providing insights and recommendations to help you make informed decisions.

Historia y evolución de MassMutual desde su fundación

La historia y evolución de MassMutual desde su fundación es un fascinante recorrido por más de 170 años de excelencia en el sector de los seguros de vida. Fundada en 1851 en Massachusetts, la compañía ha crecido hasta convertirse en una de las aseguradoras más grandes y respetadas en los Estados Unidos.

Desde sus humildes comienzos, MassMutual ha mantenido un compromiso firme con sus clientes, ofreciendo productos y servicios innovadores que se adaptan a las necesidades cambiantes de la sociedad. Su enfoque en la protección financiera y la seguridad familiar ha sido una constante a lo largo de su historia, ganándose la confianza de millones de personas en todo el país.

Valores fundamentales de MassMutual

- Integridad: La transparencia y la honestidad han sido pilares fundamentales en todas las interacciones de la compañía con sus clientes.

- Excelencia: Buscar la excelencia en todo lo que hacen, desde sus productos hasta su servicio al cliente, ha sido una prioridad constante.

- Compromiso comunitario: MassMutual se enorgullece de su compromiso con las comunidades donde opera, apoyando iniciativas sociales y causas benéficas.

Un ejemplo destacado de la filosofía de MassMutual es su enfoque en la educación financiera. La compañía ha desarrollado programas educativos y recursos para ayudar a las personas a tomar decisiones informadas sobre sus finanzas y su futuro.

Innovación y tecnología en MassMutual

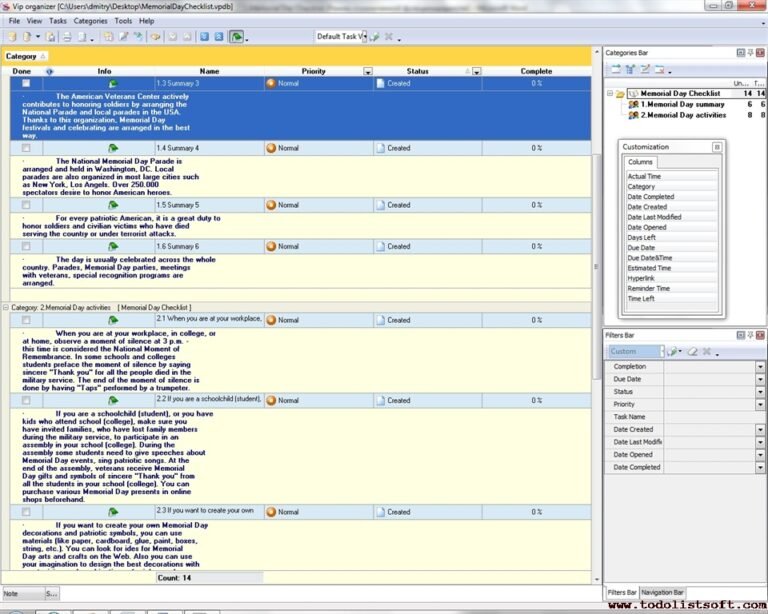

MassMutual ha abrazado la innovación y la tecnología para mejorar la experiencia del cliente y optimizar sus procesos internos. Mediante el uso de herramientas digitales y plataformas en línea, la compañía ha simplificado la contratación de seguros, la gestión de pólizas y la comunicación con los asegurados.

La implementación de la inteligencia artificial y el análisis de datos ha permitido a MassMutual personalizar sus servicios y ofrecer soluciones más precisas a sus clientes, mejorando así la satisfacción y fidelidad de estos.

La historia y evolución de MassMutual refleja su compromiso con la excelencia, la integridad y la innovación en el sector de los seguros de vida, consolidándose como una de las compañías más confiables y sólidas del mercado.

Principales productos y servicios ofrecidos por MassMutual

When it comes to Massachusetts Mutual Life Insurance Company (MassMutual), it is essential to explore their main products and services to understand the breadth of what they offer. MassMutual is known for providing a wide range of financial products and services designed to help individuals and businesses achieve their financial goals.

Life Insurance

One of the core offerings of MassMutual is life insurance. They provide various types of life insurance policies, including term life insurance and permanent life insurance such as whole life insurance and universal life insurance. These policies offer financial protection to beneficiaries in case of the policyholder’s death and can also serve as an investment vehicle for building cash value over time.

Retirement Planning

Retirement planning is another key area where MassMutual excels. They offer retirement savings plans like 401(k) plans for businesses and individual retirement accounts (IRAs) for individuals. These products help people save for retirement and achieve financial security in their later years.

Investment and Wealth Management

MassMutual also provides investment and wealth management services to help clients grow and protect their assets. They offer investment advisory services, trust services, and financial planning to assist clients in reaching their financial objectives.

Disability Income Insurance

In addition to life insurance, MassMutual offers disability income insurance to provide a source of income if a policyholder becomes disabled and is unable to work. This coverage is crucial in protecting individuals and their families from the financial impact of a disability.

Long-Term Care Insurance

For individuals concerned about the costs of long-term care as they age, MassMutual provides long-term care insurance policies. These policies can help cover the expenses associated with nursing home care, assisted living facilities, and home health care, offering peace of mind for policyholders and their loved ones.

Overall, MassMutual’s diverse range of products and services caters to the financial well-being and security of individuals and businesses, making them a trusted partner in financial planning and protection.

Frequently Asked Questions

What does Massachusetts Mutual Life Insurance Company (MassMutual) offer?

MassMutual offers a variety of insurance and financial products, including life insurance, disability income insurance, retirement solutions, and investment products.

How long has MassMutual been in business?

MassMutual was founded in 1851, making it one of the oldest and most reputable insurance companies in the United States.

Is MassMutual a mutual company?

Yes, MassMutual is a mutual company, which means it is owned by its policyholders and operates for their benefit.

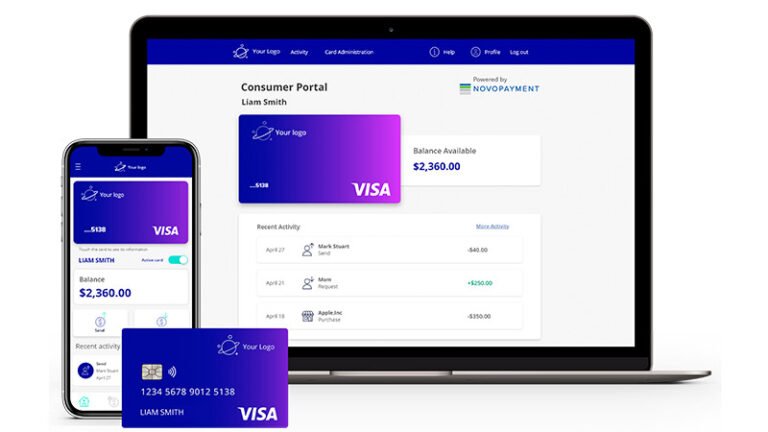

Can I access my MassMutual account online?

Yes, MassMutual offers online account access through their website or mobile app, allowing customers to manage their policies and investments.

Does MassMutual provide financial planning services?

Yes, MassMutual offers financial planning services to help customers achieve their financial goals and secure their future.

What is MassMutual’s financial strength rating?

MassMutual has consistently received high financial strength ratings from independent rating agencies, indicating its stability and ability to meet policyholder obligations.

Key Points about Massachusetts Mutual Life Insurance Company (MassMutual)

- Founded in 1851

- Offers life insurance, disability income insurance, retirement solutions, and investment products

- Owned by its policyholders as a mutual company

- Provides online account access for customers

- Offers financial planning services

- Has a strong financial strength rating

Feel free to leave your comments and questions below, and don’t forget to check out our other articles for more information on insurance and financial planning!