Money Saving Expert: Tips for Financial Success

✅Unlock financial freedom with Money Saving Expert’s top tips: budget smartly, cut unnecessary expenses, invest wisely, and maximize savings!

Becoming a money-saving expert involves implementing smart financial strategies and adopting disciplined spending habits. Whether you’re looking to increase your savings, reduce expenses, or make wise investments, these tips will help you achieve financial success.

In this article, we will explore various ways to manage your money effectively. From creating a budget and tracking your expenses to understanding the importance of emergency funds and making informed investment decisions, these guidelines will set you on the path to financial stability and growth.

1. Create a Budget and Stick to It

Creating a budget is the foundation of any successful money management plan. A budget helps you understand where your money is going and ensures that you are living within your means. Here are the steps to create an effective budget:

- List Your Income: Calculate your total monthly income, including salary, bonuses, and any other sources of income.

- Track Your Expenses: Record all your monthly expenses, including fixed costs like rent or mortgage, utilities, groceries, and variable expenses such as entertainment and dining out.

- Set Financial Goals: Identify short-term and long-term financial goals, like saving for a vacation or building a retirement fund.

- Adjust as Needed: Review your budget regularly and make adjustments to ensure you are meeting your financial goals.

2. Build an Emergency Fund

An emergency fund is crucial for financial security. It acts as a safety net during unexpected situations such as medical emergencies, car repairs, or job loss. Here’s how to build and maintain an emergency fund:

- Set a Target Amount: Aim to save at least three to six months’ worth of living expenses.

- Start Small: Begin by setting aside a small amount of money each month, and gradually increase the amount over time.

- Keep it Accessible: Store your emergency fund in a high-yield savings account where it can earn interest and be easily accessed when needed.

3. Reduce Unnecessary Expenses

Cutting back on non-essential spending can free up more money for savings and investments. Consider these strategies to reduce unnecessary expenses:

- Evaluate Subscriptions: Review your monthly subscriptions and cancel those you rarely use.

- Cook at Home: Reduce dining out by preparing meals at home, which can save a significant amount of money.

- Shop Smart: Use coupons, look for discounts, and compare prices before making purchases.

4. Make Informed Investment Decisions

Investing wisely can help grow your wealth over time. Here are some tips to make informed investment decisions:

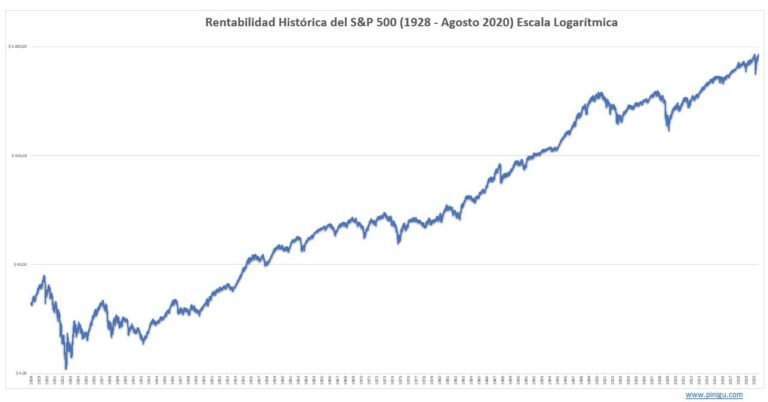

- Do Your Research: Understand the different types of investments available, such as stocks, bonds, and mutual funds.

- Diversify Your Portfolio: Spread your investments across various asset classes to minimize risk.

- Seek Professional Advice: Consider consulting with a financial advisor to help you create an investment plan tailored to your goals and risk tolerance.

5. Monitor Your Credit Score

Maintaining a good credit score is essential for financial success. A high credit score can help you secure loans with favorable terms and lower interest rates. Follow these steps to monitor and improve your credit score:

- Check Your Credit Report: Obtain a free copy of your credit report annually from the major credit bureaus and review it for accuracy.

- Pay Bills on Time: Consistently paying your bills on time is one of the most important factors in maintaining a good credit score.

- Manage Debt: Keep your credit card balances low and avoid taking on unnecessary debt.

By implementing these tips, you’ll be well on your way to becoming a money-saving expert and achieving financial success. Remember, financial stability is a journey that requires consistent effort and smart decision-making.

How to Create a Realistic Budget for Your Lifestyle

Creating a realistic budget is crucial for financial success and money-saving strategies. A well-thought-out budget can help you track your expenses, identify areas where you can cut back, and save money for future goals.

Here are some practical steps to create a realistic budget tailored to your lifestyle:

1. Calculate Your Income

The first step in creating a budget is to determine your monthly income. Include all sources of income, such as your salary, bonuses, side gigs, and any other money you receive regularly.

2. Track Your Expenses

Keep track of all your expenses for a month to get a clear picture of where your money is going. This includes fixed expenses like rent, utilities, and loan payments, as well as variable expenses like groceries, dining out, and entertainment.

3. Differentiate Between Needs and Wants

It’s essential to differentiate between needs and wants when creating a budget. Needs are essential for survival, such as housing and food, while wants are things that enhance your lifestyle but are not necessary.

4. Set Financial Goals

Setting financial goals is an integral part of budgeting. Whether you want to save for a vacation, pay off debt, or build an emergency fund, having clear goals will help you stay motivated and on track.

By following these steps and being mindful of your spending habits, you can create a realistic budget that aligns with your financial goals and lifestyle.

Understanding and Managing Credit Scores Effectively

Understanding and managing credit scores effectively is key to maintaining healthy finances and achieving long-term financial success. Your credit score is a three-digit number that reflects your creditworthiness based on your credit history. Lenders, landlords, and even potential employers use this score to evaluate your financial responsibility and reliability.

Here are some tips to help you understand and manage your credit score effectively:

Check Your Credit Report Regularly

Monitoring your credit report regularly is essential to ensure that all the information is accurate. Errors on your report can negatively impact your credit score and financial opportunities. You are entitled to a free credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) once a year.

Pay Your Bills on Time

Consistently paying your bills on time is one of the most critical factors in determining your credit score. Late payments can significantly lower your score and stay on your credit report for up to seven years. Setting up automatic payments or reminders can help you stay on track.

Keep Your Credit Utilization Low

Your credit utilization ratio, which is the amount of credit you are using compared to your total available credit, also plays a significant role in your credit score. It’s generally recommended to keep this ratio below 30% to demonstrate responsible credit management.

Avoid Opening Too Many New Accounts

Opening multiple new credit accounts within a short period can signal financial distress and lower your credit score. Each new account results in a hard inquiry on your credit report, which can ding your score slightly. Be strategic about opening new accounts and only do so when necessary.

By understanding these key factors and implementing good credit habits, you can effectively manage and improve your credit score over time, opening doors to better financial opportunities and financial success.

Frequently Asked Questions

How can I start saving money?

You can start saving money by creating a budget, tracking your expenses, and cutting back on non-essential spending.

What are some effective ways to reduce debt?

Some effective ways to reduce debt include paying more than the minimum amount due, prioritizing high-interest debt, and negotiating with creditors for lower interest rates.

Is it worth investing in the stock market?

Investing in the stock market can be worth it for long-term financial goals, but it comes with risks. It’s important to do thorough research and consider seeking advice from a financial advisor.

How can I improve my credit score?

To improve your credit score, you can pay bills on time, keep credit card balances low, and monitor your credit report for errors.

What are some good strategies for retirement planning?

Good strategies for retirement planning include starting early, contributing to retirement accounts like 401(k)s or IRAs, and diversifying your investments.

How can I protect my personal finances in case of emergencies?

You can protect your personal finances in case of emergencies by building an emergency fund, having adequate insurance coverage, and creating a financial contingency plan.

- Create a budget and stick to it.

- Avoid unnecessary expenses.

- Pay off high-interest debt first.

- Automate your savings.

- Invest for the long term.

- Monitor your credit score regularly.

- Review your financial goals periodically.

- Seek professional financial advice when needed.

Leave a comment below with any other financial topics you’d like to learn about, and don’t forget to check out our other articles for more money-saving tips!