Pre Approval from One Main Financial: Quick and Easy Steps

✅Get pre-approved from One Main Financial: Experience quick, easy steps for hassle-free loans and fast financial support!

Obtaining a pre-approval from One Main Financial can be a quick and seamless process if you follow a few simple steps. This pre-approval not only gives you a better understanding of the loan amount you could qualify for but also helps in streamlining the overall loan application process.

In this section, we will detail the step-by-step process to get pre-approved by One Main Financial, ensuring you are well-prepared and informed. This guide will cover everything from the initial application to the final pre-approval notification.

Step 1: Gather Necessary Information

Before you start your pre-approval application, it’s crucial to have all the required information ready. This usually includes:

- Personal Identification: Driver’s license or state ID.

- Proof of Income: Pay stubs, tax returns, or bank statements.

- Employment Details: Employer’s name, address, and contact information.

- Credit History: Information about current debts or loans.

Step 2: Complete the Online Application

Visit the One Main Financial website and fill out the pre-approval application form. The form will ask for basic information about you, your income, and your financial situation. This step usually takes about 10-15 minutes.

Be sure to double-check all the information you provide to avoid any delays in the process.

Step 3: Review Pre-Approval Offer

Once you submit your application, One Main Financial will perform a soft credit check, which does not affect your credit score. Based on this check, they will provide you with a pre-approval offer that outlines the loan amount, interest rate, and terms you qualify for.

Review this offer carefully to ensure it meets your needs and expectations.

Step 4: Accept the Pre-Approval

If the pre-approval offer is satisfactory, you can accept it online or by contacting a One Main Financial representative. Accepting the offer usually involves verifying some additional information and may include a hard credit check, which can impact your credit score slightly.

Step 5: Finalize the Loan Application

After accepting the pre-approval, you’ll need to finalize your loan application. This step may require you to submit additional documentation and undergo a final review.

Once all the paperwork is in order and the final review is complete, you will receive the loan funds, typically within one to two business days.

Additional Tips for a Smooth Pre-Approval Process

- Maintain a Good Credit Score: A higher credit score can help you secure better loan terms.

- Provide Accurate Information: Ensure all the details you provide are accurate to avoid delays.

- Organize Your Documents: Keep all required documents organized for quick access.

Following these steps will help you navigate the pre-approval process with ease, making you one step closer to securing the funds you need from One Main Financial.

Documentos necesarios para la pre-aprobación con One Main Financial

When applying for a loan, having all the necessary documentation ready can streamline the process and increase your chances of pre-approval. The documents required for pre-approval with One Main Financial may vary depending on the type of loan you are applying for, but some common documents include:

- Proof of income: This can include recent pay stubs, W-2 forms, or tax returns. Lenders need to verify that you have a stable income to ensure you can repay the loan.

- Identification: A driver’s license, passport, or other government-issued ID to confirm your identity.

- Proof of residence: Utility bills, lease agreements, or mortgage statements can be used to verify your address.

- Employment information: Details of your employer, including contact information and length of employment.

Having these documents ready before starting the pre-approval process with One Main Financial can help expedite the review process and get you one step closer to obtaining the financing you need.

For example, if you are looking to purchase a new home and need a mortgage loan, having all your financial documents organized and ready can make the pre-approval process smoother. This can give you an advantage over other buyers who may not have their documentation in order.

Cómo mejorar tus posibilidades de pre-aprobación con One Main Financial

When seeking financial assistance, pre-approval can be a crucial step in the process. If you’re considering applying for a loan through One Main Financial, there are several steps you can take to improve your chances of pre-approval. By following these tips, you can increase the likelihood of qualifying for the funding you need.

1. Understand the Requirements

Before applying for a loan, it’s essential to understand the criteria that One Main Financial uses to assess applicants. By knowing the requirements, you can prepare your application accordingly and highlight the aspects of your financial profile that align with what the lender is looking for.

2. Review Your Credit Report

Check your credit report for any errors or negative marks that could impact your credit score. Addressing these issues before applying for a loan can improve your creditworthiness and increase your chances of pre-approval.

3. Provide Accurate Information

When filling out your loan application, make sure to provide accurate and up-to-date information. Inaccurate details could delay the approval process or even result in a denial of your application.

4. Strengthen Your Financial Profile

Consider taking steps to strengthen your financial profile before applying for a loan. This could include paying down debt, increasing your income, or building up your savings. A stronger financial profile can improve your chances of pre-approval.

By following these steps, you can enhance your likelihood of pre-approval with One Main Financial and move closer to securing the financial assistance you need.

Frequently Asked Questions

What is a pre-approval from One Main Financial?

A pre-approval from One Main Financial is a preliminary evaluation of your creditworthiness that gives you an estimate of the loan amount you may qualify for.

How can I apply for a pre-approval from One Main Financial?

You can apply for a pre-approval from One Main Financial online by filling out a simple application form on their website.

Is a pre-approval from One Main Financial a guarantee of a loan?

No, a pre-approval is not a guarantee of a loan. It is based on the information provided and subject to verification.

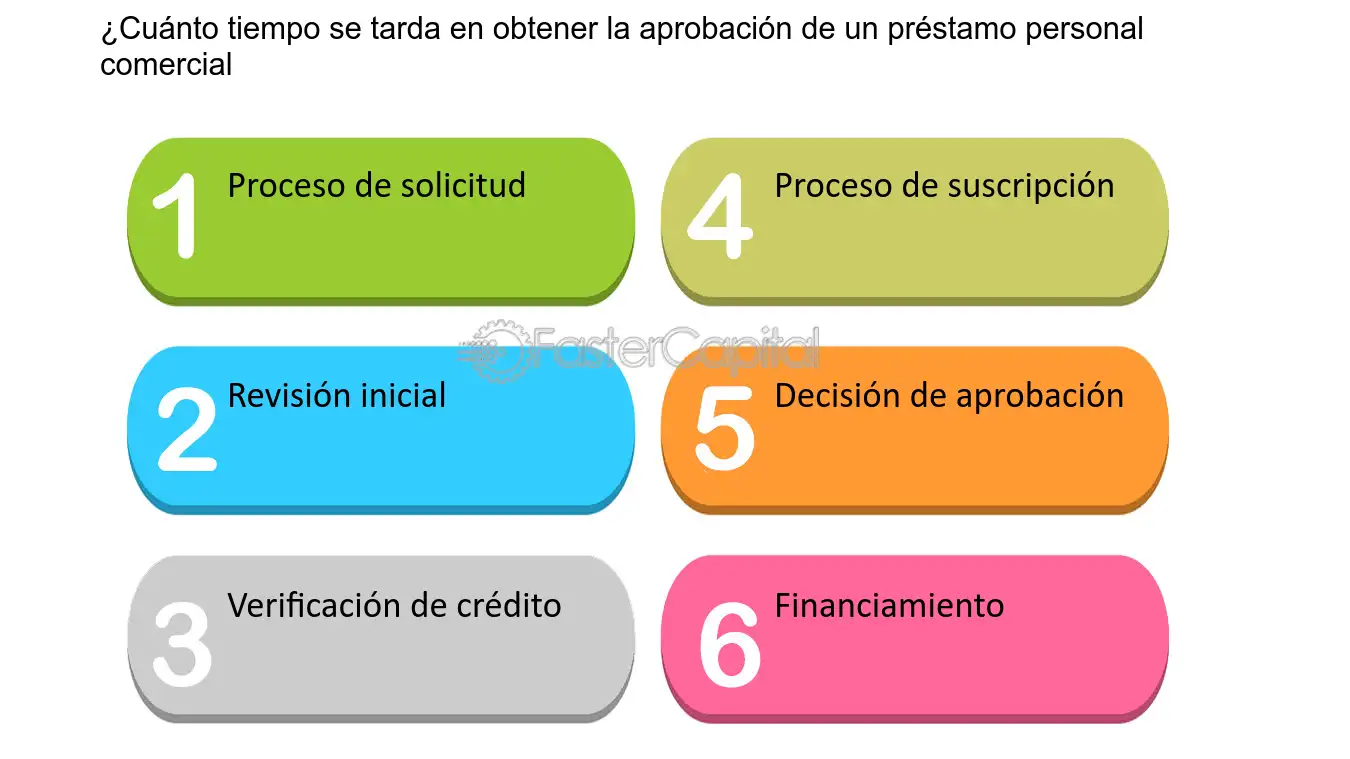

How long does it take to get a pre-approval from One Main Financial?

Typically, you can get a decision on your pre-approval application from One Main Financial within minutes to a few hours.

What documents do I need to provide for a pre-approval from One Main Financial?

Generally, you will need to provide identification, proof of income, and other financial documents to support your pre-approval application.

Can I use my pre-approval from One Main Financial to shop for a car?

Yes, having a pre-approval from One Main Financial can help you negotiate with dealers and make a more informed decision when shopping for a car.

- Pre-approval is not a guarantee of a loan.

- Application process is quick and easy.

- Documents required include identification and proof of income.

- Decision on pre-approval is typically fast.

- Pre-approval helps in negotiating with dealers for a car purchase.

- Pre-approval amount gives an estimate of the loan you may qualify for.

Feel free to leave your comments below and check out other articles on our website for more helpful information!