Movo Virtual Prepaid Visa Card: Your Digital Payment Solution

✅Movo Virtual Prepaid Visa Card: Your Digital Payment Solution for secure, convenient, and instant transactions. Perfect for online shopping and budgeting!

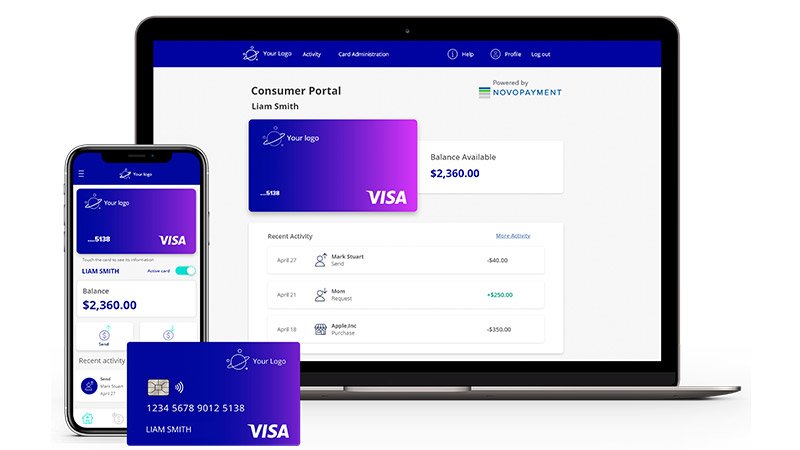

The Movo Virtual Prepaid Visa Card is a versatile digital payment solution that offers a convenient and secure way to manage your finances online. With no physical card required, you can use the virtual card for online shopping, bill payments, and even peer-to-peer money transfers. This innovative financial tool is perfect for those who prefer a digital-first approach to managing their money.

In this article, we will explore the various features and benefits of the Movo Virtual Prepaid Visa Card, how to set it up, and some practical tips on using it effectively. Whether you’re looking to streamline your online transactions or seeking a safer alternative to traditional debit and credit cards, the Movo Virtual Prepaid Visa Card has you covered.

Key Features of the Movo Virtual Prepaid Visa Card

The Movo Virtual Prepaid Visa Card comes packed with several features that make it an attractive option for digital payments:

- Instant Issuance: Get your virtual card immediately upon approval, so you can start using it without delay.

- No Physical Card: Enjoy the convenience of a card that exists solely in the digital realm, reducing the risk of loss or theft.

- Global Acceptance: Use your card anywhere Visa is accepted, making it ideal for international transactions.

- Security: Benefit from advanced security features, including fraud monitoring and the ability to lock and unlock your card instantly.

- Budget Management: Easily track your spending through the Movo app, helping you stay on top of your finances.

How to Set Up Your Movo Virtual Prepaid Visa Card

Setting up your Movo Virtual Prepaid Visa Card is quick and straightforward. Follow these simple steps:

- Download the Movo App: Available on both iOS and Android platforms, the Movo app is your gateway to managing your virtual card.

- Create an Account: Sign up using your email address and provide the necessary personal information for verification.

- Get Approved: Once your identity is verified, you will receive your virtual card details instantly.

- Load Funds: Add money to your card through bank transfers, direct deposits, or other available methods.

- Start Using Your Card: Use the card for online purchases, bill payments, or to send money to friends and family.

Practical Tips for Using Your Movo Virtual Prepaid Visa Card

To make the most out of your Movo Virtual Prepaid Visa Card, consider the following tips:

- Monitor Your Transactions: Regularly check your transaction history in the Movo app to keep track of your spending and identify any unauthorized activity.

- Set Spending Limits: Utilize the budgeting tools in the app to set spending limits and avoid overspending.

- Enable Alerts: Turn on notifications for transactions and account activity to stay informed in real-time.

- Use Virtual Cards for Subscriptions: Create separate virtual cards for different subscriptions to manage recurring payments more effectively.

- Take Advantage of Promotions: Keep an eye out for special offers and promotions from Movo and Visa that can help you save money.

How to Activate Your Movo Virtual Prepaid Visa Card

Once you have obtained your Movo Virtual Prepaid Visa Card, the next step is to activate it to start using it for your digital transactions. Activating your card is a simple process that can be done quickly online. Follow the steps below to activate your Movo Virtual Prepaid Visa Card:

- Log in to Your Movo Account: Access your Movo account either through the website or the mobile app.

- Locate Your Virtual Card: Find the section in your account dashboard that displays your virtual card details.

- Initiate Activation: Look for the option to activate your card and click on it to begin the activation process.

- Enter Required Information: Follow the prompts to enter the necessary information, which may include your card number, expiration date, and CVV code.

- Set Your PIN: Create a Personal Identification Number (PIN) for added security when making online purchases.

- Confirmation: Once you have completed the activation process, you will receive a confirmation message indicating that your Movo Virtual Prepaid Visa Card is now ready to use.

Activating your Movo Virtual Prepaid Visa Card enables you to make secure online transactions, shop at various online retailers, subscribe to digital services, and more. The convenience and security offered by virtual prepaid cards make them an ideal payment solution for online shopping, subscription services, and digital purchases.

*Remember to keep your virtual card details secure and avoid sharing them with unauthorized parties to prevent fraud and unauthorized transactions.*

Top Security Features of Movo Virtual Prepaid Visa Card

When it comes to digital payment solutions, Movo Virtual Prepaid Visa Card stands out not only for its convenience but also for its top-notch security features. Let’s dive into some of the key security elements that make this virtual prepaid card a secure choice for your online transactions.

1. Two-Factor Authentication (2FA)

Two-factor authentication adds an extra layer of security to your account by requiring two forms of verification before granting access. With Movo Virtual Prepaid Visa Card, you can enable 2FA to ensure that only you can authorize transactions, reducing the risk of unauthorized use.

2. Fraud Monitoring and Alerts

Fraud monitoring is essential in today’s digital world, and Movo understands this importance. The card comes with robust fraud monitoring systems that analyze your transactions in real-time to detect any suspicious activity. In case of any unusual behavior, you will receive alerts promptly, allowing you to take immediate action to secure your account.

3. EMV Chip Technology

EMV chip technology adds an extra layer of security to your in-person transactions. This technology generates a unique code for every transaction, making it nearly impossible for fraudsters to counterfeit your card or steal your information. When using your Movo Virtual Prepaid Visa Card at EMV chip-enabled terminals, you can have peace of mind knowing that your data is secure.

4. Virtual Card Number

One of the standout security features of Movo Virtual Prepaid Visa Card is the ability to generate a virtual card number for online purchases. Instead of using your actual card number, which can be vulnerable to theft, you can use a virtual number that is linked to your account. This adds an extra layer of security and protects your sensitive information from falling into the wrong hands.

By leveraging these advanced security features, Movo Virtual Prepaid Visa Card ensures that your digital transactions are not only convenient but also secure. Whether you are shopping online, managing subscriptions, or sending money to friends and family, having a secure payment solution is paramount in today’s digital landscape.

Frequently Asked Questions

What is a Movo Virtual Prepaid Visa Card?

A Movo Virtual Prepaid Visa Card is a digital payment solution that allows you to make online purchases securely without the need for a physical card.

How can I get a Movo Virtual Prepaid Visa Card?

You can easily sign up for a Movo account online and request a virtual card through their mobile app.

Are there any fees associated with the Movo Virtual Prepaid Visa Card?

There may be fees for certain transactions or services, so it’s important to review the fee schedule provided by Movo.

Can I reload funds onto my Movo Virtual Prepaid Visa Card?

Yes, you can add funds to your virtual card through various methods such as bank transfers or direct deposits.

Is the Movo Virtual Prepaid Visa Card secure to use for online transactions?

Yes, Movo uses encryption and security measures to protect your card information and transactions.

Can I use the Movo Virtual Prepaid Visa Card internationally?

Yes, you can use your virtual card for online purchases internationally where Visa is accepted.

Key Points:

- Virtual prepaid Visa card for online purchases

- Sign up online and request a virtual card through the mobile app

- Review fee schedule for any associated fees

- Reload funds through bank transfers or direct deposits

- Secure encryption for online transactions

- International usability where Visa is accepted

Leave a comment below if you have any more questions about the Movo Virtual Prepaid Visa Card, and don’t forget to check out our other articles for more useful information!