standard chartered bank internet banking india

✅Experience seamless and secure online banking with Standard Chartered Bank in India. Manage accounts, transfer funds, and pay bills with ease!

Standard Chartered Bank Internet Banking India offers a comprehensive suite of online banking services that cater to the needs of both personal and business customers. Through its robust and secure internet banking platform, users can easily manage their accounts, transfer funds, pay bills, and access a wide range of financial services without the need to visit a physical branch.

Whether you are a new customer or an existing one, Standard Chartered Bank’s internet banking service in India ensures that you have access to all your banking needs at your fingertips. This article provides an in-depth look into the features, benefits, and how-to guide on using the Standard Chartered Bank Internet Banking service in India.

Key Features of Standard Chartered Bank Internet Banking

Standard Chartered Bank’s internet banking platform offers a variety of features designed to make banking convenient and efficient. Some of the key features include:

- Account Management: View account balances, transaction history, and download statements.

- Fund Transfers: Transfer funds between your accounts, to other Standard Chartered accounts, or to accounts in other banks using NEFT, RTGS, and IMPS services.

- Bill Payments: Pay utility bills, credit card bills, and other service providers with ease.

- Investment Services: Manage your investments, purchase mutual funds, and access portfolio details.

- Loan Services: Apply for loans, view loan statements, and manage repayments.

- Secure Transactions: Enhanced security features such as two-factor authentication (2FA) and transaction alerts to ensure the safety of your financial information.

Benefits of Using Standard Chartered Bank Internet Banking

There are several advantages to using Standard Chartered Bank’s internet banking services in India:

- Convenience: Access your bank account 24/7 from anywhere in the world.

- Time-Saving: Perform banking transactions quickly without having to visit a branch.

- Cost-Effective: Save on transaction fees and charges compared to traditional banking methods.

- Comprehensive Services: Access a wide range of banking and financial services in one place.

- Real-Time Updates: Receive instant notifications and updates on your account activities and transactions.

How to Register for Standard Chartered Bank Internet Banking

To start using Standard Chartered Bank’s internet banking services, follow these simple steps:

- Visit the official Standard Chartered Bank India website.

- Click on the ‘Login’ button and select ‘New User Registration.’

- Enter your account number, mobile number, and other required details.

- Follow the on-screen instructions to complete the registration process.

- Once registered, log in using your User ID and password to start using the internet banking services.

Security Measures and Recommendations

Standard Chartered Bank prioritizes the security of its customers’ financial information. Here are some of the security measures and recommendations to ensure safe online banking:

- Two-Factor Authentication (2FA): Enable 2FA for an added layer of security.

- Strong Passwords: Create a strong and unique password for your internet banking account.

- Regular Monitoring: Regularly monitor your account activity and report any suspicious transactions immediately.

- Logout Safely: Always log out from your internet banking session after use, especially when using public or shared computers.

- Update Contact Information: Ensure your contact details are up-to-date to receive timely notifications and alerts.

Proceso paso a paso para registrarse en la banca en línea de Standard Chartered India

Are you looking to register for Standard Chartered Bank internet banking services in India? Follow this step-by-step guide to get started:

Create Your Online Account

- Visit the official Standard Chartered Bank India website.

- Locate the “Online Banking” section on the homepage.

- Click on the “Register Now” or “Sign Up” button.

- Fill out the registration form with your personal details such as name, account number, email address, and mobile number.

- Create a username and password for your online account.

Verification Process

After completing the registration, you may need to verify your identity. This can be done in several ways:

- Verification via SMS: You may receive an SMS with a code to verify your mobile number.

- Email Verification: Check your email for a verification link or code.

- Visit a Branch: Schedule an appointment or visit a branch with your identification documents.

Setting Up Security Features

Once your account is verified, it’s essential to set up security features to protect your online banking transactions:

- Two-Factor Authentication (2FA): Enable 2FA for an extra layer of security.

- Secure Login Credentials: Choose a strong password and keep it confidential.

- Security Questions: Set up security questions to further secure your account.

Remember to keep your login credentials confidential and avoid using public Wi-Fi networks when accessing your online banking account for added security.

By following these steps and ensuring the security of your account, you can enjoy the convenience of managing your finances online with Standard Chartered Bank in India.

Beneficios exclusivos de usar la banca por Internet de Standard Chartered en India

When it comes to online banking in India, Standard Chartered Bank offers a range of exclusive benefits that make managing your finances easier and more convenient. Let’s explore some of the key advantages of using Standard Chartered’s internet banking services in India:

1. Convenience and Accessibility:

With Standard Chartered’s online banking platform, you can access your bank accounts, make transactions, pay bills, and manage your finances from anywhere at any time. This level of convenience is especially beneficial for individuals with busy schedules who may not have time to visit a physical bank branch during regular business hours.

2. Enhanced Security Features:

Standard Chartered prioritizes the security of its customers’ online transactions. Their internet banking services are equipped with advanced security features such as two-factor authentication, encryption protocols, and biometric login options to ensure that your financial information remains safe and protected from cyber threats.

3. Real-Time Transaction Monitoring:

By using Standard Chartered’s internet banking platform, you can monitor your transactions in real time, receive instant notifications for any activity on your account, and quickly identify any unauthorized or suspicious charges. This feature empowers you to take immediate action in case of any fraudulent activity, providing you with peace of mind and financial security.

4. Personalized Financial Management:

Standard Chartered’s online banking services offer tools for personalized financial management, including budgeting features, expense tracking, and investment insights. By leveraging these resources, you can gain a better understanding of your spending habits, set financial goals, and make informed decisions to enhance your financial well-being.

Overall, utilizing Standard Chartered Bank’s internet banking services in India not only streamlines your banking experience but also provides you with the tools and security measures needed to manage your finances effectively in the digital age.

Frequently Asked Questions

What services are available through Standard Chartered Bank Internet Banking in India?

Services available include fund transfers, bill payments, account management, and statement viewing.

Is it safe to use Standard Chartered Bank Internet Banking in India?

Yes, Standard Chartered Bank employs advanced security measures to protect your online transactions.

Can I access Standard Chartered Bank Internet Banking in India from my mobile device?

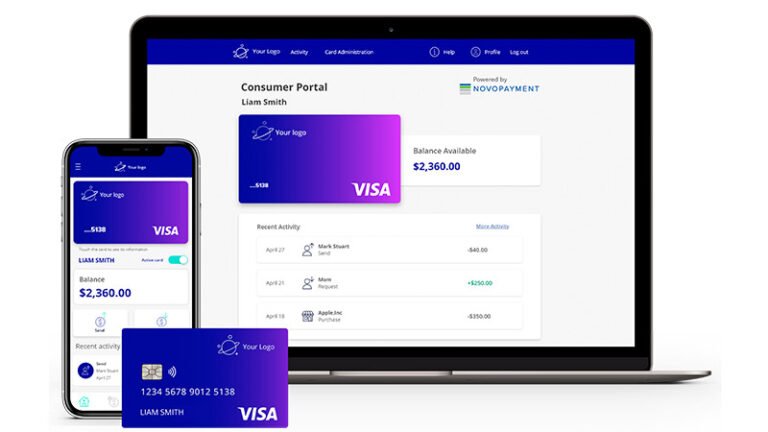

Yes, you can access internet banking through the Standard Chartered mobile app on your smartphone or tablet.

Are there any fees associated with using Standard Chartered Bank Internet Banking in India?

Most basic transactions are free, but certain services may have associated fees. It is advisable to check with the bank for specific details.

How can I reset my internet banking password for Standard Chartered Bank in India?

You can reset your password online by following the instructions on the bank’s website or by contacting customer service.

Can I schedule future transactions through Standard Chartered Bank Internet Banking in India?

Yes, you can schedule fund transfers and bill payments for future dates using the internet banking platform.

Key Points about Standard Chartered Bank Internet Banking in India

- Available services: fund transfers, bill payments, account management

- Security measures: advanced encryption and authentication methods

- Mobile access: internet banking available on the Standard Chartered mobile app

- Fee structure: certain services may have associated fees

- Password reset: can be done online or by contacting customer service

- Scheduling transactions: option to schedule future transactions

Feel free to leave your comments and questions below. Don’t forget to check out our other articles for more useful information!