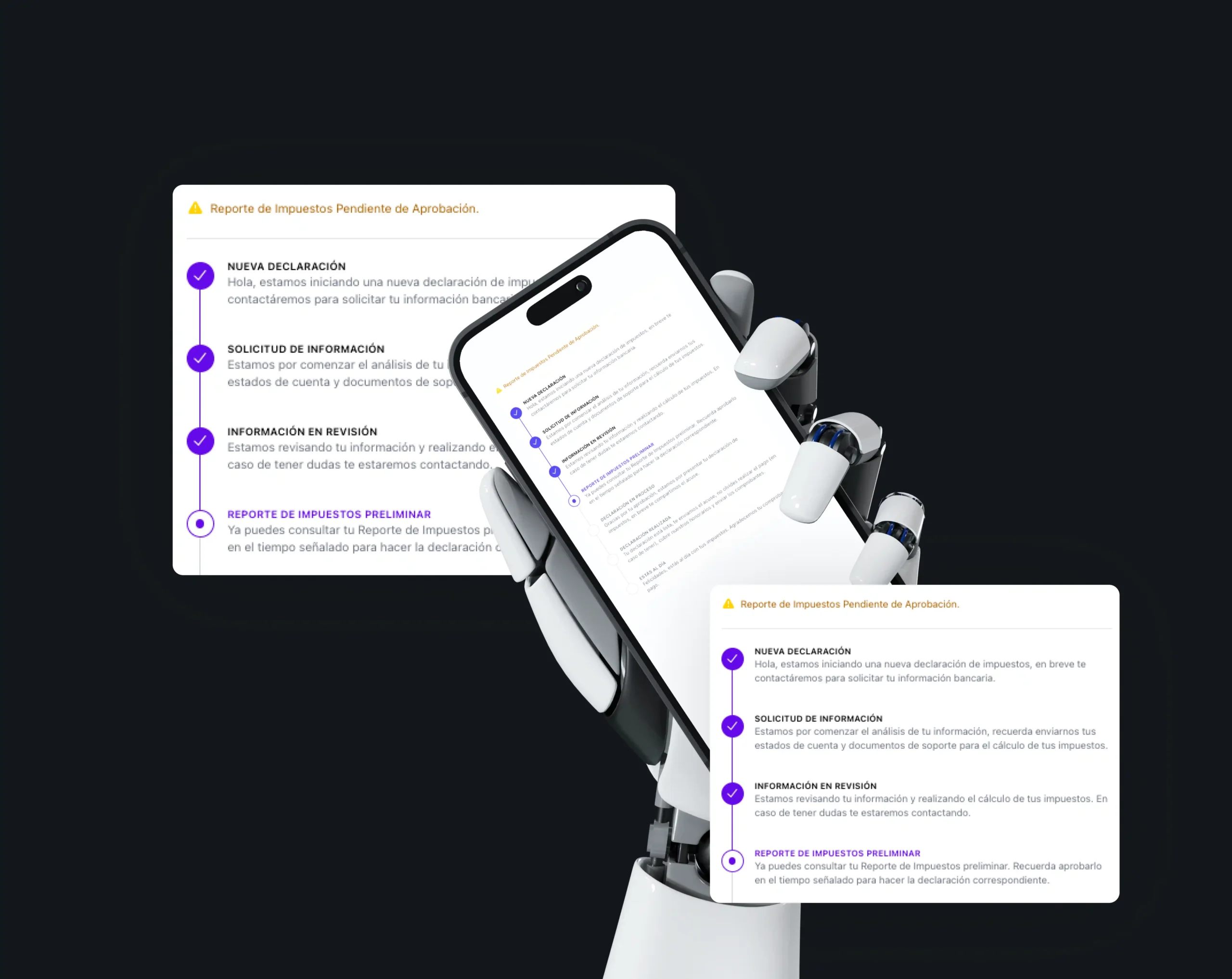

Optimum Tax Relief Client Portal: Easy Access and Management

✅Optimum Tax Relief Client Portal offers seamless access and efficient management, ensuring stress-free tax solutions and real-time updates.

The Optimum Tax Relief Client Portal is designed to provide clients with easy access and seamless management of their tax relief services. This secure, user-friendly platform allows users to view their account status, upload necessary documents, and communicate directly with their tax professionals, ensuring a streamlined experience throughout the tax resolution process.

In this article, we will delve into the features and benefits of the Optimum Tax Relief Client Portal, highlighting how it enhances client experience and simplifies tax management tasks. From document uploads to real-time updates, this portal is engineered to meet all your tax relief needs efficiently.

Key Features of the Optimum Tax Relief Client Portal

1. Secure Access

Security is a paramount concern when dealing with sensitive tax information. The Optimum Tax Relief Client Portal employs advanced encryption technologies to ensure that all data transmitted and stored is protected from unauthorized access. Clients can log in with a unique username and password, providing peace of mind that their information is secure.

2. Real-Time Account Updates

The client portal offers real-time updates on the status of your tax resolution case. You can easily track the progress of your case, view any outstanding tasks, and see recent communications from your tax professional. This transparency helps keep clients informed and engaged in the process.

3. Document Management

Uploading and managing documents is a breeze with the client portal. Clients can easily upload required documents directly to their account, ensuring that all necessary paperwork is in one place. This feature eliminates the need for mailing or faxing documents, saving time and reducing the risk of lost paperwork.

4. Direct Communication with Tax Professionals

The portal includes a messaging feature that allows clients to communicate directly with their assigned tax professional. This direct line of communication ensures that any questions or concerns are addressed promptly, enhancing the overall client experience.

How to Get Started with the Optimum Tax Relief Client Portal

To get started, clients will receive an invitation email with a link to create their account. Once the account is set up, clients can log in from any device with internet access. The intuitive interface makes it easy to navigate and locate the features you need.

Step-by-Step Guide:

- Check your email for the invitation link.

- Click the link and follow the prompts to create your account.

- Log in using your new credentials.

- Upload any required documents and start managing your tax relief case.

Benefits of Using the Optimum Tax Relief Client Portal

Using the client portal offers numerous benefits, including:

- Convenience: Access your account anytime, anywhere.

- Efficiency: Quickly upload documents and receive real-time updates.

- Security: Advanced encryption ensures your data is protected.

- Transparency: Stay informed about the progress of your case.

- Direct Communication: Easily contact your tax professional with any questions.

By leveraging the Optimum Tax Relief Client Portal, clients can enjoy a streamlined and stress-free tax resolution experience, allowing them to focus on other important aspects of their lives.

How to Navigate the Optimum Tax Relief Client Portal Interface

To make the most of your experience with the Optimum Tax Relief Client Portal, it’s essential to understand how to navigate its user-friendly interface efficiently. Here’s a guide on how to navigate the portal seamlessly:

1. Login Process

When you first access the portal, you will be prompted to enter your login credentials. Make sure to use the username and password provided to you. This step ensures the security of your personal information and tax documents.

2. Dashboard Overview

Upon successful login, you will land on the dashboard. The dashboard provides an overview of your account, including any pending tasks, messages from your tax professionals, and upcoming deadlines. This central hub gives you quick access to all essential information at a glance.

3. Uploading Documents

One of the key features of the portal is the ability to upload documents securely. Whether it’s tax forms, receipts, or other relevant files, you can easily drag and drop them into the portal. This feature eliminates the need for email exchanges and ensures that all your documents are stored in one central location.

4. Communication with Tax Professionals

If you have any questions or need assistance, the portal allows you to communicate directly with your tax professionals. You can send messages, share additional information, or request callbacks, all within the portal. This streamlined communication process enhances collaboration and ensures that your tax professionals have all the information they need to assist you effectively.

5. Monitoring Progress

The portal enables you to track the progress of your tax relief journey. You can see updates on the status of your case, any actions taken by your tax professionals, and milestones achieved. This transparency gives you peace of mind and keeps you informed every step of the way.

By mastering the navigation of the Optimum Tax Relief Client Portal, you can take control of your tax matters and collaborate effectively with your tax professionals. The intuitive interface and robust features make managing your tax relief process a seamless experience.

Features and Tools Available in the Optimum Tax Relief Client Portal

When it comes to managing your tax relief process efficiently, having access to the right tools and features can make a significant difference. The Optimum Tax Relief Client Portal offers a range of functionalities designed to streamline and simplify the tax resolution experience for clients.

Let’s explore some of the key features and tools available in the Optimum Tax Relief Client Portal:

1. Document Upload and Storage

One of the most essential aspects of tax resolution is organizing and submitting necessary documents to the IRS. With the Client Portal, you can easily upload and store all your tax-related documents securely in one place. This feature not only ensures that your information is easily accessible but also helps in maintaining a paperless process.

2. Communication Center

Effective communication is crucial during the tax relief process. The Client Portal includes a communication center that allows you to interact with your tax professionals seamlessly. You can send and receive messages, track updates, and stay informed about the progress of your case, all within the portal.

3. Case Progress Tracking

Keeping track of the progress of your tax resolution case is made simple with the Client Portal. You can monitor the status of your case, view any recent activities, and see upcoming milestones or deadlines. This transparency empowers you to stay informed and engaged throughout the tax relief process.

4. Tax Resources and Education

Understanding your tax situation is key to making informed decisions. The Client Portal provides access to tax resources, guides, and educational materials to help you navigate the complexities of tax debt relief. Whether you need tax tips, FAQs, or informational articles, the portal is a valuable source of knowledge.

By leveraging the features and tools offered in the Optimum Tax Relief Client Portal, clients can take control of their tax resolution journey with ease and confidence. Whether you are facing IRS debt, tax penalties, or other tax-related issues, having a centralized platform to manage your tax relief process can be immensely beneficial.

FAQs

How do I access the Optimum Tax Relief Client Portal?

You can access the client portal by visiting our website and clicking on the “Client Login” button.

What can I do through the Optimum Tax Relief Client Portal?

Through the portal, you can view your tax documents, communicate with your tax professionals, and track the progress of your case.

Is the Optimum Tax Relief Client Portal secure?

Yes, we use encryption and other security measures to ensure that your information is protected.

Can I upload documents to the Optimum Tax Relief Client Portal?

Yes, you can securely upload any necessary documents directly through the portal.

How can I reset my password for the Optimum Tax Relief Client Portal?

You can reset your password by clicking on the “Forgot Password” link on the login page and following the instructions.

Is there a mobile app for the Optimum Tax Relief Client Portal?

Yes, you can download our mobile app from the App Store or Google Play to access the portal on the go.

- Access your tax documents securely online

- Communicate with your tax professionals easily

- Track the progress of your case in real-time

- Upload necessary documents directly through the portal

- Reset your password easily if needed

- Download the mobile app for on-the-go access

Leave your comments below and check out other articles on our website for more helpful information!