Nationwide Building Society Internet Banking: Convenient and Secure

✅Nationwide Building Society Internet Banking offers a convenient and secure way to manage your finances, ensuring peace of mind and easy access anytime, anywhere.

Nationwide Building Society Internet Banking offers a convenient and secure way to manage your finances online. With features like real-time account monitoring, bill payments, and secure messaging, it provides a comprehensive solution for personal and business banking needs.

In this article, we will explore the various features and benefits of Nationwide Building Society Internet Banking, as well as tips for ensuring your online banking experience is safe and efficient. Whether you’re new to online banking or looking to maximize your use of the service, this guide will provide valuable insights.

Features of Nationwide Building Society Internet Banking

Nationwide Building Society offers a range of features designed to make online banking both easy and secure:

- Account Management: View real-time balances, transaction history, and manage direct debits and standing orders.

- Bill Payments: Pay bills directly from your account with just a few clicks.

- Funds Transfer: Easily transfer money between your Nationwide accounts or to other banks.

- Secure Messaging: Communicate securely with Nationwide customer service for any queries or concerns.

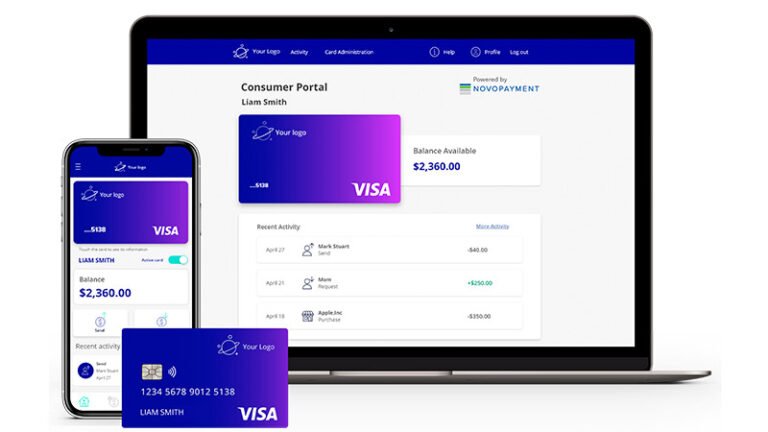

- Mobile Banking: Access your accounts on the go with Nationwide’s mobile banking app, available for both iOS and Android.

Security Features

Security is a top priority for Nationwide Building Society, and they have implemented several measures to protect your accounts:

- Two-factor Authentication (2FA): Adds an extra layer of security by requiring a second form of identification.

- Secure Login: Uses advanced encryption to protect your login credentials.

- Fraud Monitoring: Continuous monitoring of account activity to detect and prevent suspicious transactions.

- Regular Updates: Frequent software updates to address vulnerabilities and enhance security features.

How to Get Started

Getting started with Nationwide Building Society Internet Banking is straightforward. Follow these steps to set up your online banking account:

- Register Online: Visit the Nationwide Building Society website and complete the online registration form.

- Verify Your Identity: Provide the necessary identification documents to verify your identity.

- Set Up Login Details: Create a strong password and set up security questions for account recovery.

- Download the Mobile App: For added convenience, download the Nationwide mobile banking app and log in using your new credentials.

Tips for Safe Online Banking

To ensure your online banking experience remains secure, consider the following tips:

- Use Strong Passwords: Create complex passwords that include numbers, symbols, and a mix of upper and lower case letters.

- Enable 2FA: Always enable two-factor authentication for added security.

- Monitor Your Accounts: Regularly check your accounts for any unauthorized transactions.

- Update Software: Keep your banking app and any related software up to date to protect against vulnerabilities.

- Be Wary of Phishing Scams: Never click on suspicious links or provide personal information in response to unsolicited emails or messages.

By following these guidelines and utilizing the robust features offered by Nationwide Building Society Internet Banking, you can enjoy a seamless and secure online banking experience.

Cómo registrarse y comenzar a usar Nationwide Building Society Internet Banking

Registering for Nationwide Building Society Internet Banking is a simple process that allows you to access your accounts conveniently and securely. To get started, follow these steps:

- Visit the Nationwide Building Society website: Go to the official Nationwide website to begin the registration process.

- Locate the ‘Register’ button: Look for the registration button on the homepage or in the banking section of the website.

- Provide your details: Fill out the registration form with your personal information, including your name, address, account number, and any other required details.

- Choose your login credentials: Select a username and password that are secure but easy for you to remember. This will be used to access your online banking account.

- Set up additional security measures: Nationwide offers additional security features such as two-factor authentication to ensure the safety of your online transactions.

- Agree to the terms and conditions: Review the terms of service and agree to them to complete the registration process.

- Verify your identity: In some cases, you may need to verify your identity through a one-time passcode sent to your phone or email.

Once you have completed the registration process, you can log in to your Nationwide Building Society Internet Banking account and start managing your finances online. This convenient service allows you to check your account balance, transfer funds, pay bills, and more, all from the comfort of your own home.

Internet banking not only provides convenience but also enhances security by allowing you to monitor your account activity regularly and detect any unauthorized transactions promptly.

Medidas de seguridad implementadas en Nationwide Building Society para proteger tus datos

Cuando se trata de realizar transacciones en línea, la seguridad de tus datos es una prioridad absoluta. En Nationwide Building Society, se han implementado diversas medidas de seguridad para garantizar que tus datos estén protegidos en todo momento.

Una de las medidas más importantes es la autenticación de dos factores. Al iniciar sesión en tu cuenta de banca en línea, además de ingresar tu contraseña, es posible que se te solicite un código adicional que se enviará a tu teléfono móvil o correo electrónico. Este proceso añade una capa adicional de seguridad, ya que incluso si alguien obtiene tu contraseña, necesitaría el segundo factor para acceder a tu cuenta.

Otra medida de seguridad clave es el cifrado de extremo a extremo. Cuando envías información a través del sitio web de Nationwide Building Society, esta se encripta para que solo el destinatario previsto pueda leerla. Esto es crucial cuando se trata de transacciones financieras en línea, ya que evita que los ciberdelincuentes intercepten y accedan a tus datos sensibles.

Además, el monitoreo constante de la actividad de la cuenta es fundamental para detectar cualquier actividad sospechosa. Nationwide Building Society utiliza sistemas avanzados que analizan los patrones de uso y las transacciones para identificar posibles fraudes y proteger así a sus clientes de posibles ataques cibernéticos.

Es importante tener en cuenta que, a pesar de todas estas medidas de seguridad, los usuarios también desempeñan un papel crucial en la protección de sus propios datos. Es fundamental mantener la confidencialidad de tus credenciales de inicio de sesión, no compartir tu información con terceros y mantener tus dispositivos seguros y actualizados para proteger tus datos de manera efectiva.

Nationwide Building Society se toma muy en serio la seguridad de sus clientes y ha implementado diversas medidas para proteger los datos financieros y personales de manera efectiva en su plataforma de banca en línea.

Frequently Asked Questions

Is Nationwide Building Society Internet Banking safe to use?

Yes, Nationwide Building Society Internet Banking uses advanced security features to protect your information.

Can I access my account using the Nationwide Building Society mobile app?

Yes, you can easily access your account and perform transactions using the mobile app.

What services can I access through Nationwide Building Society Internet Banking?

You can check your account balance, transfer funds, pay bills, set up alerts, and more.

Is there a fee for using Nationwide Building Society Internet Banking?

No, there is no fee for using Nationwide Building Society Internet Banking.

Can I contact customer support if I have issues with Internet Banking?

Yes, you can contact customer support through the website, mobile app, or by phone for assistance.

Is Nationwide Building Society Internet Banking available 24/7?

Yes, you can access Nationwide Building Society Internet Banking anytime, 24 hours a day, 7 days a week.

- Secure access to your account

- Mobile app for easy banking on the go

- Various services available: balance check, fund transfer, bill payment, alerts

- No fees for using Internet Banking

- Customer support available for assistance

- 24/7 availability for convenient banking

Feel free to leave your comments below and check out our other articles for more information on banking services.