Montgomery Ward Buy Now Pay Later Credit Options

✅Montgomery Ward’s Buy Now Pay Later credit options offer flexible payment plans, instant approval, and no annual fees, making shopping more accessible and stress-free.

Montgomery Ward Buy Now Pay Later Credit Options allow customers to purchase items without having to pay the full amount upfront. Instead, they can spread the cost over a series of payments, making it easier to manage larger purchases. This option is particularly useful for those who need to buy essential items but may not have the immediate funds available.

Montgomery Ward offers a variety of credit options to fit different financial needs and circumstances. In this article, we will explore the different Buy Now Pay Later options available, how they work, and the benefits and potential drawbacks of using them.

Understanding Montgomery Ward Credit Options

Montgomery Ward provides several financing options to accommodate customers with varying credit profiles and purchasing power. Below are the primary credit options available:

- Montgomery Ward Credit Account: This is the most popular option, allowing customers to open a line of credit directly with Montgomery Ward. The account can be used to make purchases both online and through their catalog. Payments can be spread over several months, with minimum monthly payments required.

- Third-Party Financing: Montgomery Ward may also partner with third-party financial institutions to offer promotional financing. These offers may include deferred interest or no interest if paid in full within a specific period.

- Installment Plans: For some items, Montgomery Ward offers special installment plans, which break down the total cost into equal monthly payments over a set term.

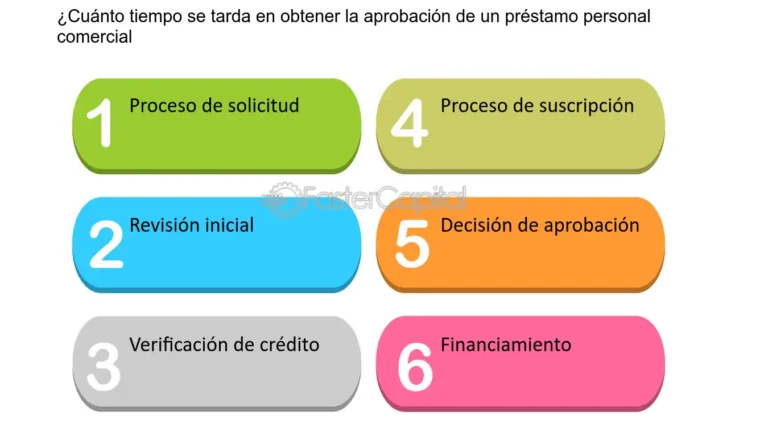

How to Apply for Montgomery Ward Credit

Applying for a Montgomery Ward Credit Account is a straightforward process. Here are the steps to follow:

- Visit the Montgomery Ward website or call their customer service to request a credit application.

- Fill out the application form with your personal and financial details.

- Submit the application for review. Approval decisions are typically made within a few minutes.

- If approved, you will receive a credit limit and can start using your account to make purchases immediately.

Benefits of Using Montgomery Ward Credit

There are several advantages to using Montgomery Ward’s Buy Now Pay Later options:

- Flexibility: Spread out payments over time, making it easier to manage your budget.

- Immediate Access: Purchase essential items without having to wait until you have saved the full amount.

- Building Credit: Responsible use of your Montgomery Ward Credit Account can help build or improve your credit score.

- Exclusive Offers: Cardholders may receive special promotions and discounts.

Potential Drawbacks

While there are many benefits to using Montgomery Ward credit options, there are also some potential drawbacks to consider:

- Interest Rates: Depending on your credit profile, interest rates can be high. It’s important to read the terms and conditions carefully.

- Credit Impact: Missing payments or carrying high balances can negatively affect your credit score.

- Fees: Late payment fees and other charges can add up if you’re not careful.

Tips for Managing Your Montgomery Ward Credit Account

To make the most of your Montgomery Ward credit account, consider the following tips:

- Set a Budget: Determine how much you can afford to pay each month and stick to it.

- Track Your Spending: Keep an eye on your purchases and account balance to avoid overspending.

- Pay More Than the Minimum: If possible, pay more than the minimum monthly payment to reduce interest charges and pay off your balance faster.

- Stay Informed: Regularly review your account statements and be aware of any changes to your interest rates or terms.

Cómo funciona el programa de crédito de Montgomery Ward

El programa de crédito de Montgomery Ward ofrece a sus clientes la posibilidad de comprar productos ahora y pagarlos más tarde, lo que resulta atractivo para aquellos que desean adquirir artículos de valor sin tener que desembolsar todo el dinero de inmediato.

Cuando un cliente opta por utilizar el programa Buy Now Pay Later de Montgomery Ward, puede adquirir productos como muebles, electrodomésticos, ropa, entre otros, y posponer el pago de la compra para un momento posterior. Esta opción de crédito flexible permite a los consumidores disfrutar de sus productos mientras realizan pagos a plazos, lo que puede ser beneficioso para aquellos con presupuestos ajustados.

Algunos de los beneficios clave de participar en el programa de crédito de Montgomery Ward incluyen:

- Flexibilidad de pago: Los clientes pueden dividir el costo de su compra en pagos mensuales, lo que puede facilitar la adquisición de artículos costosos.

- Acceso a productos de calidad: Permite a los consumidores comprar productos de alta calidad que de otra manera podrían no ser capaces de adquirir de inmediato.

- Conveniencia: La opción de Buy Now Pay Later ofrece comodidad y conveniencia a los clientes al permitirles obtener productos sin tener que pagar el monto total por adelantado.

Por ejemplo, imagine que una familia necesita comprar una lavadora y una secadora nuevas. Con el programa de crédito de Montgomery Ward, pueden adquirir estos electrodomésticos y pagarlos en cuotas mensuales, lo que les brinda la posibilidad de disfrutar de la comodidad de tener electrodomésticos nuevos sin afectar significativamente su flujo de efectivo inmediato.

Ventajas y desventajas del crédito Buy Now Pay Later

When it comes to shopping, Buy Now Pay Later credit options have become increasingly popular among consumers. These payment plans allow shoppers to make a purchase and delay the payment for a later date, often with little to no interest involved. While this may seem like a convenient way to manage expenses, it is essential to consider the advantages and disadvantages of using Buy Now Pay Later credit options.

Advantages of Buy Now Pay Later Credit Options:

- Financial Flexibility: By choosing a Buy Now Pay Later option, consumers can spread out their payments over time, making it easier to afford big-ticket items or unexpected expenses.

- No Interest or Low Interest: Many Buy Now Pay Later plans come with no interest if the balance is paid in full within a certain period. Even if interest is charged, it is often lower than traditional credit card rates.

- Convenience: These credit options provide a quick and easy way to make purchases without having to pay the full amount upfront, offering more purchasing power to consumers.

Disadvantages of Buy Now Pay Later Credit Options:

- Accrued Interest: If the balance is not paid off within the promotional period, consumers may end up paying high interest rates on the remaining balance, potentially costing more than the original purchase price.

- Overspending: The ease of using Buy Now Pay Later options can lead to impulse buying and overspending, especially if consumers do not keep track of their purchases and payment due dates.

- Impact on Credit Score: Failing to make payments on time can negatively impact a consumer’s credit score, making it harder to qualify for future loans or credit cards.

While Buy Now Pay Later credit options offer convenience and flexibility, it is crucial for consumers to weigh the pros and cons before utilizing these payment plans. Responsible budgeting and timely payments are key to making the most of these financial tools without falling into debt traps.

Frequently Asked Questions

1. What is the Buy Now Pay Later option at Montgomery Ward?

The Buy Now Pay Later option at Montgomery Ward allows customers to purchase items and pay for them at a later date without incurring interest charges.

2. How can I qualify for Buy Now Pay Later at Montgomery Ward?

To qualify for the Buy Now Pay Later option at Montgomery Ward, customers typically need to pass a credit check or meet certain eligibility criteria set by the company.

3. Are there any fees associated with the Buy Now Pay Later option at Montgomery Ward?

There may be fees associated with the Buy Now Pay Later option at Montgomery Ward, such as late payment fees or fees for opting into the program. It’s important to read the terms and conditions carefully.

4. What happens if I miss a payment with Buy Now Pay Later at Montgomery Ward?

If you miss a payment with Buy Now Pay Later at Montgomery Ward, you may incur late fees and it could negatively impact your credit score. It’s important to make payments on time to avoid these consequences.

5. Can I pay off my balance early with Buy Now Pay Later at Montgomery Ward?

Yes, you can typically pay off your balance early with Buy Now Pay Later at Montgomery Ward without incurring any penalties. This can help you save on interest charges.

6. Is Buy Now Pay Later a good option for financing purchases at Montgomery Ward?

Buy Now Pay Later can be a convenient option for financing purchases at Montgomery Ward, but it’s important to carefully consider your financial situation and the terms of the program before proceeding.

- Buy Now Pay Later allows customers to purchase items and pay for them at a later date.

- Qualification for Buy Now Pay Later may require a credit check or meeting eligibility criteria.

- There may be fees associated with the Buy Now Pay Later option, such as late payment fees.

- Missing a payment with Buy Now Pay Later can result in late fees and impact your credit score.

- Early payment of the balance is usually allowed with Buy Now Pay Later, without penalties.

- Customers should carefully evaluate if Buy Now Pay Later is the right financing option for them.

Leave a comment below if you have any other questions or check out our other articles for more information on financing options!