Speedy Cash Payday Loans Online: Fast and Easy Approval

✅Get fast and easy approval with Speedy Cash Payday Loans online! Quick access to funds when you need them most. Apply now and get instant relief!

When you’re in a financial bind and need quick access to cash, Speedy Cash Payday Loans Online can be a lifesaver. These loans offer fast and easy approval, providing you with the funds you need without the lengthy application process typical of traditional loans. With Speedy Cash, you can apply online, receive approval in minutes, and get your money as soon as the next business day.

In this article, we’ll delve deeper into how Speedy Cash Payday Loans work, the application process, eligibility criteria, and some tips to ensure you make the most out of your loan. Whether you’re facing an unexpected expense or simply need a financial bridge until your next paycheck, understanding the ins and outs of payday loans can help you make an informed decision.

How Speedy Cash Payday Loans Work

Speedy Cash Payday Loans are short-term loans designed to cover urgent expenses until your next payday. These loans are typically for smaller amounts, ranging from $100 to $1,500, depending on state regulations and your income level. The loan amount, fees, and repayment terms will be clearly outlined in the loan agreement.

Application Process

Applying for a Speedy Cash Payday Loan online is straightforward and convenient:

- Step 1: Visit the Speedy Cash website and fill out the online application form with your personal, employment, and banking information.

- Step 2: Submit your application and wait for the approval decision, which typically takes just a few minutes.

- Step 3: Once approved, review and accept the loan agreement.

- Step 4: Receive your funds, which are usually deposited into your bank account by the next business day.

Eligibility Criteria

To qualify for a Speedy Cash Payday Loan, you generally need to meet the following requirements:

- Be at least 18 years old (19 in some states).

- Have a regular source of income, which can be employment or government benefits.

- Possess an active checking account.

- Provide a valid phone number and email address.

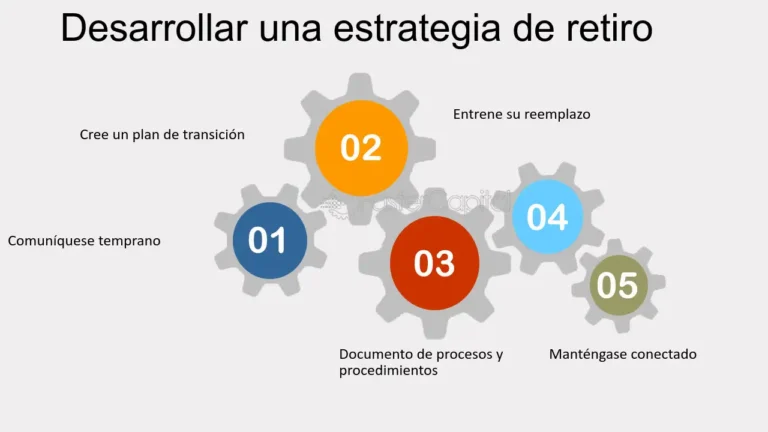

Tips for Successful Loan Management

While Speedy Cash Payday Loans can be a great solution for immediate financial needs, it’s important to manage your loan responsibly:

- Borrow only what you need: Avoid taking out a larger loan than necessary to minimize the amount of interest and fees you’ll pay.

- Plan for repayment: Ensure you have a clear plan to repay the loan on time to avoid additional fees and negative impacts on your credit score.

- Understand the terms: Carefully read the loan agreement to understand the fees, interest rates, and repayment terms.

- Consider alternatives: If possible, explore other borrowing options with lower interest rates and fees before taking out a payday loan.

By following these tips, you can use Speedy Cash Payday Loans responsibly and effectively manage your short-term financial needs. In the next sections, we’ll explore some common questions and concerns about payday loans, as well as additional resources to help you make informed financial decisions.

Requisitos y documentos necesarios para solicitar un préstamo rápido

When applying for a Speedy Cash payday loan online, it’s essential to have all the necessary requirements and documents ready to expedite the approval process. Meeting these requirements ensures a smooth and efficient application process, increasing the chances of quick approval and disbursement of funds.

Requirements for a Speedy Cash Payday Loan:

- Valid Identification: You will need to provide a government-issued ID to confirm your identity.

- Proof of Income: Documents such as pay stubs or bank statements are required to demonstrate your ability to repay the loan.

- Active Bank Account: A checking account in good standing is necessary for the deposit and withdrawal of funds.

- Age Requirement: You must be at least 18 years old to qualify for a payday loan.

- Contact Information: Valid phone numbers and email addresses for communication purposes.

Documents Needed:

When applying for a Speedy Cash payday loan online, you may be required to upload certain documents to support your application. These documents may include:

| Document | Description |

|---|---|

| Photo ID | A clear copy of your government-issued identification. |

| Proof of Income | Recent pay stubs, bank statements, or tax documents. |

| Bank Statement | Evidence of an active checking account for fund transfer. |

| Proof of Address | Utility bills or lease agreements showing your current address. |

Having these requirements and documents readily available can expedite the approval process for your Speedy Cash payday loan, ensuring a fast and seamless experience.

Remember, providing accurate and up-to-date information is crucial for a successful loan application. Double-check all the details before submitting your application to avoid any delays in approval.

Comparativa entre Speedy Cash y otros prestamistas en línea

When it comes to online payday loans, comparing different lenders is crucial to ensure you are getting the best deal possible. In this section, we will provide a comparison between Speedy Cash and other online lenders to help you make an informed decision.

Speedy Cash

Speedy Cash is a well-known online lender that offers quick and convenient payday loans to customers in need of emergency funds. With a simple online application process and fast approval times, Speedy Cash is a popular choice for many borrowers.

Other Online Lenders

There are several other online lenders in the market that also provide payday loans with fast approval. Some of these lenders include LendUp, CashNetUSA, and Check Into Cash. Each lender has its own set of terms and conditions, interest rates, and repayment options.

Comparison Table

| Lender | Approval Time | Maximum Loan Amount | Interest Rates |

|---|---|---|---|

| Speedy Cash | Within minutes | $1,500 | Varies by state |

| LendUp | 1 business day | $1,000 | Varies based on credit score |

| CashNetUSA | Same day | $3,000 | Varies by state |

| Check Into Cash | Within minutes | $1,000 | Varies by state |

As shown in the comparison table, each lender has its own strengths and weaknesses. While Speedy Cash offers quick approval within minutes, CashNetUSA provides higher maximum loan amounts. It’s essential to consider factors such as approval time, loan amount, and interest rates before choosing a lender.

Before applying for a payday loan online, make sure to read the terms and conditions carefully, compare different lenders, and choose the one that best suits your financial needs.

Frequently Asked Questions

What are the requirements to apply for a Speedy Cash payday loan online?

To apply for a Speedy Cash payday loan online, you need to be at least 18 years old, have a steady source of income, and have an active checking account.

How long does it take to get approved for a Speedy Cash payday loan online?

Typically, you can get approved for a Speedy Cash payday loan online within minutes. The funds are usually deposited into your account the next business day.

What is the maximum amount I can borrow with a Speedy Cash payday loan online?

The maximum amount you can borrow with a Speedy Cash payday loan online varies by state but is typically between $100 to $1,500.

Can I apply for a Speedy Cash payday loan online with bad credit?

Yes, you can still apply for a Speedy Cash payday loan online even if you have bad credit. Speedy Cash considers other factors besides your credit score when making a decision.

Are there any fees associated with a Speedy Cash payday loan online?

Yes, there are fees associated with a Speedy Cash payday loan online, including an origination fee and interest charges. These fees vary depending on the amount you borrow and the state regulations.

What happens if I can’t repay my Speedy Cash payday loan online on time?

If you can’t repay your Speedy Cash payday loan online on time, you may incur additional fees and interest. It’s important to contact Speedy Cash as soon as possible to discuss repayment options.

Key Points to Remember when considering a Speedy Cash payday loan online:

- Minimum age requirement is 18 years old

- Steady source of income is necessary

- Active checking account is required

- Approval can be as fast as minutes

- Funds are typically deposited the next business day

- Maximum loan amount varies by state

- Bad credit applicants are considered

- Fees include origination fee and interest charges

- Additional fees may apply for late repayment

Have more questions about Speedy Cash payday loans online? Leave a comment below and check out our other articles for more information!