One Main Financial San Diego: Your Local Lending Solution

✅One Main Financial San Diego: Your local lending solution for personalized loans, quick approvals, and financial support right in your community!

One Main Financial in San Diego offers a wide range of lending solutions tailored to meet the diverse financial needs of the community. With a strong presence in the area, One Main Financial is dedicated to providing accessible and flexible loan options that help individuals achieve their financial goals. Whether you need a personal loan for debt consolidation, home improvements, or unexpected expenses, One Main Financial is a reliable local resource.

San Diego residents can benefit from the expertise and customer-centric approach of One Main Financial. This financial institution prides itself on a simple and straightforward application process, competitive interest rates, and personalized customer service. In this article, we will explore the various loan options available, the application process, and tips for managing your loans effectively.

Loan Options Available at One Main Financial in San Diego

One Main Financial provides a variety of loan products to cater to different financial needs. Here are some of the key loan options:

- Personal Loans: Ideal for covering major expenses such as medical bills, home repairs, or travel.

- Debt Consolidation Loans: Combine multiple debts into a single loan with a fixed interest rate, simplifying your monthly payments.

- Auto Loans: Finance the purchase of a new or used vehicle with competitive rates and flexible terms.

- Home Improvement Loans: Fund renovations or repairs to enhance the value and comfort of your home.

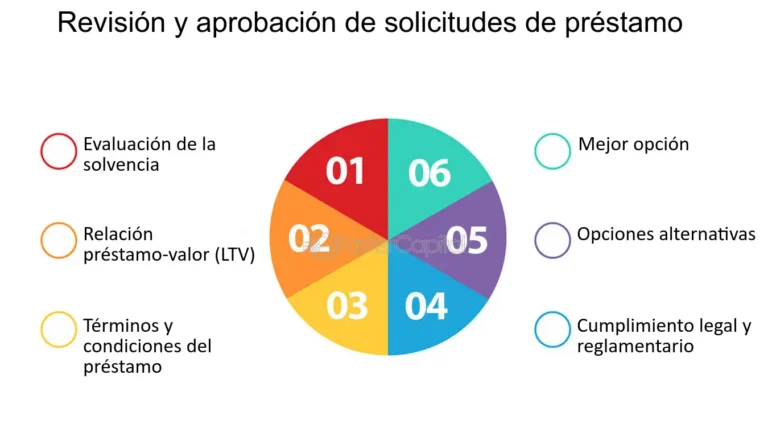

How to Apply for a Loan at One Main Financial

Applying for a loan at One Main Financial is designed to be a hassle-free experience. Follow these steps to get started:

- Check Your Eligibility: Ensure you meet the basic requirements such as being 18 years or older, having a valid ID, and proof of income.

- Gather Necessary Documents: Collect documents like your government-issued ID, proof of residence, and income statements.

- Complete the Application: Fill out the application form online or visit the San Diego branch for assistance.

- Review Loan Terms: Once approved, review the loan terms carefully, including the interest rate, repayment schedule, and any associated fees.

- Sign the Agreement: After agreeing to the terms, sign the loan agreement to finalize the process.

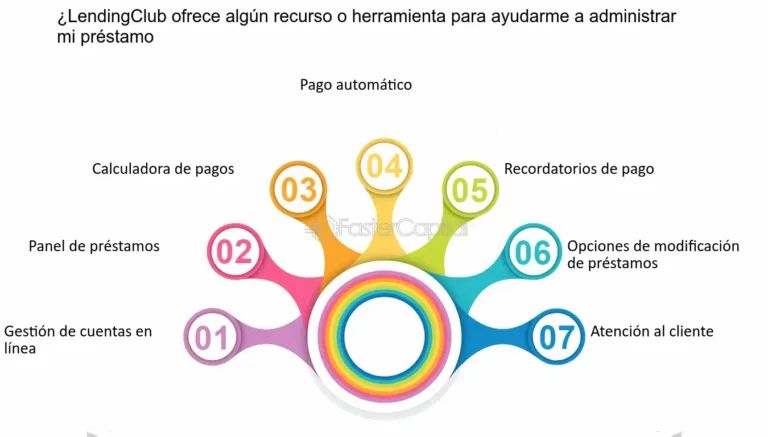

Tips for Managing Your Loan Effectively

Successfully managing your loan is crucial to maintaining financial stability. Here are some tips to help you stay on track:

- Set Up Automatic Payments: Ensure timely payments by setting up automatic withdrawals from your bank account.

- Create a Budget: Plan your monthly expenses to ensure you can comfortably make your loan payments.

- Monitor Your Credit Score: Regularly check your credit score to understand how your loan affects your credit health.

- Communicate with Your Lender: If you encounter financial difficulties, contact One Main Financial to discuss possible solutions such as deferment or restructuring your loan.

Why Choose One Main Financial in San Diego?

There are several reasons why One Main Financial stands out as a preferred lender in San Diego:

- Local Expertise: With a deep understanding of the San Diego community, One Main Financial can offer personalized solutions.

- Customer Service: Dedicated support teams are available to assist you through every step of the loan process.

- Competitive Rates: Enjoy competitive interest rates that make borrowing more affordable.

- Flexible Terms: Find loan terms that fit your financial situation and repayment ability.

Tipos de préstamos disponibles en One Main Financial San Diego

When it comes to loans, One Main Financial San Diego offers a variety of options to meet your financial needs. Understanding the different types of loans available can help you make an informed decision that aligns with your goals and budget.

Personal Loans

Personal loans are a versatile financial product that can be used for a wide range of purposes, such as debt consolidation, home improvements, or unexpected expenses. At One Main Financial San Diego, you can apply for a personal loan to cover these needs with competitive interest rates and flexible repayment terms.

Auto Loans

For those looking to purchase a new vehicle, auto loans from One Main Financial San Diego can provide the necessary funds. Whether you’re buying a car, truck, or SUV, an auto loan can help you drive away with your dream vehicle without breaking the bank.

Home Improvement Loans

If you’re planning to renovate your home or undertake a major repair project, home improvement loans can be a valuable resource. One Main Financial San Diego offers home improvement loans with competitive rates, allowing you to enhance your living space without draining your savings.

Debt Consolidation Loans

Debt consolidation loans can help you simplify your finances by combining multiple debts into a single loan with one monthly payment. By choosing a debt consolidation loan from One Main Financial San Diego, you can streamline your debt repayment process and potentially reduce your overall interest expenses.

Whether you need funds for a specific purpose or simply want to have a financial safety net, exploring the loan options available at One Main Financial San Diego can empower you to make sound financial decisions that support your ambitions.

Cómo solicitar un préstamo en One Main Financial San Diego

When it comes to applying for a loan at One Main Financial San Diego, the process is straightforward and customer-friendly. Whether you need funds for a home improvement project, debt consolidation, or unexpected expenses, One Main Financial San Diego offers various loan options to suit your needs.

Here’s how you can easily apply for a loan:

- Visit the Branch: One Main Financial in San Diego has a physical branch where you can speak with a loan specialist in person. This option allows you to ask questions and get personalized assistance throughout the application process.

- Apply Online: For convenience and speed, you can also apply for a loan online through the One Main Financial website. The online application is simple to fill out and can be done from the comfort of your home at any time.

- Gather Required Documents: Before applying, make sure to have necessary documents such as proof of income, identification, and any other financial records that may be required for the loan application.

Once you have submitted your application, a loan specialist will review your information and determine the best loan option for your situation. It’s important to provide accurate details to ensure a smooth approval process.

Remember, borrowing responsibly and understanding the terms of the loan are crucial steps when taking out a loan.

Benefits of Choosing One Main Financial San Diego for Your Loan Needs

One Main Financial San Diego stands out as a reliable lending solution for several reasons:

| Benefits | Details |

|---|---|

| Personalized Service | Loan specialists provide individualized attention to help you choose the right loan option. |

| Flexible Repayment Plans | Options for flexible repayment terms that align with your budget and financial goals. |

| Quick Approval Process | Fast approval process so you can access funds promptly for your needs. |

By selecting One Main Financial San Diego for your lending needs, you can benefit from a customer-focused approach and a range of financial solutions tailored to meet your requirements.

Frequently Asked Questions

What types of loans does One Main Financial San Diego offer?

One Main Financial San Diego offers personal loans for various purposes, including debt consolidation, home improvements, and unexpected expenses.

What are the eligibility requirements for a loan with One Main Financial San Diego?

Applicants must be at least 18 years old, have a valid ID, proof of income, and a checking account to qualify for a loan with One Main Financial San Diego.

How quickly can I receive funds from One Main Financial San Diego after approval?

Once approved, funds from One Main Financial San Diego can be deposited into your account as soon as the next business day.

Is it possible to pay off my loan early with One Main Financial San Diego?

Yes, One Main Financial San Diego allows borrowers to pay off their loans early without incurring any prepayment penalties.

What sets One Main Financial San Diego apart from other lenders?

One Main Financial San Diego offers personalized customer service and flexible repayment options tailored to each individual’s financial needs.

Key Points about One Main Financial San Diego

- Personal loans for various purposes available

- Fast approval process

- No prepayment penalties

- Flexible repayment options

- Excellent customer service

Feel free to leave your comments and check out other articles on our website that may interest you!