The Golden One Credit Union: Financial Services and Membership Benefits

✅The Golden One Credit Union offers unbeatable financial services, exclusive member benefits, and community-focused support. Join for a brighter financial future!

The Golden One Credit Union offers a comprehensive range of financial services and membership benefits designed to meet the diverse needs of its members. With a focus on personalized service and community involvement, The Golden One Credit Union provides its members with a variety of banking products, competitive rates, and exclusive perks.

Founded with the mission to serve its members and community, The Golden One Credit Union has established itself as a trusted financial institution. This article explores the various financial services and membership benefits available to its members, providing a detailed overview to help you make informed decisions about your financial well-being.

Financial Services Offered

The Golden One Credit Union provides a wide array of financial services, including but not limited to:

- Checking and Savings Accounts: Members can choose from several types of checking and savings accounts, each with competitive interest rates and low fees.

- Loans: The credit union offers various loan options, including auto loans, personal loans, and home mortgages, all with attractive rates and flexible repayment terms.

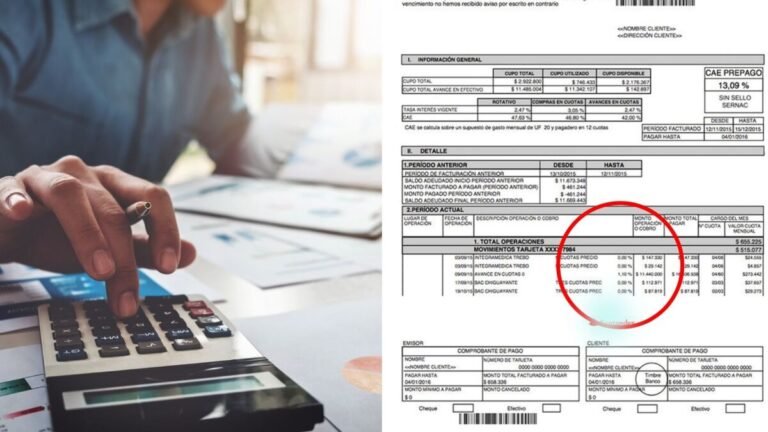

- Credit Cards: Members have access to credit cards with low interest rates, no annual fees, and various rewards programs.

- Investment Services: The Golden One Credit Union provides investment advice and services to help members plan for their future, including retirement accounts and wealth management.

- Online and Mobile Banking: With robust online and mobile banking platforms, members can manage their accounts, pay bills, transfer funds, and more, all from the convenience of their devices.

Membership Benefits

Joining The Golden One Credit Union comes with numerous benefits designed to enhance the financial health of its members:

- Lower Fees: As a not-for-profit institution, The Golden One Credit Union often has lower fees compared to traditional banks, saving members money on transactions and account maintenance.

- Higher Savings Rates: Members typically enjoy higher interest rates on savings accounts and certificates of deposit (CDs), allowing their money to grow faster.

- Community Involvement: The credit union actively participates in community events and supports local charities, fostering a sense of community among its members.

- Financial Education: The Golden One Credit Union offers educational resources and workshops to help members improve their financial literacy and make informed decisions.

- Exclusive Discounts: Members can access exclusive discounts on a variety of products and services, from travel and entertainment to insurance and technology.

How to Become a Member

Becoming a member of The Golden One Credit Union is straightforward. Eligibility typically requires you to live, work, or worship in certain areas, or be related to an existing member. Once you qualify, you can join by opening a savings account with a modest initial deposit, usually around $5.

Statistics and Member Growth

According to recent data, The Golden One Credit Union has consistently grown its membership base, reflecting its strong reputation and member satisfaction. As of the latest figures, the credit union serves over 1 million members and manages assets exceeding $12 billion.

Conclusion

By choosing The Golden One Credit Union, members gain access to a wide range of financial services and enjoy numerous benefits that support their financial health and community well-being. Whether you’re looking for a new banking relationship or want to take advantage of lower fees and better rates, The Golden One Credit Union provides a compelling option.

Requisitos y Procedimientos para Convertirse en Miembro

Joining The Golden One Credit Union is a straightforward process that offers a wide range of financial benefits. To become a member, individuals must meet certain requirements and follow specific procedures. Below, we outline the steps and criteria for joining this esteemed credit union.

Membership Eligibility Criteria:

To be eligible for membership at The Golden One Credit Union, individuals must meet one of the following criteria:

- Residency: Individuals who live or work in specific geographic areas where the credit union operates are eligible for membership. This could include individuals residing in particular counties, cities, or neighborhoods.

- Employment: Employees of select companies or organizations that have a partnership with the credit union may qualify for membership.

- Family Connection: Family members of current credit union members are often eligible to join. This could include spouses, children, siblings, and more.

- Association Membership: Some associations, clubs, or groups have partnerships with the credit union, allowing their members to join.

Membership Application Process:

Once an individual confirms their eligibility for membership, they can proceed with the application process. The steps typically involve the following:

- Completing an Application: The prospective member fills out a membership application form, providing personal information and details to verify their eligibility.

- Opening an Account: Along with the application, the individual may need to open a savings account with an initial deposit, as required by the credit union.

- Verification of Eligibility: The credit union reviews the application and supporting documents to confirm the individual’s eligibility based on the specified criteria.

- Membership Approval: Once the eligibility is verified, the credit union approves the membership, granting the individual access to a range of financial services and benefits.

Joining a credit union like The Golden One Credit Union can provide individuals with not only traditional banking services but also a sense of community and shared financial goals. By following the outlined requirements and procedures, individuals can access exclusive benefits tailored to their needs.

Opciones de Préstamos y Tasas de Interés Competitivas

When it comes to financial services, having strong loan options and competitive interest rates can make a significant difference for individuals and businesses. At The Golden One Credit Union, members have access to a variety of loan products tailored to meet their diverse needs.

Let’s delve into the loan options available at The Golden One Credit Union and explore how competitive interest rates can benefit members:

Personal Loans

Whether you need funds for a home renovation project, a dream vacation, or to consolidate debt, personal loans from The Golden One Credit Union offer flexible terms and competitive rates. Members can enjoy the convenience of applying online and receiving quick approval, making it a hassle-free solution for their financial needs.

Auto Loans

Planning to purchase a new car? Auto loans from The Golden One Credit Union come with low interest rates and various repayment options. Members can benefit from pre-approval, allowing them to negotiate with confidence at the dealership and secure the best deal on their vehicle.

Mortgage Loans

For those looking to buy a home or refinance an existing mortgage, The Golden One Credit Union provides mortgage loans with competitive rates and expert guidance throughout the process. With personalized service and knowledgeable staff, members can navigate the complexities of home financing with ease.

By offering a diverse range of loan products and ensuring competitive interest rates, The Golden One Credit Union empowers its members to achieve their financial goals effectively and affordably.

Frequently Asked Questions

What are the membership requirements for The Golden One Credit Union?

To join The Golden One Credit Union, you need to meet certain eligibility criteria such as living in a specific geographic area or being affiliated with a particular organization.

What types of financial services does The Golden One Credit Union offer?

The Golden One Credit Union offers a wide range of financial services including savings accounts, checking accounts, loans, credit cards, and investment options.

Is The Golden One Credit Union insured?

Yes, The Golden One Credit Union is insured by the National Credit Union Administration (NCUA) up to $250,000 per depositor.

Can I access my accounts online with The Golden One Credit Union?

Yes, The Golden One Credit Union offers online banking services that allow you to check your account balance, transfer funds, and pay bills conveniently.

Does The Golden One Credit Union charge fees for using ATMs?

The Golden One Credit Union provides access to a network of surcharge-free ATMs, but fees may apply for using out-of-network ATMs.

How can I contact The Golden One Credit Union for customer support?

You can reach The Golden One Credit Union customer service team by phone, email, or by visiting a branch location near you.

- Membership eligibility criteria

- Financial services offered

- NCUA insurance coverage

- Online banking features

- ATM fee information

- Customer support contact options

Feel free to leave your comments below if you have any more questions or explore other articles on our website that may interest you.