Wells Fargo: Cómo Abrir una Cuenta de Débito Fácilmente

✅Open a Wells Fargo debit account easily by visiting their website, filling out an online application, or visiting a local branch with your ID and initial deposit.

Opening a Wells Fargo debit account is a straightforward process that can be completed either online or in-person at a Wells Fargo branch. To open a debit account, you will need to provide certain documentation and meet specific requirements. This guide will walk you through the steps to ensure a smooth account opening experience.

Wells Fargo offers a range of debit accounts tailored to meet different financial needs. From everyday checking accounts to student-specific options, there’s a variety of choices available. Below, we will outline the general steps to open a Wells Fargo debit account, the documents you will need, and some tips to help you navigate the process efficiently.

Steps to Open a Wells Fargo Debit Account

- Choose the Right Account: Wells Fargo offers different types of checking accounts, including Everyday Checking, Preferred Checking, and Student Checking. Review the features and fees associated with each account to determine which one best suits your needs.

- Gather Necessary Documents: You will need to provide:

- A valid government-issued ID (such as a driver’s license or passport)

- Your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

- Proof of address (such as a utility bill or lease agreement)

- Apply Online or In-Person: You can start the application process on the Wells Fargo website or by visiting a local branch. For online applications, visit the Wells Fargo account opening page and follow the prompts to enter your information. If you prefer to apply in-person, schedule an appointment or walk into a branch.

- Fund Your Account: Initial deposits may be required depending on the type of account you choose. Make sure you have the funds available to meet these requirements.

- Activate Your Debit Card: Once your account is open, you will receive a debit card. Follow the instructions provided to activate your card and set up your PIN for secure transactions.

Tips for a Smooth Account Opening

Here are some additional tips to help ensure a smooth account opening experience:

- Double-check documentation: Make sure all your documents are up-to-date and valid.

- Review account features: Take time to understand the benefits and fees associated with the account you choose.

- Set up online banking: Wells Fargo offers robust online and mobile banking services. Setting up these services can provide you with easy access to your account information and transactions.

- Consider direct deposit: If you receive regular income, setting up direct deposit can simplify your banking and provide benefits such as fee waivers.

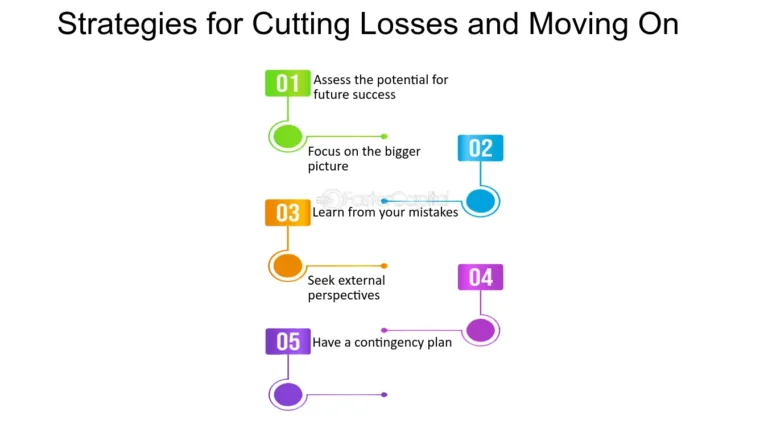

Common Issues and Solutions

While opening a Wells Fargo debit account is generally straightforward, you might encounter some common issues. Here’s how to address them:

- Insufficient documentation: Ensure you have all the required documents before starting the application process. Missing documents can delay the account opening.

- Credit check concerns: Some accounts may require a credit check. If you have concerns about your credit, discuss alternative options with a Wells Fargo representative.

- Initial deposit requirements: Be aware of the minimum initial deposit required for the account you choose. Plan ahead to ensure you can meet this requirement.

Requisitos necesarios para abrir una cuenta en Wells Fargo

When considering opening a debit account at Wells Fargo, it’s essential to be aware of the necessary requirements. Meeting these criteria is crucial to ensure a smooth and hassle-free account opening process. Below are some key requirements to consider:

- Identification: You will need to provide a valid form of identification, such as a driver’s license, passport, or state-issued ID. This is to verify your identity and prevent fraud.

- Minimum Deposit: Some bank accounts may require an initial deposit to open the account. Wells Fargo, for example, may have specific minimum deposit requirements that you need to fulfill.

- Social Security Number (SSN): You will typically need to provide your SSN when opening a bank account in the United States for tax and identification purposes.

- Proof of Address: You may be asked to provide a document, such as a utility bill or lease agreement, to verify your residential address.

- Age Requirement: While the age to open a bank account can vary by institution, most banks require the account holder to be at least 18 years old. If you are under 18, you may need a parent or guardian to be a joint account holder.

Ensuring you have all the necessary documentation and meet the specified criteria will make the process of opening a debit account at Wells Fargo much smoother and quicker. It’s always a good idea to check with the bank beforehand to confirm the exact requirements and streamline the account opening process.

Pasos detallados para completar la solicitud en línea

When it comes to opening a debit account at Wells Fargo, the process is streamlined and user-friendly, especially if you opt for the online application. Below are detailed steps to guide you through the process:

1. Visit the Wells Fargo Website

To start the process, visit the official Wells Fargo website. Look for the section dedicated to opening a new account.

2. Choose the Type of Debit Account

Wells Fargo offers various types of debit accounts, each with its own features and benefits. Select the one that best suits your needs, whether it’s a basic account or one with additional perks like rewards programs.

3. Fill Out the Online Application

Once you’ve selected the debit account you want, proceed to fill out the online application form. You’ll need to provide personal information such as your name, address, social security number, and other details required for account setup.

4. Fund Your New Account

After completing the application, you’ll need to fund your new account. Wells Fargo typically allows various funding options, including transferring funds from an existing account, depositing a check, or making an initial deposit in person at a branch.

5. Review and Confirm

Before submitting your application, take a moment to review all the information you’ve provided. Make sure everything is accurate and up to date. Once you’re satisfied, you can proceed to confirm your application.

By following these steps, you can easily complete the online application process for a Wells Fargo debit account. This convenient method saves you time and allows you to manage your finances efficiently from the comfort of your own home.

Preguntas frecuentes

¿Cuáles son los requisitos para abrir una cuenta de débito en Wells Fargo?

Debes ser mayor de 18 años, tener un número de seguro social válido y presentar una identificación con fotografía.

¿Cuánto cuesta abrir una cuenta de débito en Wells Fargo?

La mayoría de las cuentas de débito en Wells Fargo no tienen cargos de apertura, pero pueden aplicarse cargos mensuales dependiendo del tipo de cuenta.

¿Qué beneficios ofrece una cuenta de débito en Wells Fargo?

Las cuentas de débito de Wells Fargo ofrecen acceso a una amplia red de cajeros automáticos, servicios bancarios en línea y móviles, y protección contra fraudes.

¿Puedo realizar depósitos directos en mi cuenta de débito de Wells Fargo?

Sí, puedes configurar depósitos directos de tu salario u otros pagos recurrentes en tu cuenta de débito de Wells Fargo.

¿Cómo puedo solicitar una tarjeta de débito en Wells Fargo?

Una vez que abres una cuenta de débito en Wells Fargo, puedes solicitar una tarjeta de débito a través de la sucursal bancaria, en línea o por teléfono.

¿Qué debo hacer si pierdo o me roban mi tarjeta de débito de Wells Fargo?

Debes reportar inmediatamente la pérdida o robo de tu tarjeta de débito a Wells Fargo llamando al número de atención al cliente para que puedan bloquearla y emitirte una nueva.

- Requisitos: ser mayor de 18 años, tener número de seguro social válido, presentar identificación con fotografía.

- Cargos: no hay cargos de apertura, pero pueden aplicarse cargos mensuales.

- Beneficios: amplia red de cajeros automáticos, servicios bancarios en línea y móviles, protección contra fraudes.

- Depósitos directos: puedes configurar depósitos directos de tu salario u otros pagos recurrentes.

- Solicitud de tarjeta: solicítala en la sucursal, en línea o por teléfono una vez abierta la cuenta.

- Reporte de tarjeta perdida: llama al número de atención al cliente para reportar la pérdida o robo y solicitar una nueva.

¡Déjanos tus preguntas o comentarios sobre cómo abrir una cuenta de débito en Wells Fargo y revisa otros artículos relacionados en nuestra web!